Question

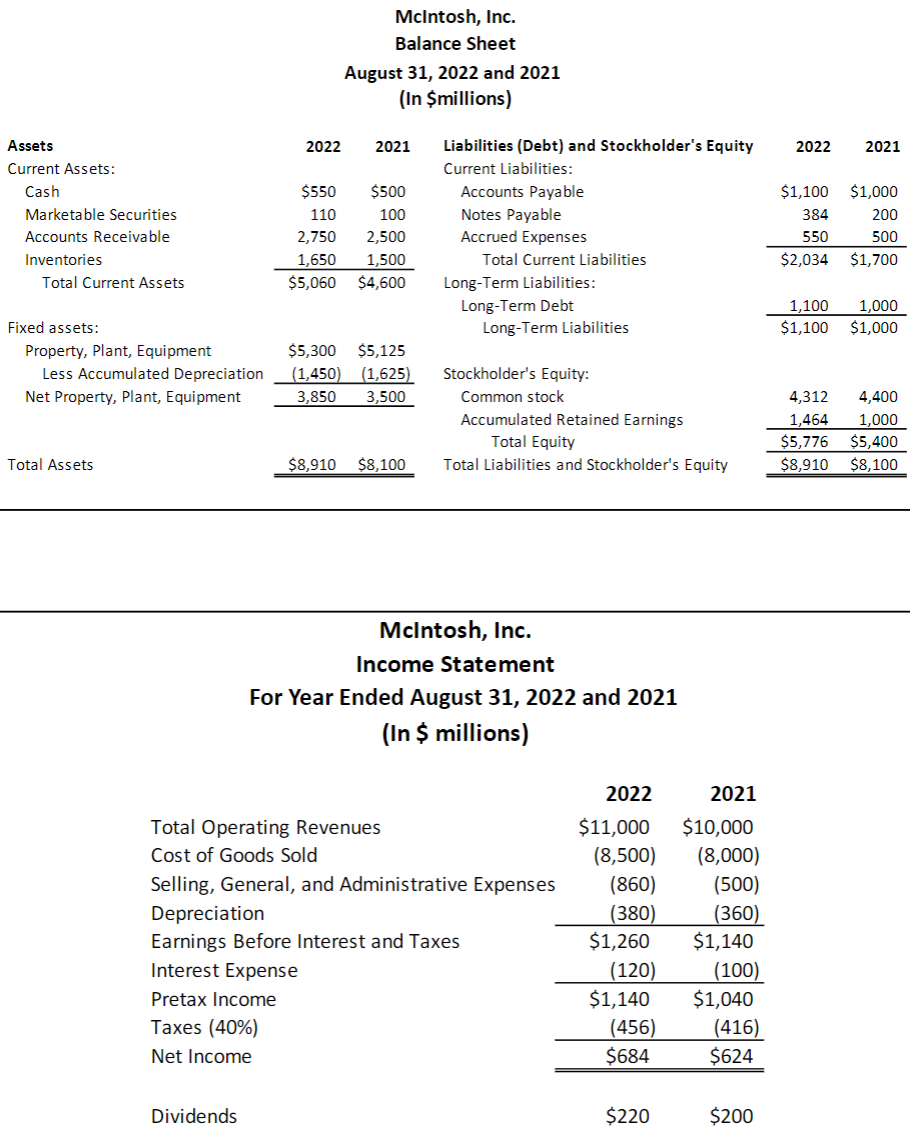

McIntosh, Inc. is forecasting a 12% increase in sales next year (2023). Assets, spontaneous liabilities, depreciation, and operating expenses are expected to increase in proportion,

McIntosh, Inc. is forecasting a 12% increase in sales next year (2023). Assets, spontaneous liabilities, depreciation, and operating expenses are expected to increase in proportion, as the firm is operating at full capacity. However, Notes Payable, Long-term Debt, and Interest are expected to remain constant, and the firm is not expected to issue or buyback any shares. The tax rate and payout ratio are not expected to change.

Using the information on the attached balance sheet and income statement, calculate external funding needed for McIntosh, Inc. in 2023 using pro forma financial statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started