Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MCK Inc. purchased on January 1, 2021, $600.000. 6% bonds of Aguirre Co. for $536,621. The bonds were purchased to yield 8% interest. Interest

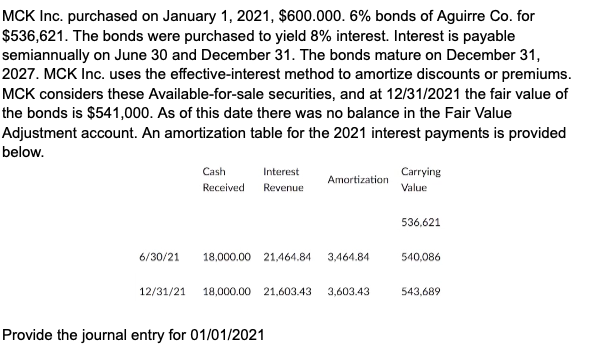

MCK Inc. purchased on January 1, 2021, $600.000. 6% bonds of Aguirre Co. for $536,621. The bonds were purchased to yield 8% interest. Interest is payable semiannually on June 30 and December 31. The bonds mature on December 31, 2027. MCK Inc. uses the effective-interest method to amortize discounts or premiums. MCK considers these Available-for-sale securities, and at 12/31/2021 the fair value of the bonds is $541,000. As of this date there was no balance in the Fair Value Adjustment account. An amortization table for the 2021 interest payments is provided below. Cash Interest Received Revenue Carrying Amortization Value 536,621 6/30/21 18,000.00 21,464.84 3,464.84 540,086 12/31/21 18,000.00 21,603.43 3,603.43 543,689 Provide the journal entry for 01/01/2021

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The journal entry for 01012021 i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started