Answered step by step

Verified Expert Solution

Question

1 Approved Answer

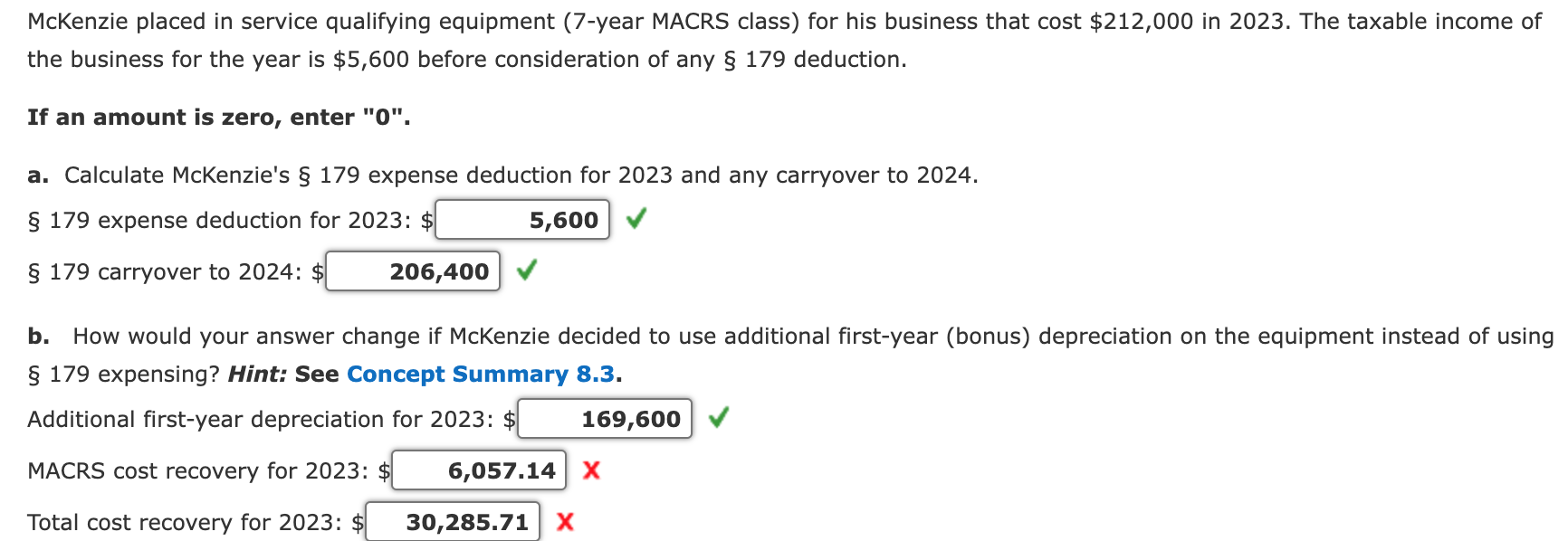

McKenzie placed in service qualifying equipment (7-year MACRS class) for his business that cost $212,000 in 2023 . The taxable income of the business for

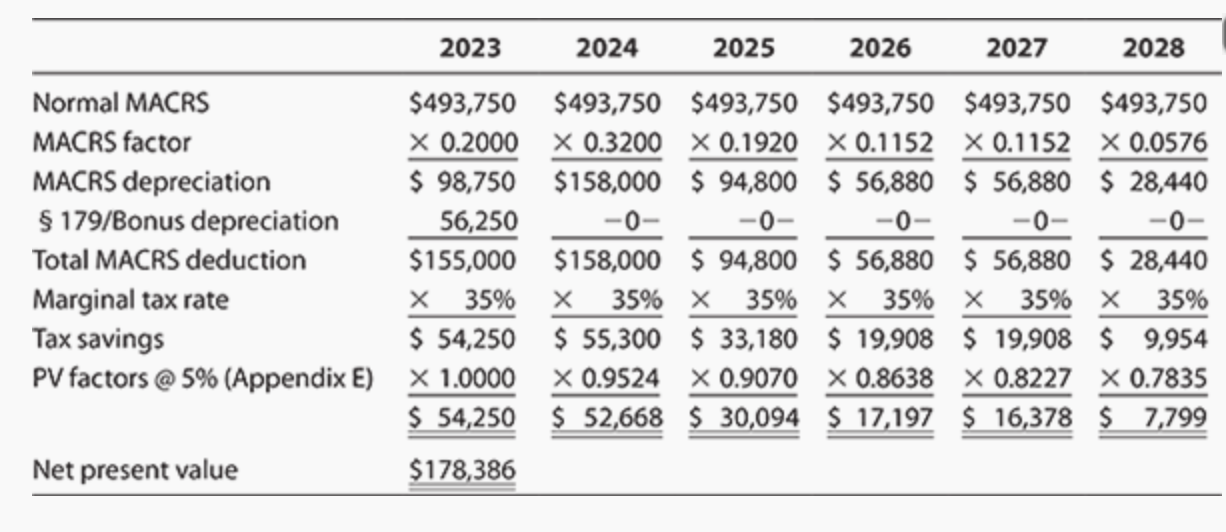

McKenzie placed in service qualifying equipment (7-year MACRS class) for his business that cost $212,000 in 2023 . The taxable income of the business for the year is $5,600 before consideration of any 179 deduction. If an amount is zero, enter "0". a. Calculate McKenzie's 179 expense deduction for 2023 and any carryover to 2024 . 179 expense deduction for 2023: s 179 carryover to 2024:$ b. How would your answer change if McKenzie decided to use additional first-year (bonus) depreciation on the equipment instead of using 179 expensing? Hint: See Concept Summary 8.3. Additional first-year depreciation for 2023: \$ MACRS cost recovery for 2023: \$ X Total cost recovery for 2023: \$ X \begin{tabular}{|c|c|c|c|c|c|c|} \hline & 2023 & 2024 & 2025 & 2026 & 2027 & 2028 \\ \hline Normal MACRS & $493,750 & $493,750 & $493,750 & $493,750 & $493,750 & $493,750 \\ \hline MACRS factor & 0.2000 & 0.3200 & 0.1920 & 0.1152 & 0.1152 & 0.0576 \\ \hline MACRS depreciation & $98,750 & $158,000 & $94,800 & $56,880 & $56,880 & $28,440 \\ \hline179/ Bonus depreciation & 56,250 & 0 & 0 & 0 & 0 & 0 \\ \hline Total MACRS deduction & $155,000 & $158,000 & $94,800 & $56,880 & $56,880 & $28,440 \\ \hline Marginal tax rate & 35% & 35% & 35% & 35% & 35% & 35% \\ \hline Tax savings & $54,250 & $55,300 & $33,180 & $19,908 & $19,908 & $9,954 \\ \hline \multirow[t]{2}{*}{ PV factors @ 5\% (Appendix E) } & 1.0000 & 0.9524 & 0.9070 & 0.8638 & 0.8227 & 0.7835 \\ \hline & $5,250 & $52,668 & $30,094 & $17,197 & $16,378 & $7,799 \\ \hline Net present value & $178,386 & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to consider two scenarios a Calculation using Section 179 deduction 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started