Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mclaughlin Inc. operates with a June 30 year-end. During 2017, the following transactions occurred: a. January 1: Signed a one-year, 10% loan for $35,000. Interest

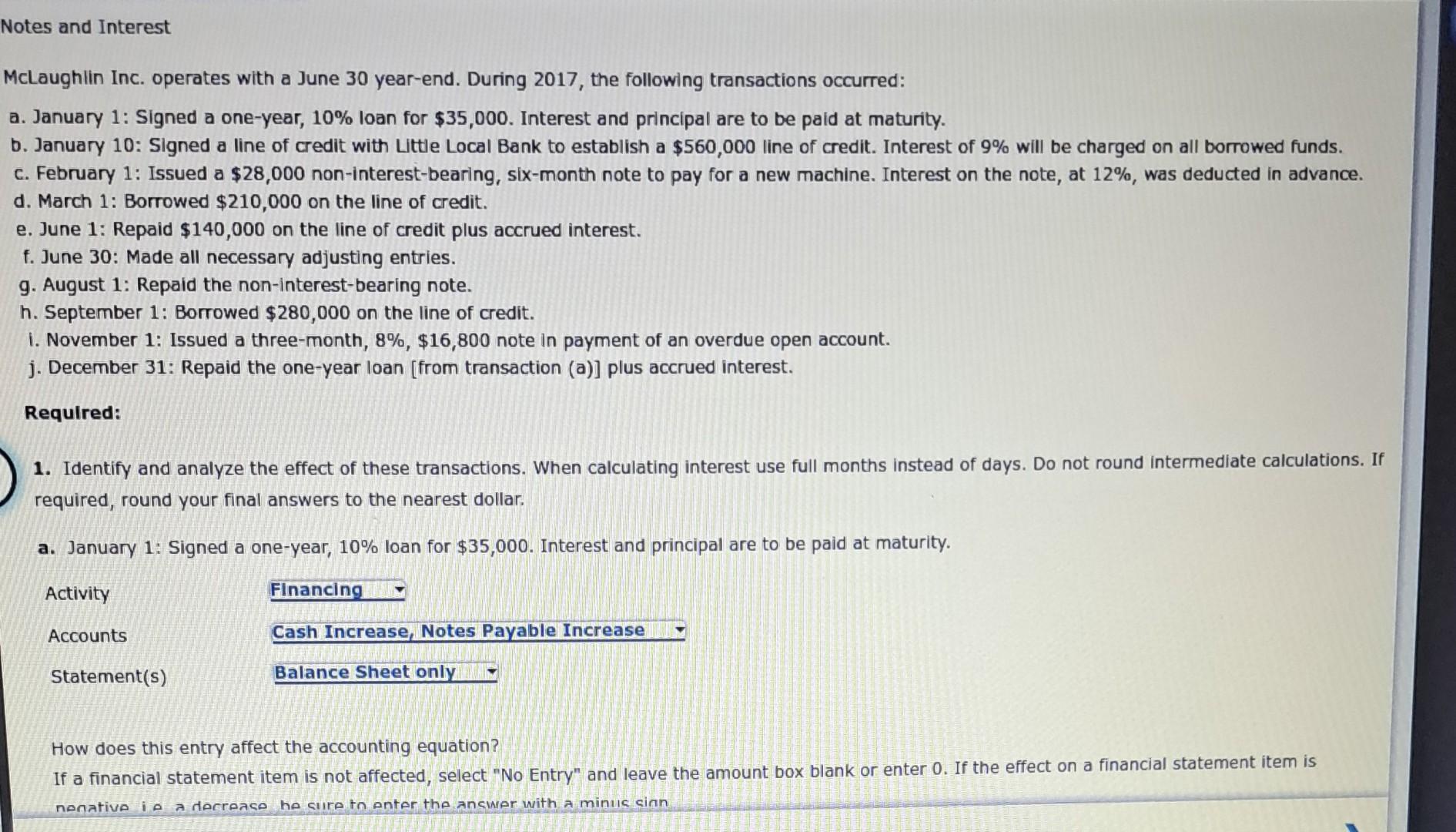

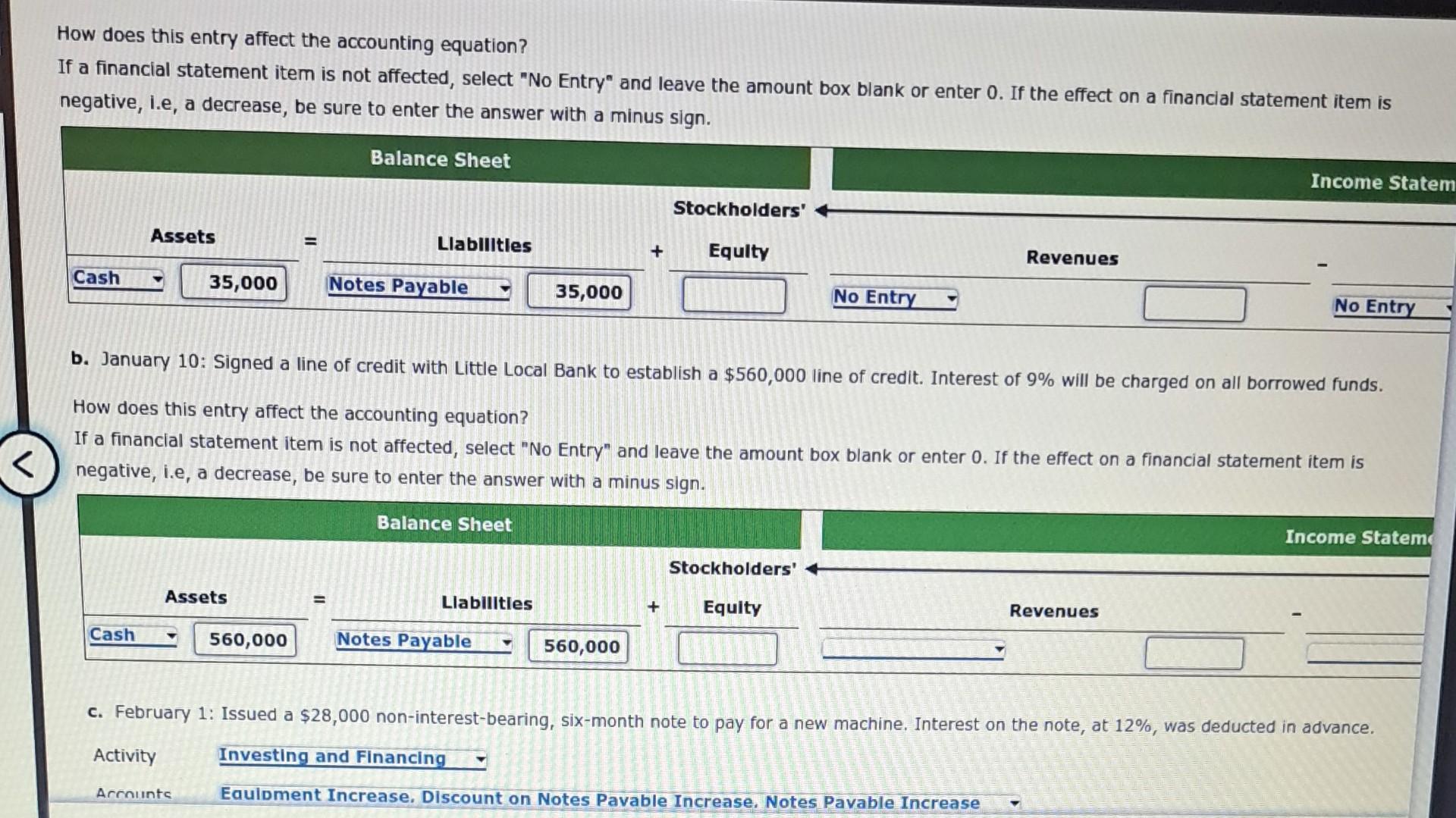

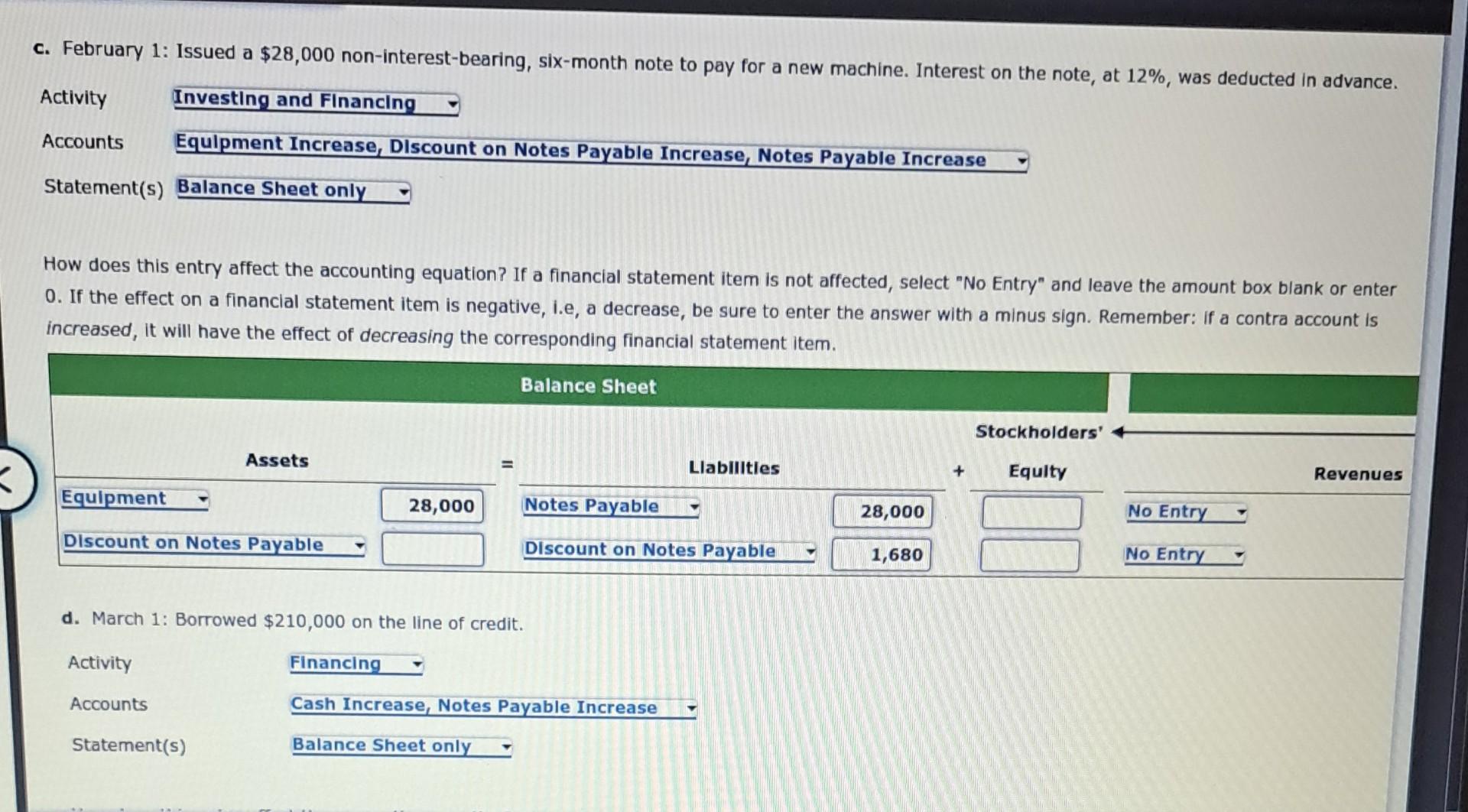

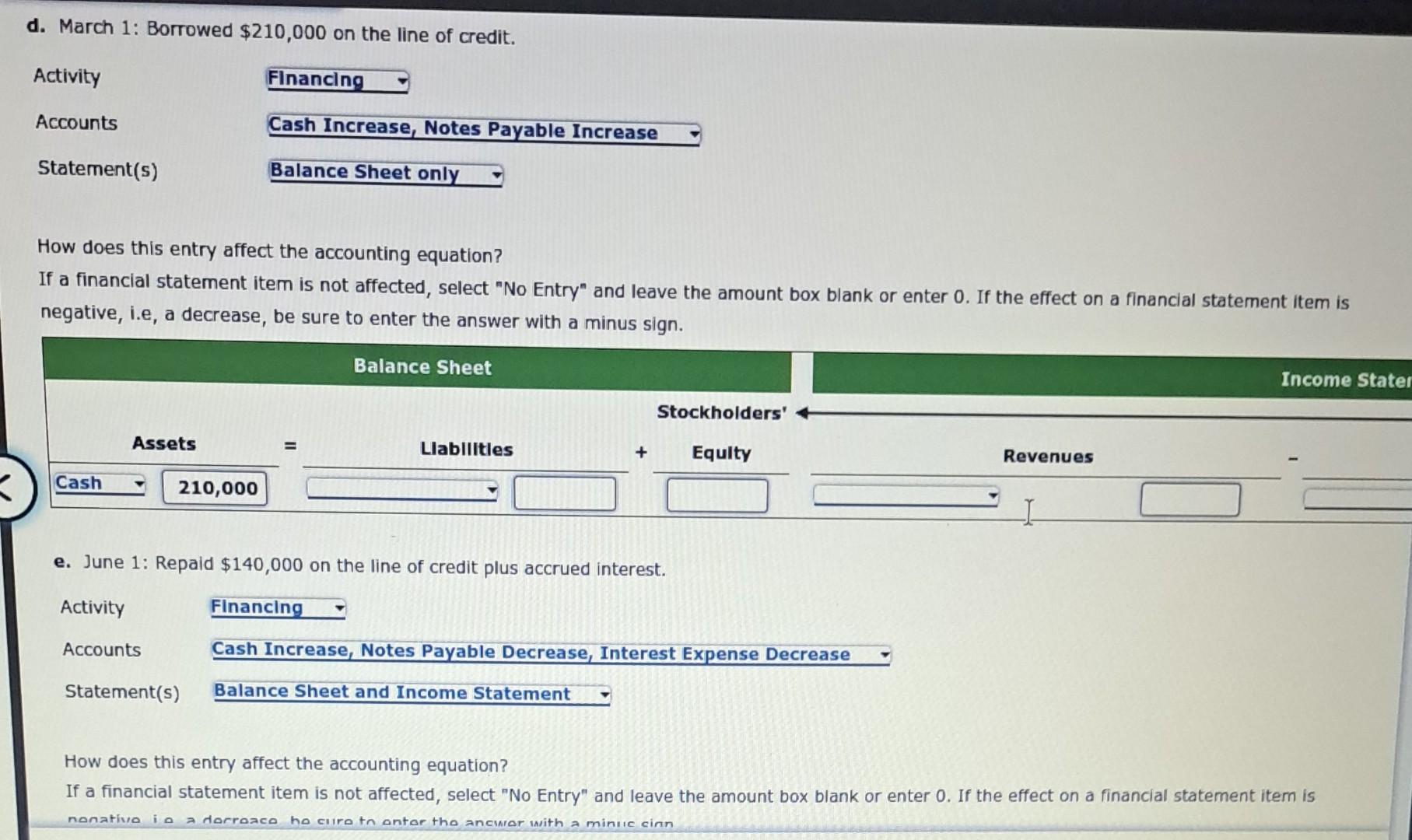

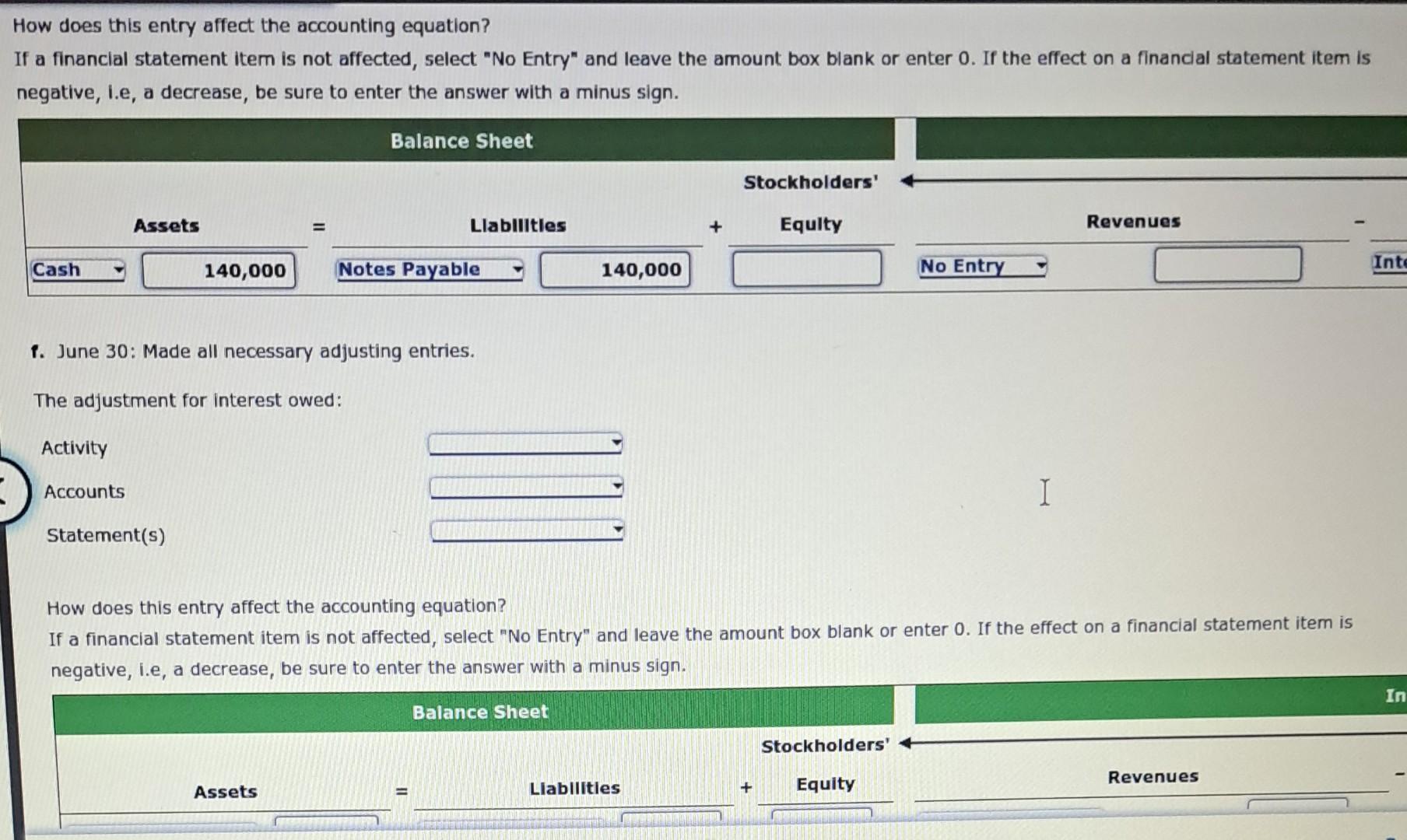

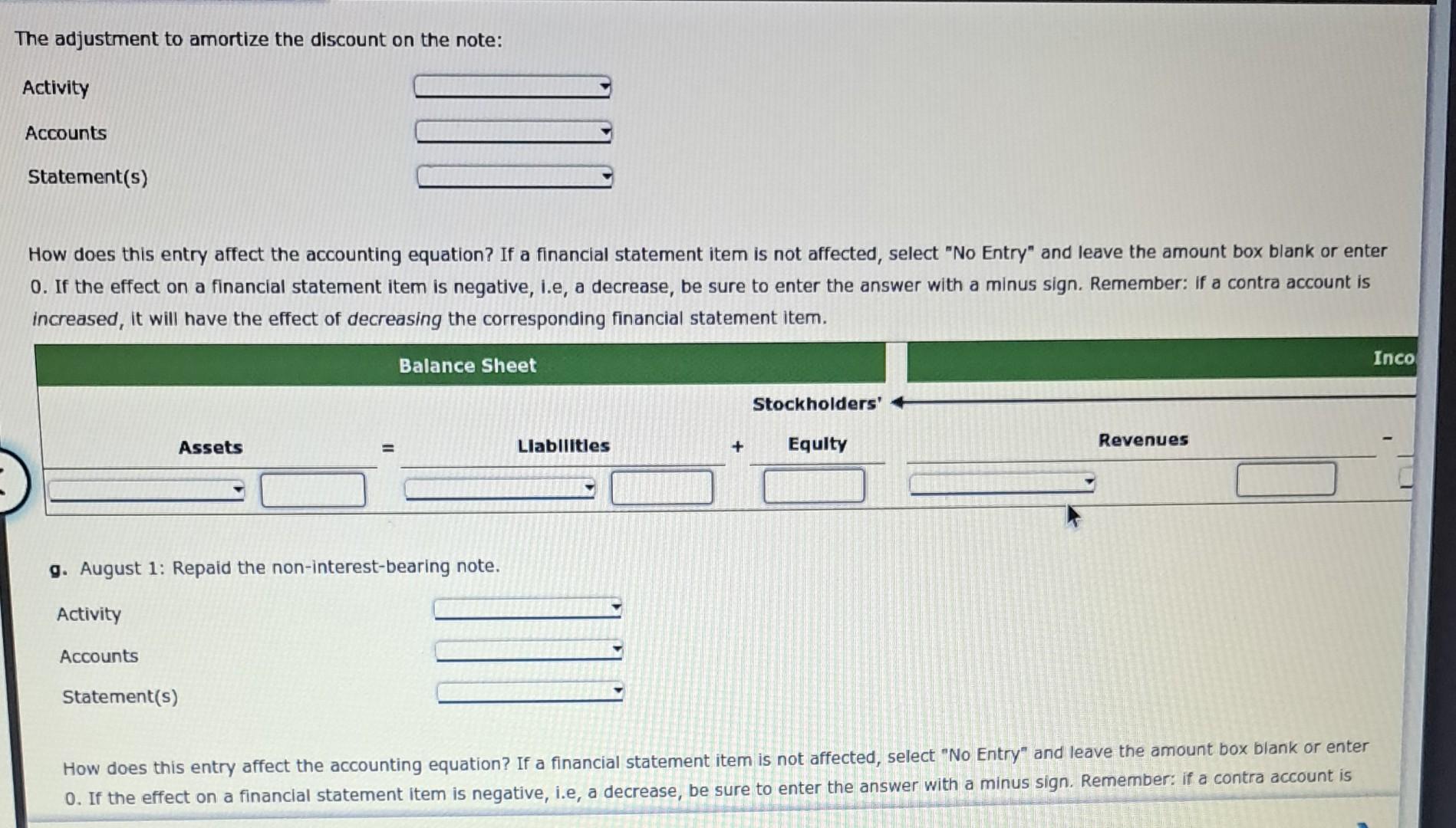

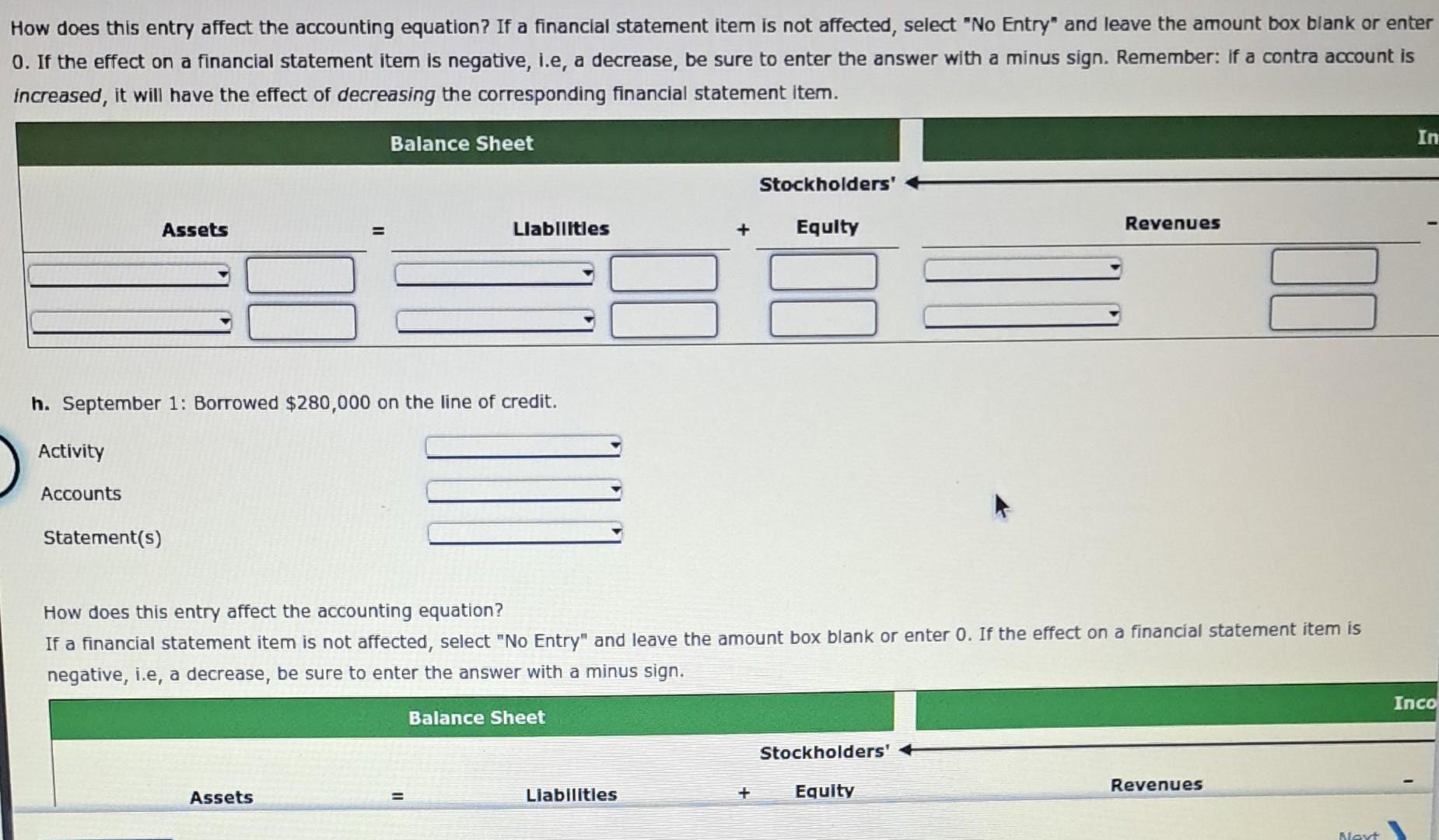

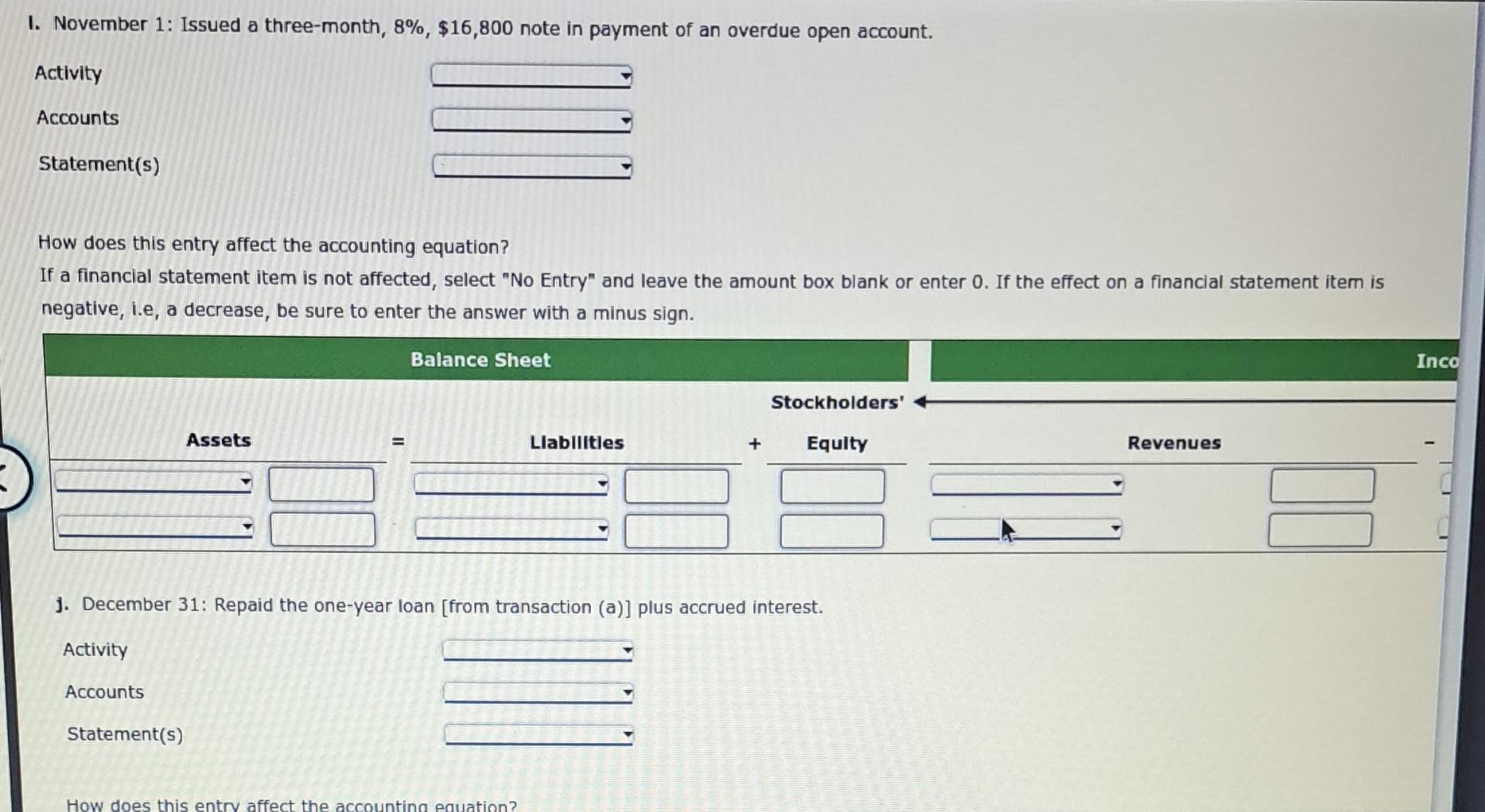

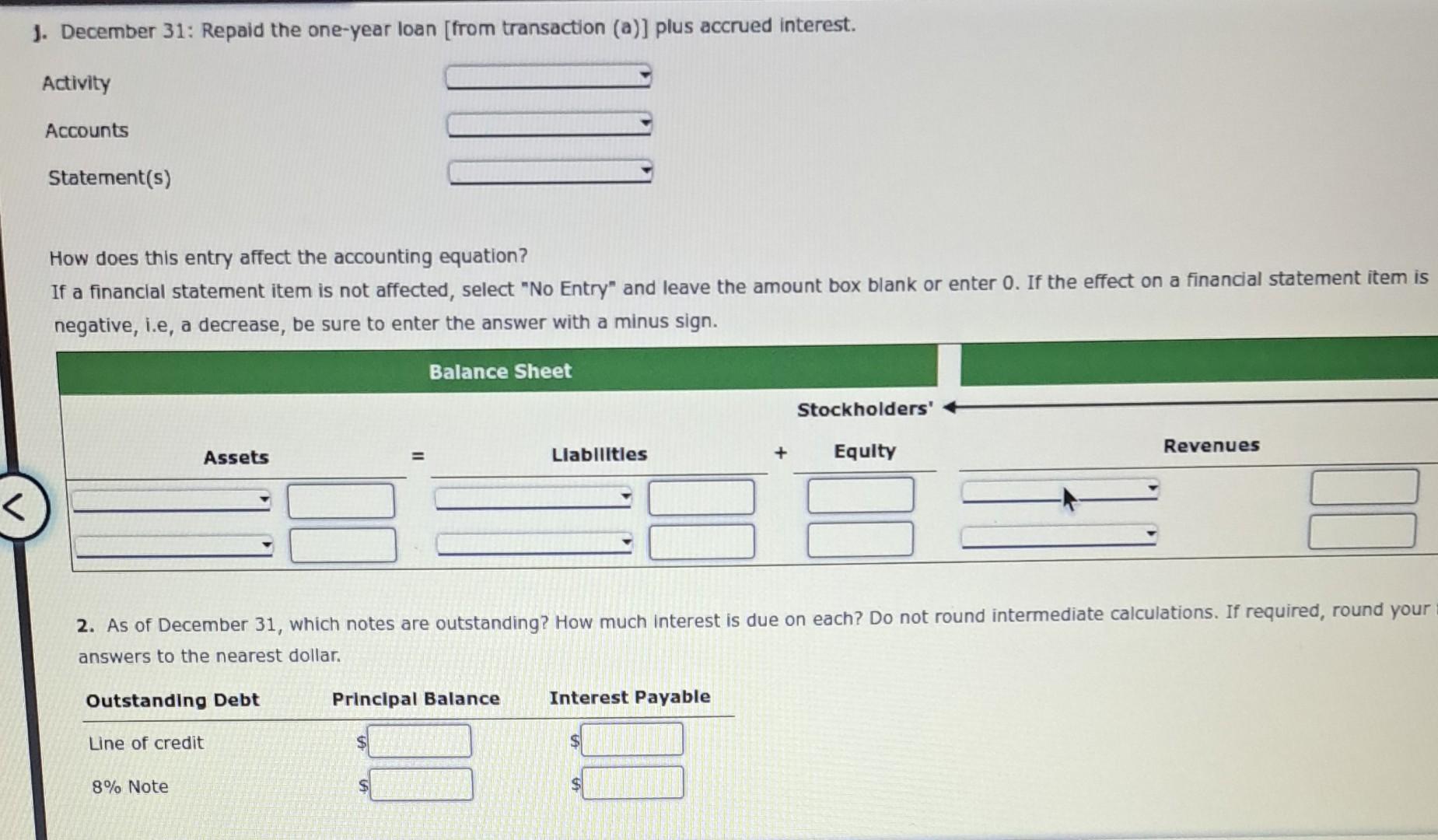

Mclaughlin Inc. operates with a June 30 year-end. During 2017, the following transactions occurred: a. January 1: Signed a one-year, 10% loan for $35,000. Interest and principal are to be paid at maturity. b. January 10: Signed a line of credit with Little Local Bank to establish a $560,000 line of credit. Interest of 9% will be charged on all borrowed funds. c. February 1: Issued a $28,000 non-interest-bearing, six-month note to pay for a new machine. Interest on the note, at 12%, was deducted in advance. d. March 1: Borrowed $210,000 on the line of credit. e. June 1: Repaid $140,000 on the line of credit plus accrued interest. f. June 30: Made all necessary adjusting entries. g. August 1: Repaid the non-interest-bearing note. h. September 1: Borrowed $280,000 on the line of credit. 1. November 1: Issued a three-month, 8%,$16,800 note in payment of an overdue open account. j. December 31: Repaid the one-year loan [from transaction (a)] plus accrued interest. Required: 1. Identify and analyze the effect of these transactions. When calculating interest use full months instead of days. Do not round intermediate calculations. If required, round your final answers to the nearest dollar. a. January 1: Signed a one-year, 10% loan for $35,000. Interest and principal are to be paid at maturity. Activity Accounts Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is nenative is a derroace he cuire in enter the ancwer with a minus sian How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is negative, I.e, a decrease, be sure to enter the answer with a minus sign. b. January 10: Signed a line of credit with Little Local Bank to establish a $560,000 line of credit. Interest of 9% will be charged on all borrowed funds. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. c. February 1: Issued a $28,000 non-interest-bearing, six-month note to pay for a new machine. Interest on the note, at 12%, was deducted in advance. Activity Armunts Eaulpment Increase, Discount on Notes Pavable Increase. Notes Pavable Increase c. February 1: Issued a $28,000 non-interest-bearing, six-month note to pay for a new machine. Interest on the note, at 12%, was deducted in advance. Activity Investing and Financlng Accounts Equlpment Increase, Dlscount on Notes Payable Increase, Notes Payable Increase Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Remember: if a contra account is increased, it will have the effect of decreasing the corresponding financial statement item. d. March 1: Borrowed $210,000 on the line of credit. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is nonative io a dorroaco ho curo th ontor tho ancwior whith a minlic cinn How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is negative, l.e, a decrease, be sure to enter the answer with a minus sign. 1. June 30: Made all necessary adjusting entries. The adjustment for interest owed: How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is negative, l.e, a decrease, be sure to enter the answer with a minus sign. The adjustment to amortize the discount on the note: How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is negative, I.e, a decrease, be sure to enter the answer with a minus sign. Remember: if a contra account is increased, it will have the effect of decreasing the corresponding financial statement item. g. August 1: Repaid the non-interest-bearing note. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Remember: if a contra account is How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Remember: if a contra account is increased, it will have the effect of decreasing the corresponding financial statement item. h. September 1: Borrowed $280,000 on the line of credit. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. J. December 31: Repaid the one-year loan [from transaction (a)] plus accrued interest. J. December 31: Repaid the one-year loan [from transaction (a)] plus accrued interest. How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter 0 . If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. 2. As of December 31 , which notes are outstanding? How much interest is due on each? Do not round intermediate calculations. If required, round your answers to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started