Answered step by step

Verified Expert Solution

Question

1 Approved Answer

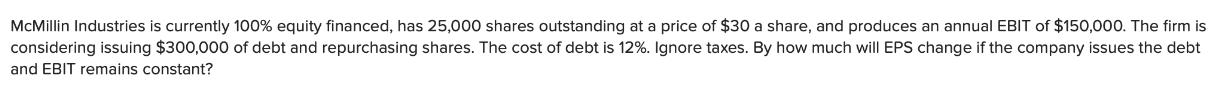

McMillin Industries is currently 100% equity financed, has 25,000 shares outstanding at a price of $30 a share, and produces an annual EBIT of

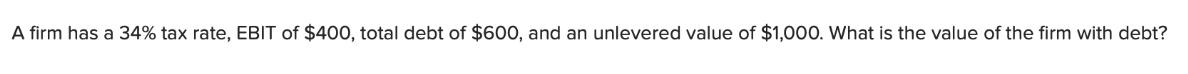

McMillin Industries is currently 100% equity financed, has 25,000 shares outstanding at a price of $30 a share, and produces an annual EBIT of $150,000. The firm is considering issuing $300,000 of debt and repurchasing shares. The cost of debt is 12%. Ignore taxes. By how much will EPS change if the company issues the debt and EBIT remains constant? A firm has a 34% tax rate, EBIT of $400, total debt of $600, and an unlevered value of $1,000. What is the value of the firm with debt?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the Earnings Per Share EPS before and after the debt issu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e87abc7c9f_880261.pdf

180 KBs PDF File

661e87abc7c9f_880261.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started