Question

McMullen and Mulligan, CPAs, were conducting the audit of Cusick Machine Tool Company for the year ended December 31. The senior-in-charge of the audit, plans

McMullen and Mulligan, CPAs, were conducting the audit of Cusick Machine Tool Company for the year ended December 31. The senior-in-charge of the audit, plans to use MUS to audit Cusicks inventory account. The balance at December 31 was $9,000,000.

Required:

A. Based on the following information, use the appropriate table to compute the required MUS sample and sampling interval:

Tolerable misstatement = 4%

Expected misstatement = 1%

Risk of incorrect acceptance = 5%

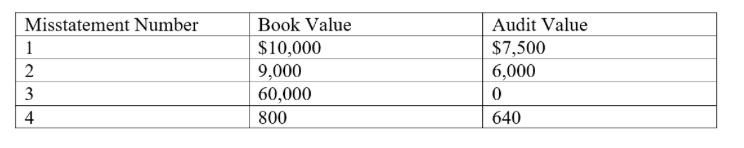

B. The staff accountant performed the audit procedures listed in the inventory audit program and notes the following results of the tests:

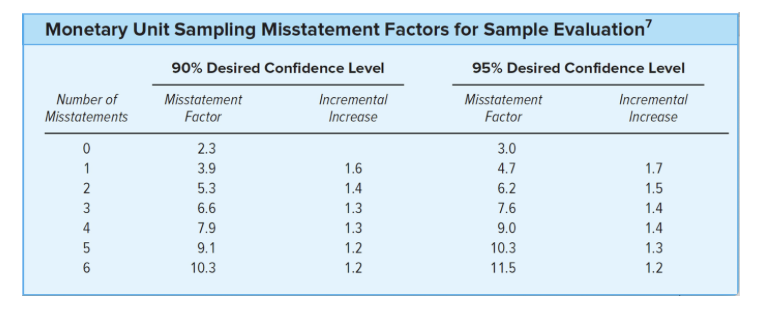

Using this information and the MUS misstatement factors in the table below, calculate the upper misstatement limit.

Using this information and the MUS misstatement factors in the table below, calculate the upper misstatement limit.

C. What conclusion should the auditor make concerning the inventory?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started