Answered step by step

Verified Expert Solution

Question

1 Approved Answer

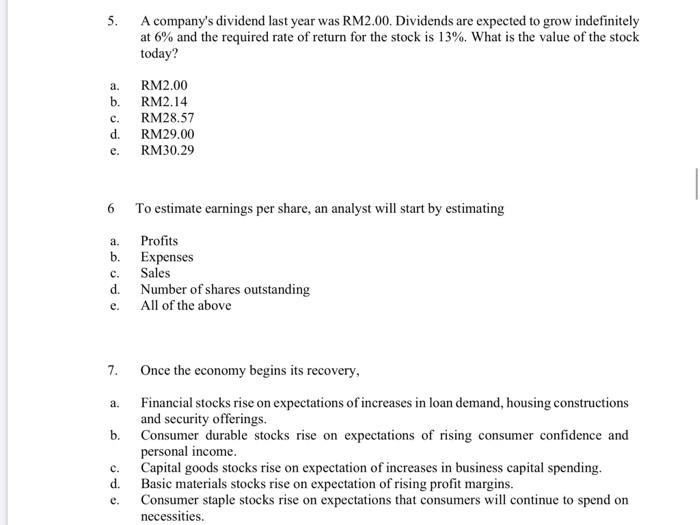

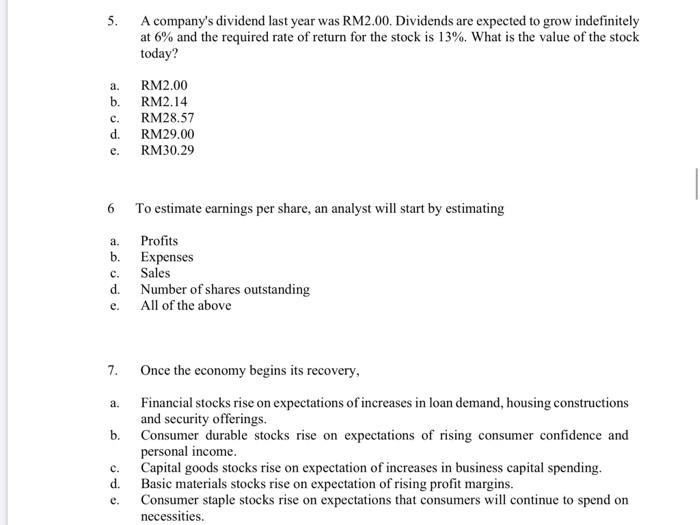

mcq pt2 5. 5 A company's dividend last year was RM2.00. Dividends are expected to grow indefinitely at 6% and the required rate of return

mcq pt2

5. 5 A company's dividend last year was RM2.00. Dividends are expected to grow indefinitely at 6% and the required rate of return for the stock is 13%. What is the value of the stock today? a. b. C. d. e. RM2.00 RM2.14 RM28.57 RM29.00 RM30.29 6 To estimate earnings per share, an analyst will start by estimating a. Profits b. Expenses c. Sales d. Number of shares outstanding e. All of the above 7. a. b. Once the economy begins its recovery, Financial stocks rise on expectations of increases in loan demand, housing constructions and security offerings. Consumer durable stocks rise on expectations of rising consumer confidence and personal income. Capital goods stocks rise on expectation of increases in business capital spending. Basic materials stocks rise on expectation of rising profit margins. Consumer staple stocks rise on expectations that consumers will continue to spend on necessities. c. d. e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started