Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MCQs, but please provide with brief explainations 1. An irrevocable Letter of Credit provides for payment at sight upon presentation of following documents: Commercial Invoice

MCQs, but please provide with brief explainations

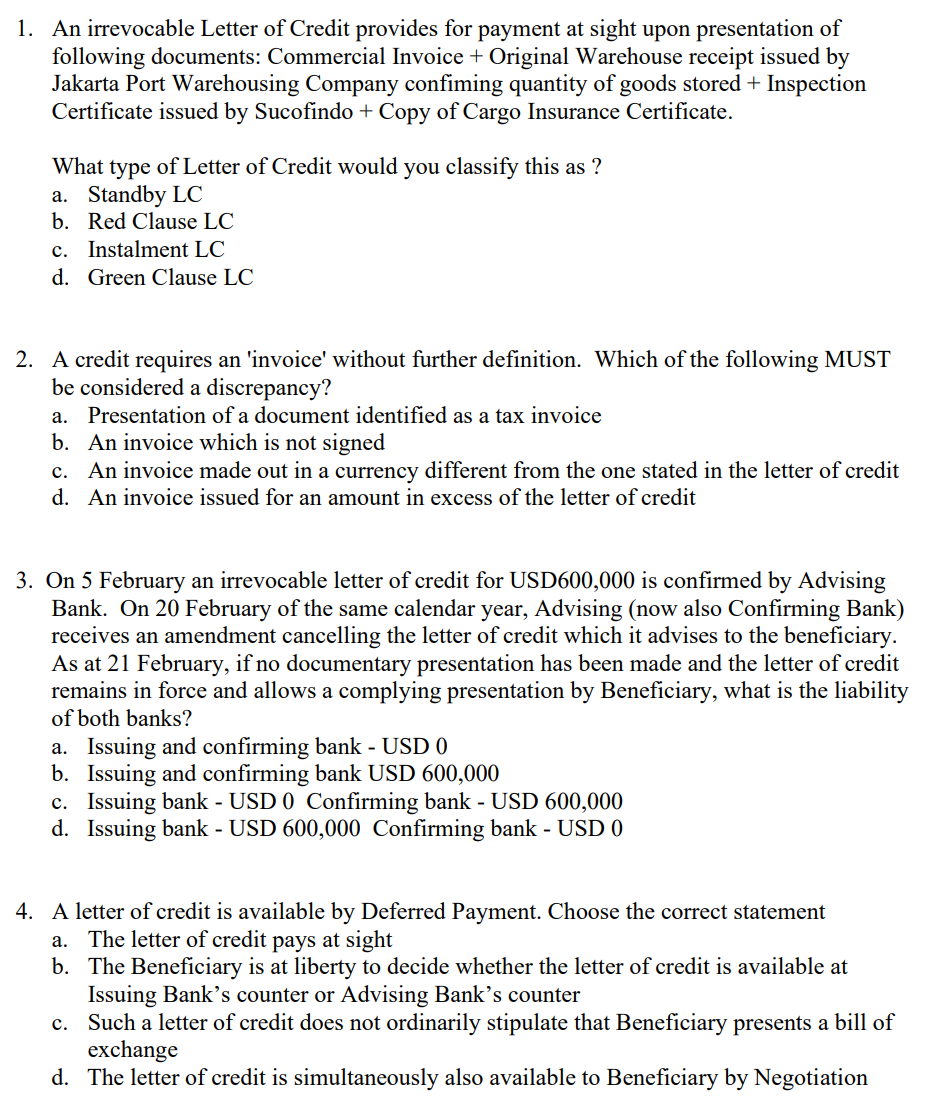

1. An irrevocable Letter of Credit provides for payment at sight upon presentation of following documents: Commercial Invoice + Original Warehouse receipt issued by Jakarta Port Warehousing Company confiming quantity of goods stored + Inspection Certificate issued by Sucofindo + Copy of Cargo Insurance Certificate. What type of Letter of Credit would you classify this as? a. Standby LC b. Red Clause LC c. Instalment LC d. Green Clause LC 2. A credit requires an 'invoice' without further definition. Which of the following MUST be considered a discrepancy? a. Presentation of a document identified as a tax invoice b. An invoice which is not signed c. An invoice made out in a currency different from the one stated in the letter of credit d. An invoice issued for an amount in excess of the letter of credit 3. On 5 February an irrevocable letter of credit for USD600,000 is confirmed by Advising Bank. On 20 February of the same calendar year, Advising (now also Confirming Bank) receives an amendment cancelling the letter of credit which it advises to the beneficiary. As at 21 February, if no documentary presentation has been made and the letter of credit remains in force and allows a complying presentation by Beneficiary, what is the liability of both banks? a. Issuing and confirming bank - USD 0 b. Issuing and confirming bank USD 600,000 c. Issuing bank - USD 0 Confirming bank - USD 600,000 d. Issuing bank - USD 600,000 Confirming bank - USD 0 4. A letter of credit is available by Deferred Payment. Choose the correct statement a. The letter of credit pays at sight b. The Beneficiary is at liberty to decide whether the letter of credit is available at Issuing Bank's counter or Advising Bank's counter c. Such a letter of credit does not ordinarily stipulate that Beneficiary presents a bill of exchange d. The letter of credit is simultaneously also available to Beneficiary by NegotiationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started