Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MCQs for Derivatives management 62. The practice of adjusting regularly the futures price to reflect current market conditions is known as marked to markets 63.

MCQs for Derivatives management

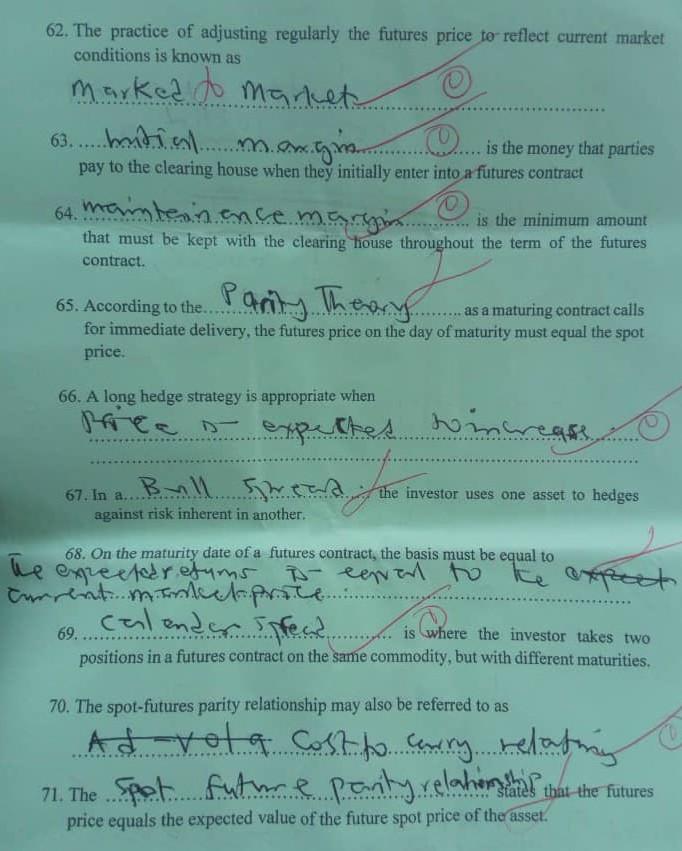

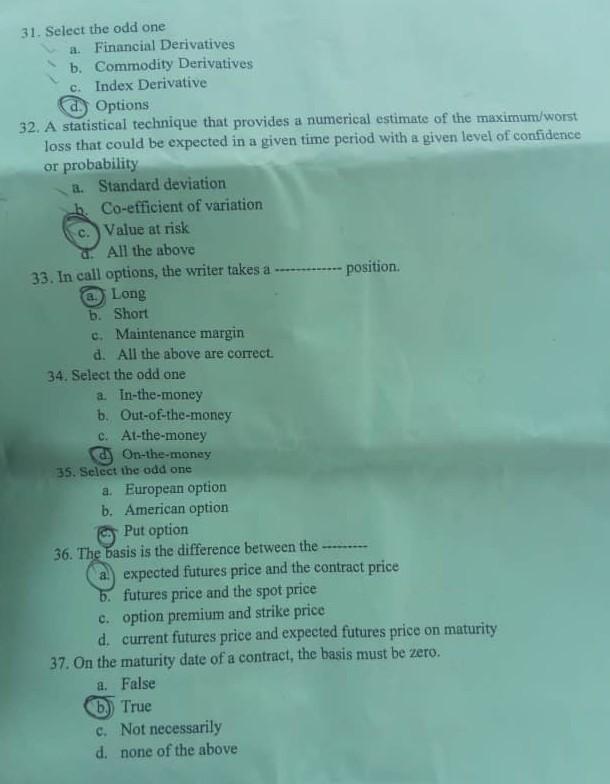

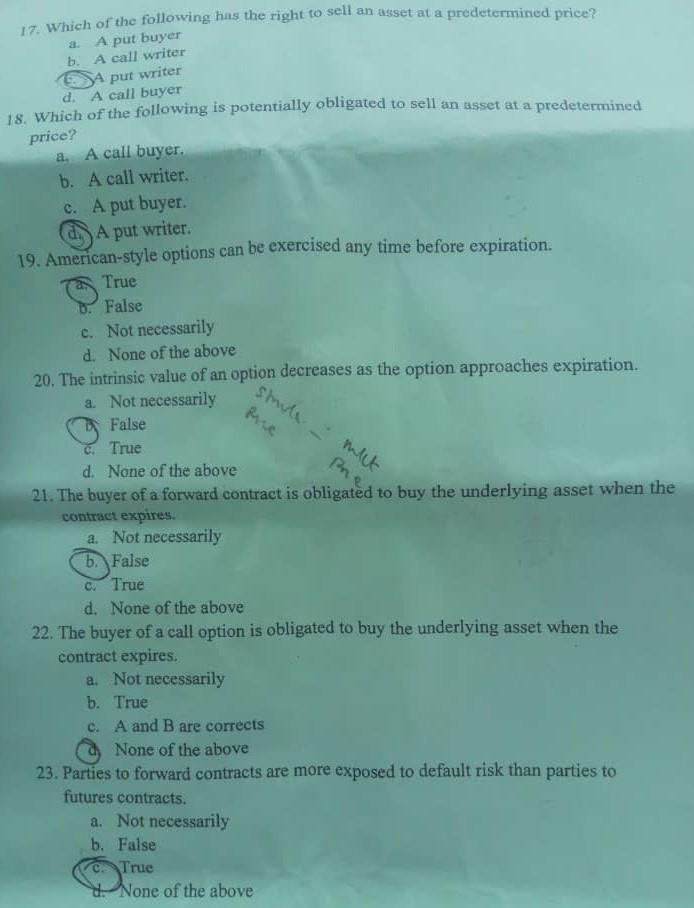

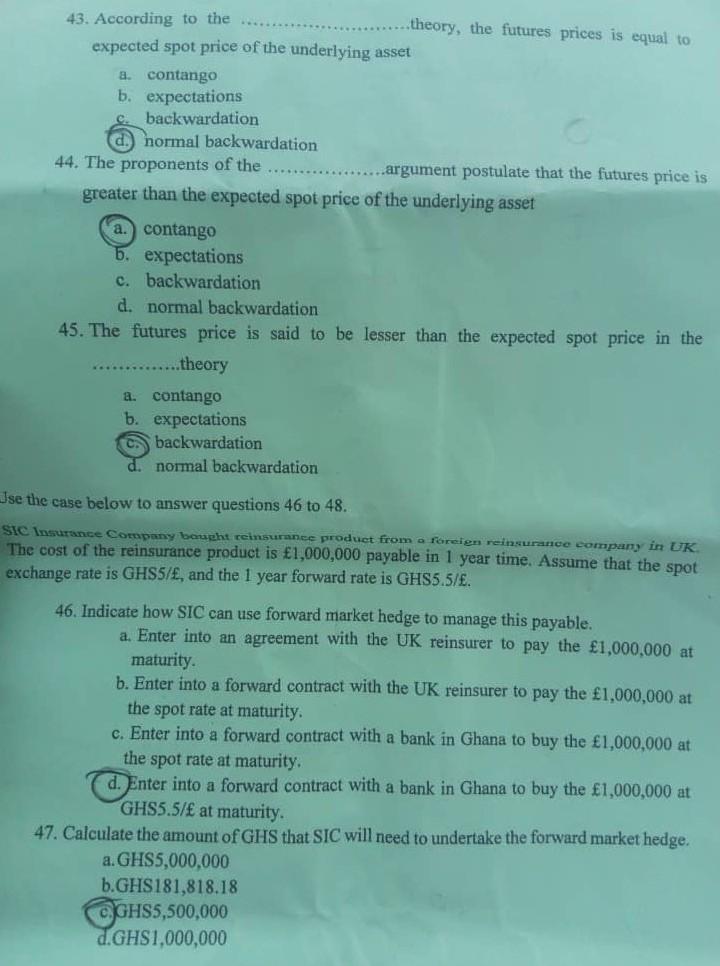

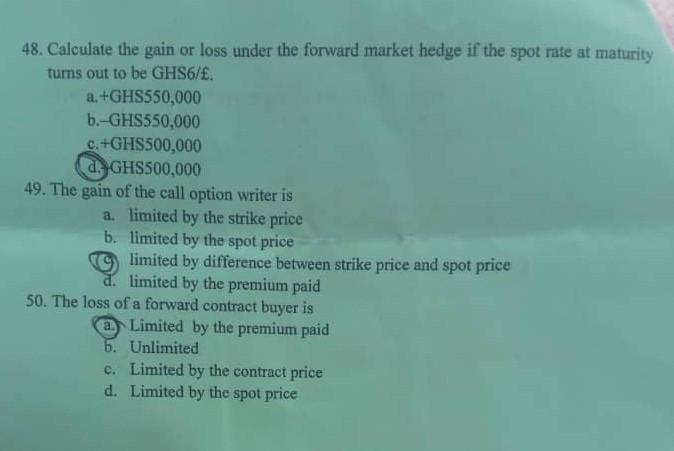

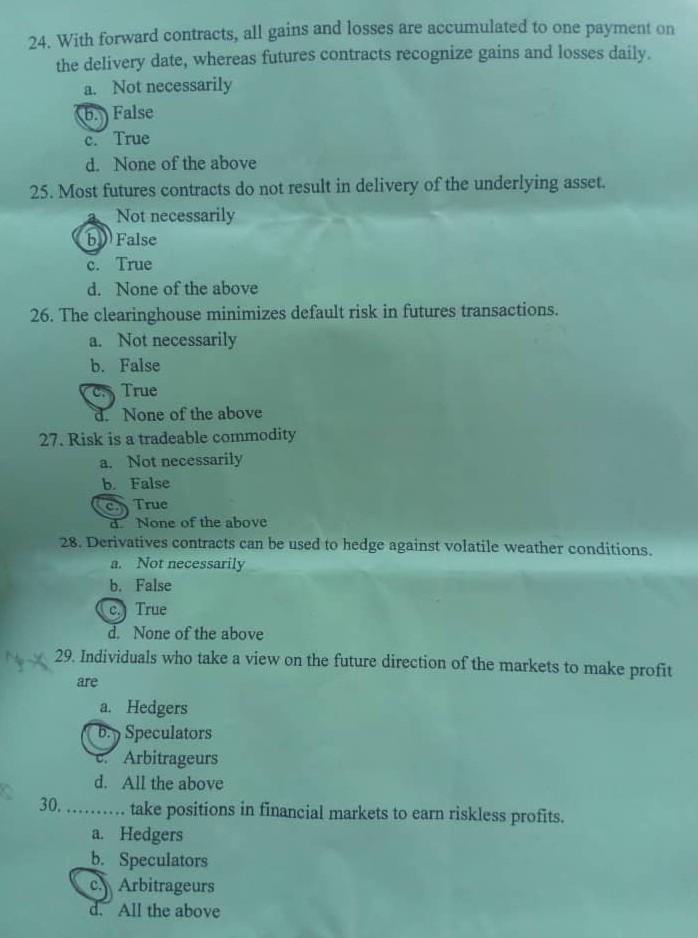

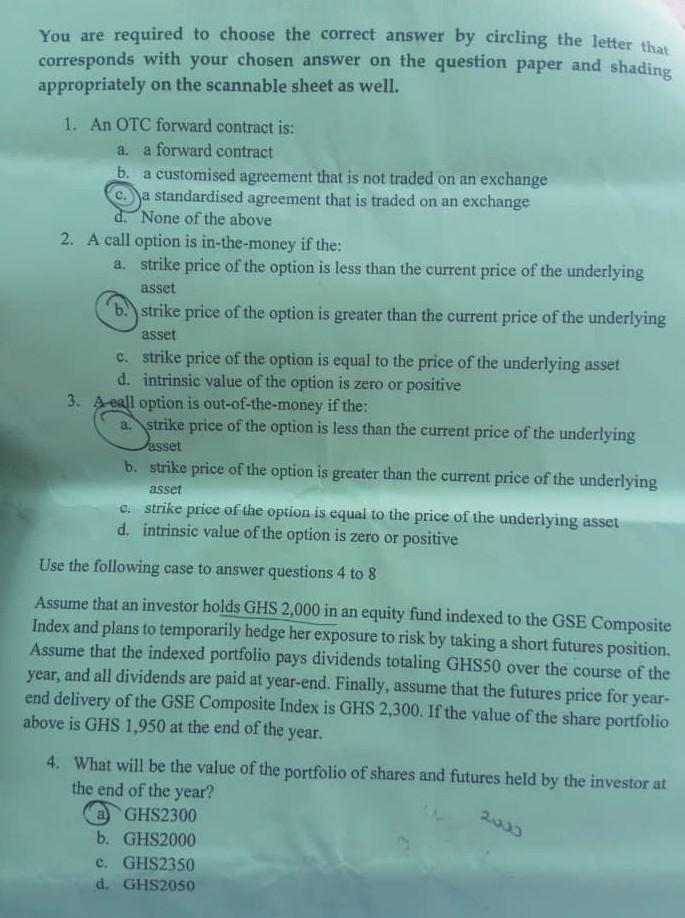

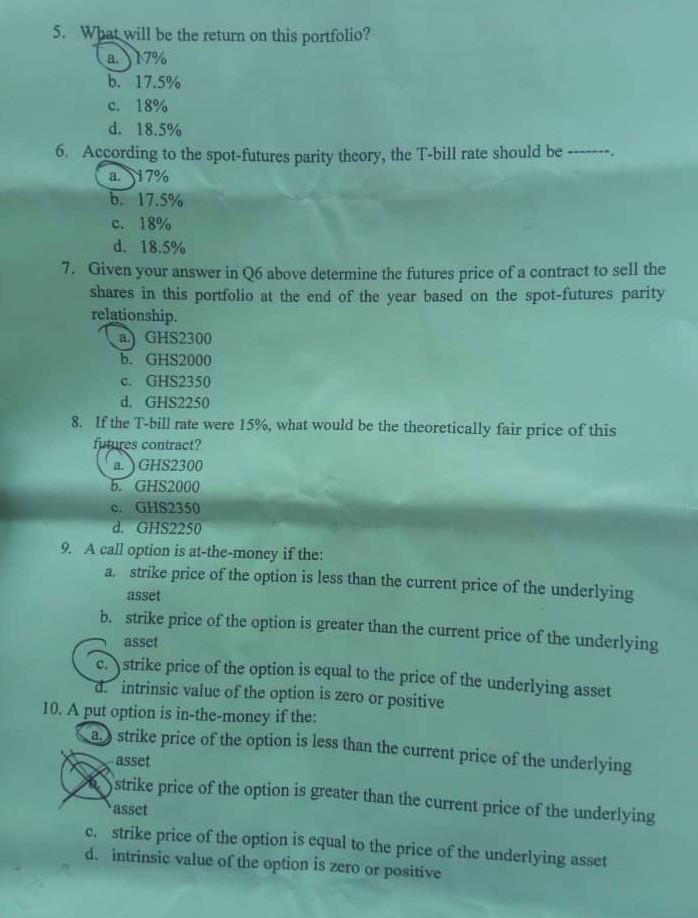

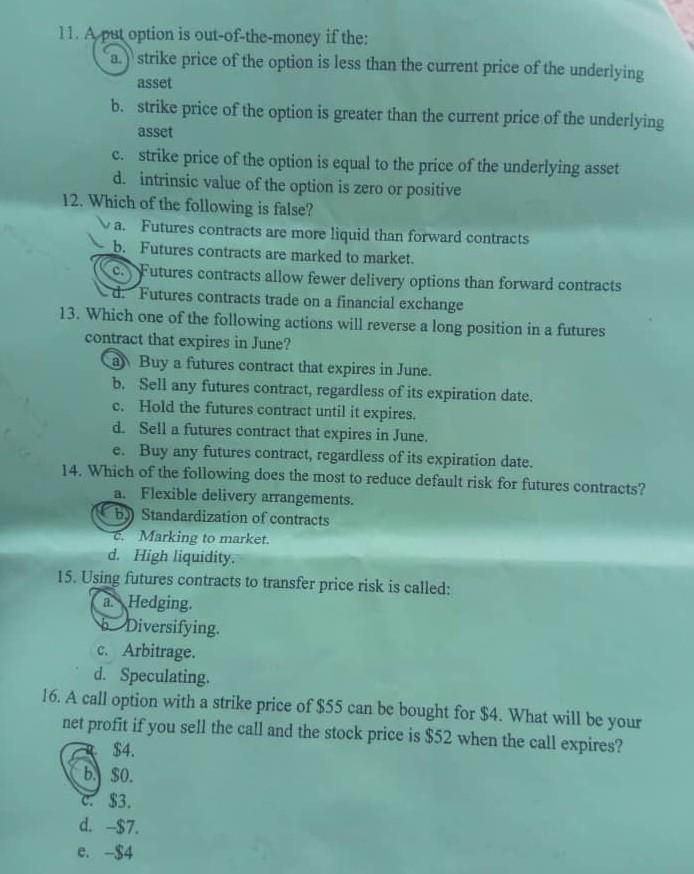

62. The practice of adjusting regularly the futures price to reflect current market conditions is known as marked to markets 63. bitial man gt............... is the money that parties pay to the clearing house when they initially enter into a futures contract 64. maintean encemargis is the minimum amount that must be kept with the clearing house throughout the term of the futures contract. 65. According to the.. Parity Theary as a maturing contract calls for immediate delivery, the futures price on the day of maturity must equal the spot price. 66. A long hedge strategy is appropriate when Pfree D expected. wincreas 67. In a.. Bl read Brill the investor uses one asset to hedges against risk inherent in another. 68. On the maturity date of a futures contract, the basis must be equal to the expected returns Dearer to Current market price. I eared to the expect calender sprea....... is where the investor takes two 69. positions in a futures contract on the same commodity, but with different maturities. 70. The spot-futures parity relationship may also be referred to as Ad vola cost to carry relating 71. The Spot future party relationshi states that the futures price equals the expected value of the future spot price of the asset. 31. Select the odd one a. Financial Derivatives b. Commodity Derivatives c. Index Derivative d Options 32. A statistical technique that provides a numerical estimate of the maximum/worst loss that could be expected in a given time period with a given level of confidence or probability a. Standard deviation b. Co-efficient of variation Value at risk All the above 33. In call options, the writer takes a ---- position. a Long b. Short c. Maintenance margin d. All the above are correct. 34. Select the odd one a. In-the-money b. Out-of-the-money c. At-the-money On-the-money 35. Select the odd one a. European option b. American option Put option 36. The basis is the difference between the a expected futures price and the contract price b. futures price and the spot price c. option premium and strike price d. current futures price and expected futures price on maturity 37. On the maturity date of a contract, the basis must be zero. a. False b) True c. Not necessarily d. none of the above 17. Which of the following has the right to sell an asset at a predetermined price? A put buyer b. A call writer A put writer d. A call buyer 18. Which of the following is potentially obligated to sell an asset at a predetermined price? a. A call buyer. b. A call writer. c. A put buyer. dA put writer. 19. American-style options can be exercised any time before expiration. True b. False c. Not necessarily d. None of the above 20. The intrinsic value of an option decreases as the option approaches expiration. a. Not necessarily False c. True d. None of the above 21. The buyer of a forward contract is obligated to buy the underlying asset when the contract expires. a. Not necessarily b. False c. True d. None of the above 22. The buyer of a call option is obligated to buy the underlying asset when the contract expires. a. Not necessarily b. True c. A and B are corrects None of the above 23. Parties to forward contracts are more exposed to default risk than parties to futures contracts. a. Not necessarily b. False True d. None of the above shule mlet Pn 43. According to the theory, the futures prices is equal to expected spot price of the underlying asset a. contango b. expectations c. backwardation d. normal backwardation 44. The proponents of the ..argument postulate that the futures price is greater than the expected spot price of the underlying asset a. contango 5. expectations c. backwardation d. normal backwardation 45. The futures price is said to be lesser than the expected spot price in the ...........theory a. contango b. expectations C backwardation normal backwardation Jse the case below to answer questions 46 to 48. SIC Insurance Company bought reinsurance product from a foreign reinsurance company in UK. The cost of the reinsurance product is 1,000,000 payable in 1 year time. Assume that the spot exchange rate is GHS5/, and the 1 year forward rate is GHS5.5/. 46. Indicate how SIC can use forward market hedge to manage this payable. a. Enter into an agreement with the UK reinsurer to pay the 1,000,000 at maturity. b. Enter into a forward contract with the UK reinsurer to pay the 1,000,000 at the spot rate at maturity. c. Enter into a forward contract with a bank in Ghana to buy the 1,000,000 at the spot rate at maturity. d. Enter into a forward contract with a bank in Ghana to buy the 1,000,000 at GHS5.5/ at maturity. 47. Calculate the amount of GHS that SIC will need to undertake the forward market hedge. a. GHS5,000,000 b.GHS181,818.18 GHS5,500,000 d.GHS1,000,000 48. Calculate the gain or loss under the forward market hedge if the spot rate at maturity turns out to be GHS6/. a.+GHS550,000 b.-GHS550,000 c.+GHS500,000 d. GHS500,000 49. The gain of the call option writer is a. limited by the strike price b. limited by the spot price limited by difference between strike price and spot price d. limited by the premium paid 50. The loss of a forward contract buyer is a Limited by the premium paid 6. Unlimited c. Limited by the contract price d. Limited by the spot price 24. With forward contracts, all gains and losses are accumulated to one payment on the delivery date, whereas futures contracts recognize gains and losses daily. a. Not necessarily 6. False c. True d. None of the above 25. Most futures contracts do not result in delivery of the underlying asset. Not necessarily b False c. True d. None of the above 26. The clearinghouse minimizes default risk in futures transactions. a. Not necessarily b. False True None of the above 27. Risk is a tradeable commodity a. Not necessarily b. False C True None of the above 28. Derivatives contracts can be used to hedge against volatile weather conditions. a. Not necessarily b. False True d. None of the above 29. Individuals who take a view on the future direction of the markets to make profit are a. Hedgers b. Speculators Arbitrageurs d. All the above take positions in financial markets to earn riskless profits. a. Hedgers b. Speculators c. Arbitrageurs All the above 30. You are required to choose the correct answer by circling the letter that corresponds with your chosen answer on the question paper and shading appropriately on the scannable sheet as well. 1. An OTC forward contract is: a. a forward contract b. a customised agreement that is not traded on an exchange c. a standardised agreement that is traded on an exchange d. None of the above 2. A call option is in-the-money if the: a. strike price of the option is less than the current price of the underlying asset b. strike price of the option is greater than the current price of the underlying asset c. strike price of the option is equal to the price of the underlying asset d. intrinsic value of the option is zero or positive 3. Aeall option is out-of-the-money if the: a strike price of the option is less than the current price of the underlying asset b. strike price of the option is greater than the current price of the underlying asset c. strike price of the option is equal to the price of the underlying asset d. intrinsic value of the option is zero or positive Use the following case to answer questions 4 to 8 Assume that an investor holds GHS 2,000 in an equity fund indexed to the GSE Composite Index and plans to temporarily hedge her exposure to risk by taking a short futures position. Assume that the indexed portfolio pays dividends totaling GHS50 over the course of the year, and all dividends are paid at year-end. Finally, assume that the futures price for year- end delivery of the GSE Composite Index is GHS 2,300. If the value of the share portfolio above is GHS 1,950 at the end of the year. 4. What will be the value of the portfolio of shares and futures held by the investor at the end of the year? 2003 a GHS2300 b. GHS2000 c. GHS2350 d. GHS2050 5. What will be the return on this portfolio? a. 17% b. 17.5% c. 18% d. 18.5% 6. According to the spot-futures parity theory, the T-bill rate should be -- a. 17% b. 17.5% c. 18% d. 18.5% 7. Given your answer in Q6 above determine the futures price of a contract to sell the shares in this portfolio at the end of the year based on the spot-futures parity relationship. a.) GHS2300 b. GHS2000 c. GHS2350 d. GHS2250 8. If the T-bill rate were 15%, what would be the theoretically fair price of this futures contract? a.) GHS2300 b. GHS2000 c. GHS2350 d. GHS2250 9. A call option is at-the-money if the: a. strike price of the option is less than the current price of the underlying asset b. strike price of the option is greater than the current price of the underlying asset c.strike price of the option is equal to the price of the underlying asset d. intrinsic value of the option is zero or positive 10. A put option is in-the-money if the: astrike price of the option is less than the current price of the underlying asset strike price of the option is greater than the current price of the underlying asset c. strike price of the option is equal to the price of the underlying asset d. intrinsic value of the option is zero or positive 11. A pst option is out-of-the-money if the: a. strike price of the option is less than the current price of the underlying asset b. strike price of the option is greater than the current price of the underlying asset c. strike price of the option is equal to the price of the underlying asset intrinsic value of the option is zero or positive d. 12. Which of the following is false? a. Futures contracts are more liquid than forward contracts b. Futures contracts are marked to market. Futures contracts allow fewer delivery options than forward contracts d. Futures contracts trade on a financial exchange 13. Which one of the following actions will reverse a long position in a futures contract that expires in June? a Buy a futures contract that expires in June. b. Sell any futures contract, regardless of its expiration date. c. Hold the futures contract until it expires, d. Sell a futures contract that expires in June. e. Buy any futures contract, regardless of its expiration date. 14. Which of the following does the most to reduce default risk for futures contracts? a. Flexible delivery arrangements. b) Standardization of contracts C. Marking to market. d. High liquidity. 15. Using futures contracts to transfer price risk is called: a. Hedging. Diversifying. c. Arbitrage. d. Speculating. 16. A call option with a strike price of $55 can be bought for $4. What will be your net profit if you sell the call and the stock price is $52 when the call expires? $4. b. $0. C. $3. d. -$7. e. -$4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started