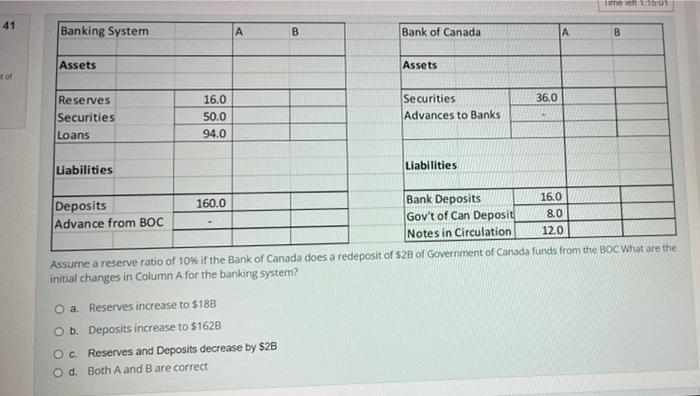

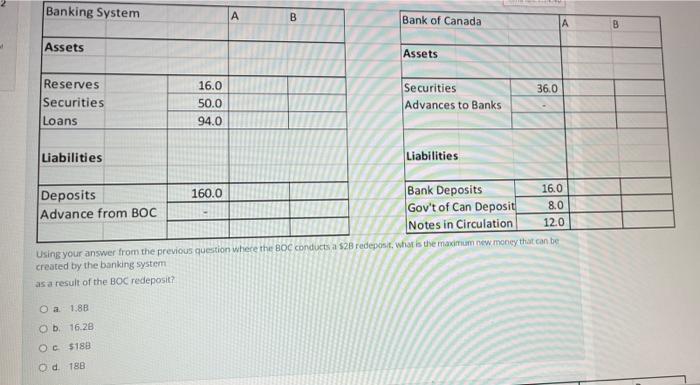

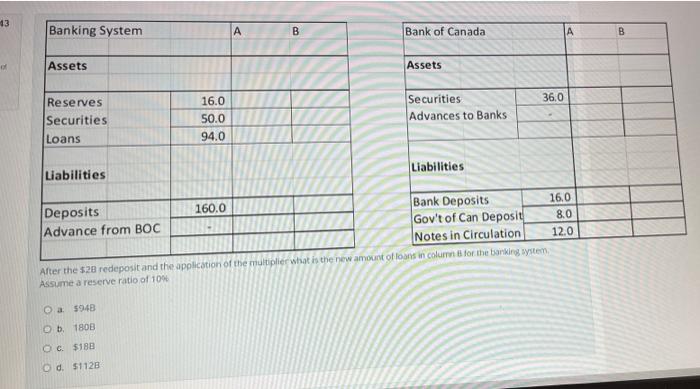

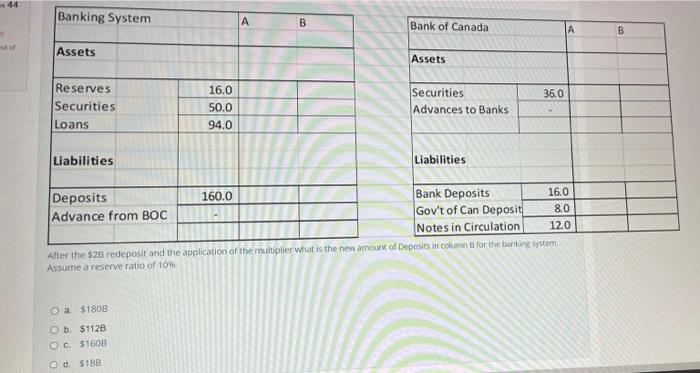

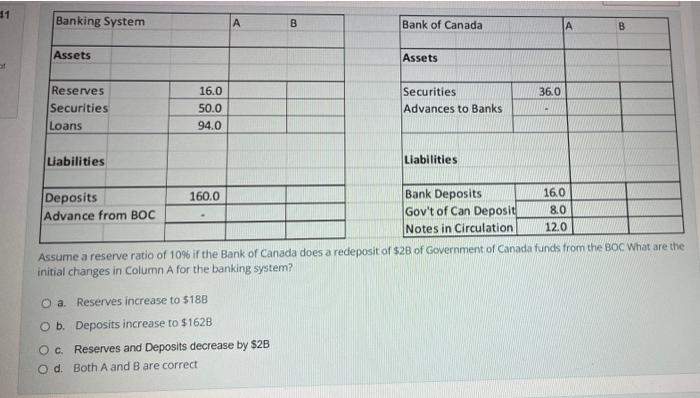

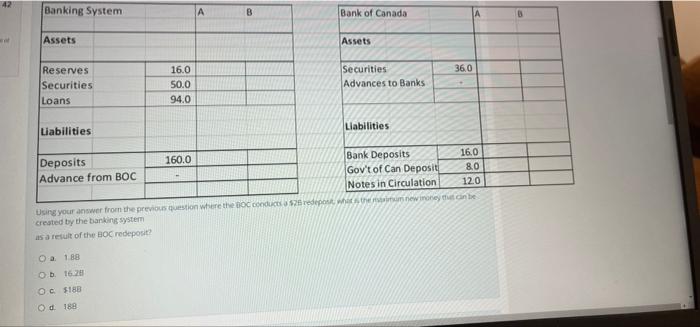

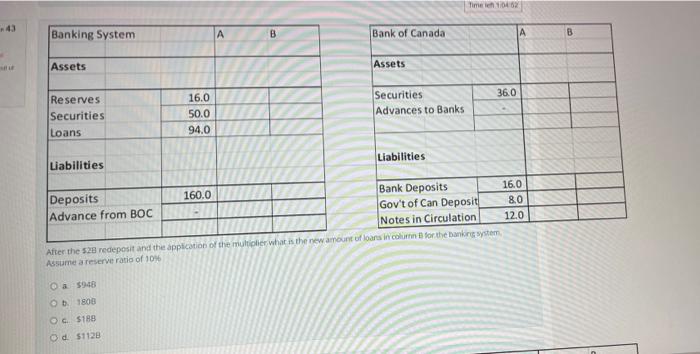

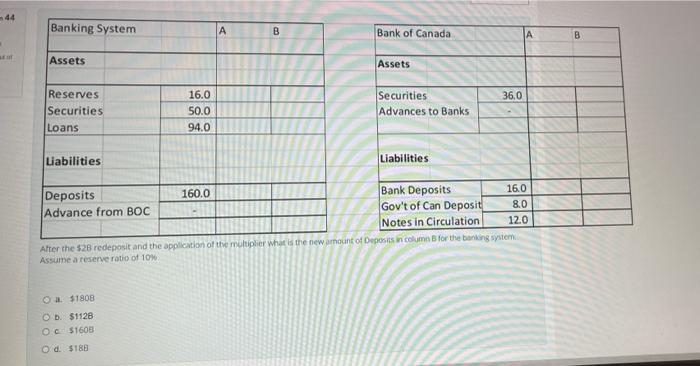

me 150 41 Banking System B Bank of Canada B Assets Assets not 36.0 Reserves Securities Loans 16.0 50.0 94.0 Securities Advances to Banks Liabilities Liabilities Deposits 160.0 Bank Deposits 16.0 Advance from BOC Gov't of Can Deposit 8.0 Notes in Circulati 12.0 Assume a reserve ratio of 10% if the Bank of Canada does a redeposit of $2B of Government of Canada funds from the BOC What are the initial changes in Column A for the banking system? O a. Reserves increase to $180 O b. Deposits increase to $162B OC Reserves and Deposits decrease by $2B O d. Both A and Bare correct Banking System A B Bank of Canada A B Assets Assets 36.0 Reserves Securities Loans 16.0 50.0 94.0 Securities Advances to Banks Liabilities Liabilities Deposits 160.0 Bank Deposits 16.0 Advance from BOC Gov't of Can Deposit 8.0 Notes in Circulation 12.0 Using your answer from the previous question where the BOC conducts a 528 redeposit, what is the maximum new money that can be created by the banking system as a result of the BOC redeposit? O a 1.8B Ob 16.28 Oc5188 O d. 188 43 Banking System A B Bank of Canada A B Assets Assets 36,0 Reserves Securities Loans 16.0 50.0 94.0 Securities Advances to Banks Liabilities Liabilities Deposits 160.0 Bank Deposits 16.0 Advance from BOC Gov't of Can Deposit 8.0 Notes in Circulation 12.0 After the $20 redeposit and the apolication of the multiplier what is the new amount of loans in columns for the banking wstem Assume a reserve ratio of 10 O a $948 b. 180B OC 5188 od 51128 Banking System A B Bank of Canada B Assets Assets 36.0 Reserves Securities Loans 16.0 50.0 94.0 Securities Advances to Banks Liabilities Liabilities Deposits 160.0 Bank Deposits 16.0 Advance from BOC Gov't of Can Deposit 80 Notes in Circulation 12.0 After the $2B redeposit and the application of the multiplier what is the new amount of Deposits in column B for the banking system Assume a reserve ratio of 10 O a $1808 Ob $1128 Oc$160B d. 5188 11 Banking System B Bank of Canada B Assets Assets 36.0 Reserves Securities Loans 16.0 50.0 94.0 Securities Advances to Banks Liabilities Liabilities Deposits 160.0 Bank Deposits 16.0 Advance from BOC Gov't of Can Deposit 8.0 Notes in Circulation 12.0 Assume a reserve ratio of 10% if the Bank of Canada does a redeposit of $2B of Government of Canada funds from the BOC What are the initial changes in Column A for the banking system? a. Reserves increase to $18B O b. Deposits increase to $1628 Oc. Reserves and Deposits decrease by $2B O d. Both A and B are correct Banking System A B Bank of Canada Assets Assets 36,0 Reserves Securities Loans 16.0 50.0 94.0 Securities Advances to Banks Liabilities Liabilities Deposits 160.0 Bank Deposits 16.0 Advance from BOC Gov't of Can Deposit 8.0 Notes in Circulation 120 Using your answer from the previous question where the conducts as redepot what the new money that can be created by the banking system as a result of the BOC redepout? Oa 188 Ob 162 Oc5188 Od 188 Time in 43 Banking System B Bank of Canada B Assets Assets 36.0 Reserves Securities Loans 16.0 50.0 94.0 Securities Advances to Banks Liabilities Liabilities Deposits 160.0 Bank Deposits 16.0 Advance from BOC Gov't of Can Deposit 80 Notes in Circulation 12.0 After the 528 redeposit and the application of the multiplier what is the new amount of loans in column for the banking system Assume a reserve ratio of 10% a $948 Ob 1808 OCS188 Od $1128 44 Banking System B Bank of Canada A B Assets Assets 36,0 Reserves Securities Loans 16.0 50.0 94.0 Securities Advances to Banks Liabilities Liabilities Deposits 160.0 Bank Deposits 16.0 Advance from BOC Gov't of Can Deposit 8.0 Notes in Circulation 12.0 After the $26 redeposit and the application of the multiplier what is the new amount of Deposits incolumn for the banking system Assume a reserve ratio of 10% O a $1808 $1128 OC 5160B Od: $180