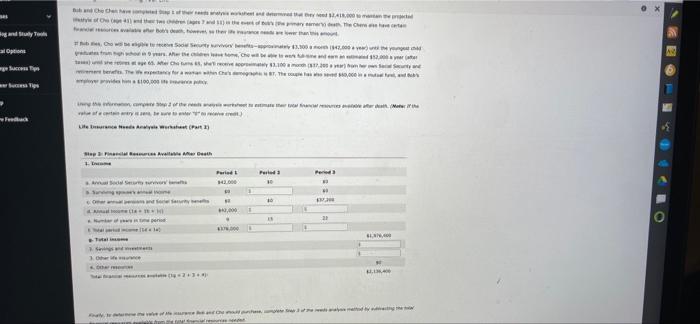

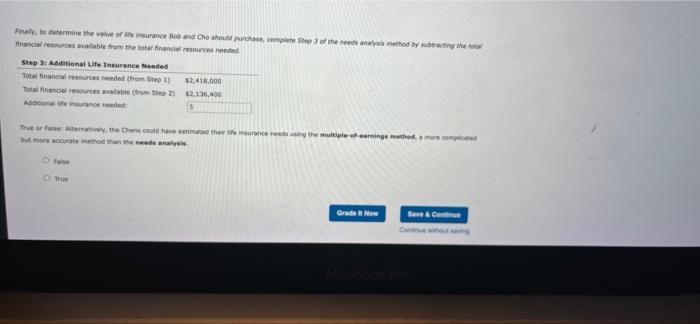

me and Study To alOptions 4 T Band Cheche have some of their needs anys Cage 41) and the two children ages 7 and 11) is the and me that they seed 11,418,000 to mantan the c of semary emerto death the Chene se have certa are lower than valate after Bob's death, howeves, so there we ee to receive Social Securty survivors best-apply$3.300 a moth (342,000 a year) unt the youngest pratutt gh who 9 years. Aer the children atome, Che w nemad 152,000 a year after Stand tas) und este 65. Mer Che tuns, she receive apprimately $3.100 m (17,200 xpectancy for a man with Che's op 87 The e has also se year) from her $60,000 in per provides him $100,000 ing ration, competep of the textmate the total ansatt(e of certain tryse be sure to cre Life Insurance Analyst (Part 2) Step 3: Financial Rece Available A Death Ice Period 3 Period 3 A Soal Se 10 13 Surving s Home Others and Social Security (14 15 21 Humber $1,310,000 Tal 13.400 med by the MA www. 3.0 and m Period 1 $41,000 40,000 4X76,000 (q +2+3+4) of Lent.al resu $ NYDECHO Finally, to determine the value of life insurance Bob and Che should purchase, complete Step 3 of the needs analysis method by subtracting the total financial resources available from the total financial resources needed. Step 3: Additional Life Insurance Needed Total financial resources needed (from Step 1) Total financial resources available (from Step 2) $2,418,000 $2.136,400 S Additional life insurance needed: True or False Alternatively, the Chens could have estimated their life insurance needs using the multiple-of-earnings method, are complicated but more accurate method than the needs analysis O True Grade It Now Save & Continue Continue with s me and Study To alOptions 4 T Band Cheche have some of their needs anys Cage 41) and the two children ages 7 and 11) is the and me that they seed 11,418,000 to mantan the c of semary emerto death the Chene se have certa are lower than valate after Bob's death, howeves, so there we ee to receive Social Securty survivors best-apply$3.300 a moth (342,000 a year) unt the youngest pratutt gh who 9 years. Aer the children atome, Che w nemad 152,000 a year after Stand tas) und este 65. Mer Che tuns, she receive apprimately $3.100 m (17,200 xpectancy for a man with Che's op 87 The e has also se year) from her $60,000 in per provides him $100,000 ing ration, competep of the textmate the total ansatt(e of certain tryse be sure to cre Life Insurance Analyst (Part 2) Step 3: Financial Rece Available A Death Ice Period 3 Period 3 A Soal Se 10 13 Surving s Home Others and Social Security (14 15 21 Humber $1,310,000 Tal 13.400 med by the MA www. 3.0 and m Period 1 $41,000 40,000 4X76,000 (q +2+3+4) of Lent.al resu $ NYDECHO Finally, to determine the value of life insurance Bob and Che should purchase, complete Step 3 of the needs analysis method by subtracting the total financial resources available from the total financial resources needed. Step 3: Additional Life Insurance Needed Total financial resources needed (from Step 1) Total financial resources available (from Step 2) $2,418,000 $2.136,400 S Additional life insurance needed: True or False Alternatively, the Chens could have estimated their life insurance needs using the multiple-of-earnings method, are complicated but more accurate method than the needs analysis O True Grade It Now Save & Continue Continue with s