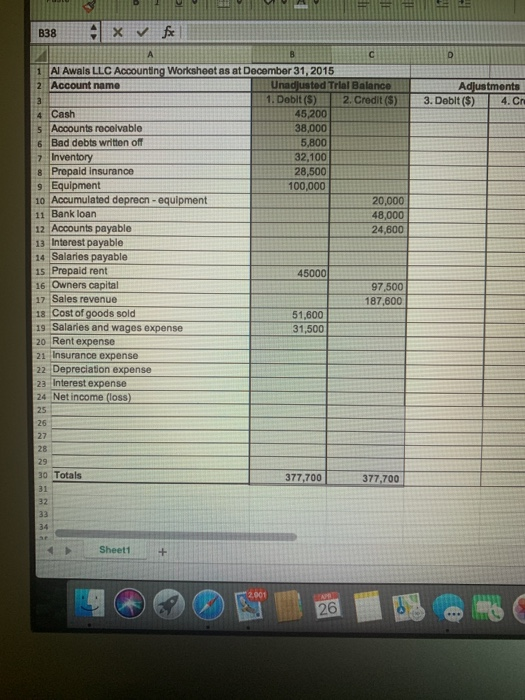

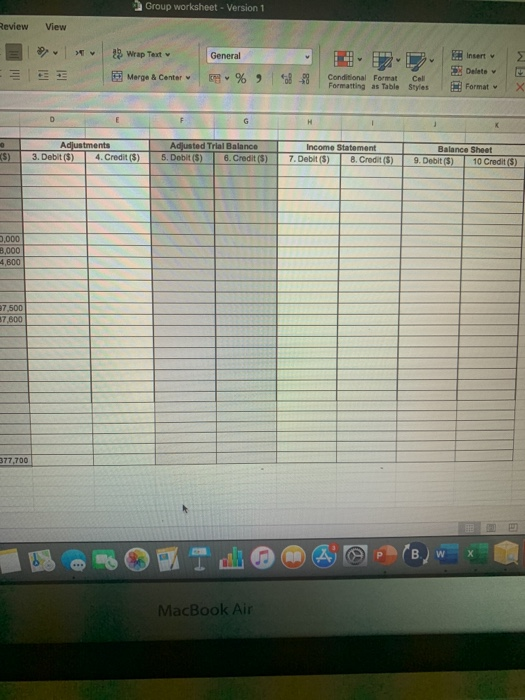

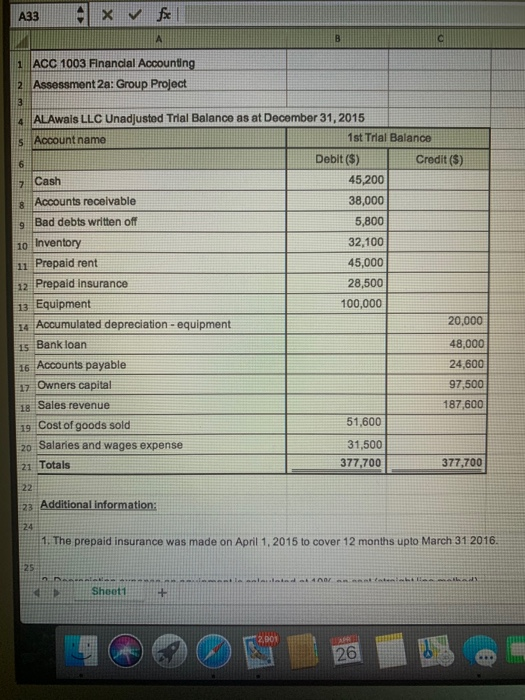

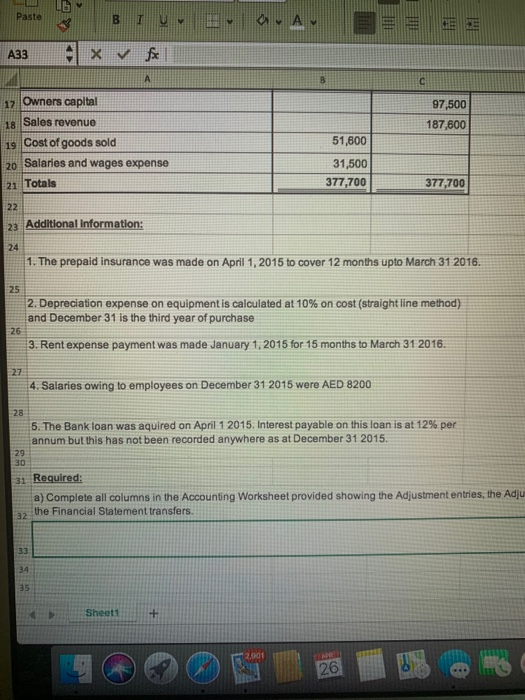

ME B38 x fx Adjustments 3. Debit($) 4.cn Al Awals LLC Accounting Worksheet as at December 31, 2015 Account name Unadjusted Trial Balance 1. Debit (S) 2. Credit (S) 4 Cash 45,200 Accounts receivable 38,000 6 Bad debts written off 5,800 7. Inventory 32,100 8 Prepaid Insurance 28,500 9 Equipment 100,000 10 Accumulated deprecn - equipment 20.000 11 Bank loan 48.000 12 Accounts payable 24,600 13 Interest payable 14 Salarios payable 15 Prepaid rent 45000 16 Owners capital 97,500 17 Sales revenue 187.600 18 Cost of goods sold 51,600 19 Salaries and wages expense 31,500 20 Rent expense 21 Insurance expense 22 Depreciation expense 23 Interest expense 24 Net income (loss) 30 Totals 377,700 377,700 Sheet1 Group worksheet - Version 1 Review View * Wrap Test Merge & Contar General % 10- 13 E 2 888 let Delete Format Conditional Format Formatting as Table Call Styles X D E F G H I (S) Adjustments 3. Debit (S) 4. Credit (3) Adjusted Trial Balance 5. Debit (5) 6. Credit (5) Income Statement 7. Debit($) 8. Credit (5) Balance Sheet 9. Debit ($) 10 Credit (5) IT T L 3.000 3,000 4,600 97,500 37,600 377,700 MacBook Air MMMMMMMMMMUTHIYA AAMIAI A33 X f A ACC 1003 Financial Accounting Assessment 2a: Group Project ALAwais LLC Unadjusted Trial Balance as at December 31, 2015 Account name 1st Trial Balance Debit ($) Credit ($) Cash 45,200 Accounts receivable 38,000 Bad debts written off 5,800 10 Inventory 32,100 11 Prepaid rent 45,000 Prepaid insurance 28,500 13 Equipment 100,000 Accumulated depreciation - equipment 20,000 15 Bank loan 48,000 16 Accounts payable 24,600 Owners capital 97,500 18 Sales revenue 187,600 19 Cost of goods sold 51,600 20 Salaries and wages expense 31,500 Totals 377,700 377,700 EZ Additional information: 1. The prepaid insurance was made on April 1, 2015 to cover 12 months upto March 31 2016. lai.lt et latenlab S GPC 26 . A. A 5 Paste C A33 B 1 U y for x 97,500 187,600 Owners capital Sales revenue Cost of goods sold Salaries and wages expense No 51,600 31,500 377,700 Totals 377,700 Additional Information: 1. The prepaid insurance was made on April 1, 2015 to cover 12 months upto March 31 2016. 2. Depreciation expense on equipment is calculated at 10% on cost (straight line method) and December 31 is the third year of purchase 3. Rent expense payment was made January 1, 2015 for 15 months to March 31 2016. 4. Salarios owing to employees on December 31 2015 were AED 8200 5. The Bank loan was aquired on April 1 2015. Interest payable on this loan is at 12% per annum but this has not been recorded anywhere as at December 31 2015. 31 Required: a) Complete all columns in the Accounting Worksheet provided showing the Adjustment entries, the Adju 32 the Financial Statement transfers. Sheet1