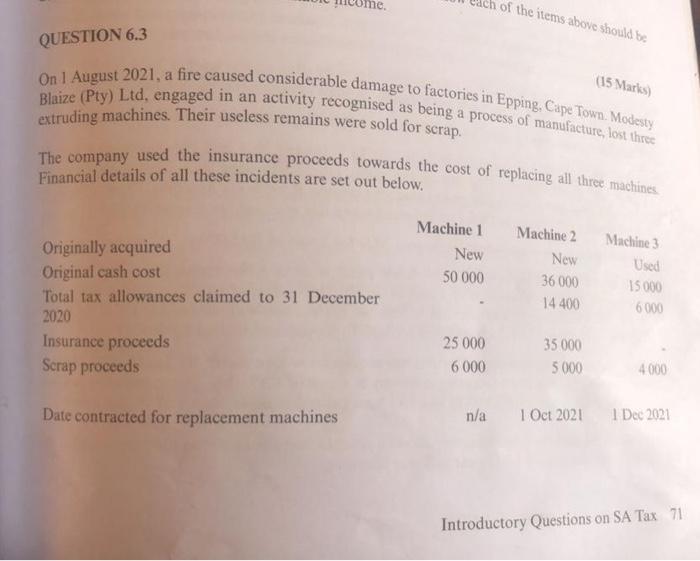

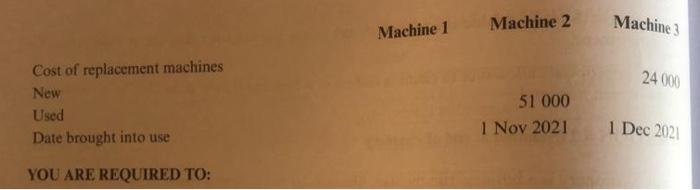

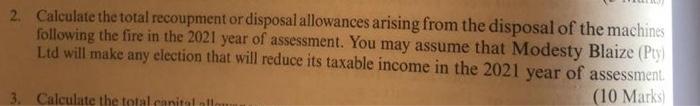

me. ch of the items above should be QUESTION 6.3 (15 Marts On 1 August 2021, a fire caused considerable damage to factories in Epping, Cape Town. Modesty Blaize (Pty) Ltd, engaged in an activity recognised as being a process of manufacture, lost three extruding machines. Their useless remains were sold for scrap. The company used the insurance proceeds towards the cost of replacing all three machines Financial details of all these incidents are set out below. Machine 1 Machine 2 Originally acquired New New Original cash cost 50 000 36 000 15000 Total tax allowances claimed to 31 December 14 400 6000 2020 Insurance proceeds 25 000 35 000 6 000 5000 4000 Scrap proceeds n/a 1 Oct 2021 1 Dec 2021 Date contracted for replacement machines Machine 3 Used Introductory Questions on SA Tax 71 Machine 2 Machine Machine 1 24 000 Cost of replacement machines New Used Date brought into use 51 000 1 Nov 2021 1 Dec 2021 YOU ARE REQUIRED TO: 2. Calculate the total recoupment or disposal allowances arising from the disposal of the machines following the fire in the 2021 year of assessment. You may assume that Modesty Blaize (Pty) Ltd will make any election that will reduce its taxable income in the 2021 year of assessment (10 Marks 3. Calculate the total canita! me. ch of the items above should be QUESTION 6.3 (15 Marts On 1 August 2021, a fire caused considerable damage to factories in Epping, Cape Town. Modesty Blaize (Pty) Ltd, engaged in an activity recognised as being a process of manufacture, lost three extruding machines. Their useless remains were sold for scrap. The company used the insurance proceeds towards the cost of replacing all three machines Financial details of all these incidents are set out below. Machine 1 Machine 2 Originally acquired New New Original cash cost 50 000 36 000 15000 Total tax allowances claimed to 31 December 14 400 6000 2020 Insurance proceeds 25 000 35 000 6 000 5000 4000 Scrap proceeds n/a 1 Oct 2021 1 Dec 2021 Date contracted for replacement machines Machine 3 Used Introductory Questions on SA Tax 71 Machine 2 Machine Machine 1 24 000 Cost of replacement machines New Used Date brought into use 51 000 1 Nov 2021 1 Dec 2021 YOU ARE REQUIRED TO: 2. Calculate the total recoupment or disposal allowances arising from the disposal of the machines following the fire in the 2021 year of assessment. You may assume that Modesty Blaize (Pty) Ltd will make any election that will reduce its taxable income in the 2021 year of assessment (10 Marks 3. Calculate the total canita