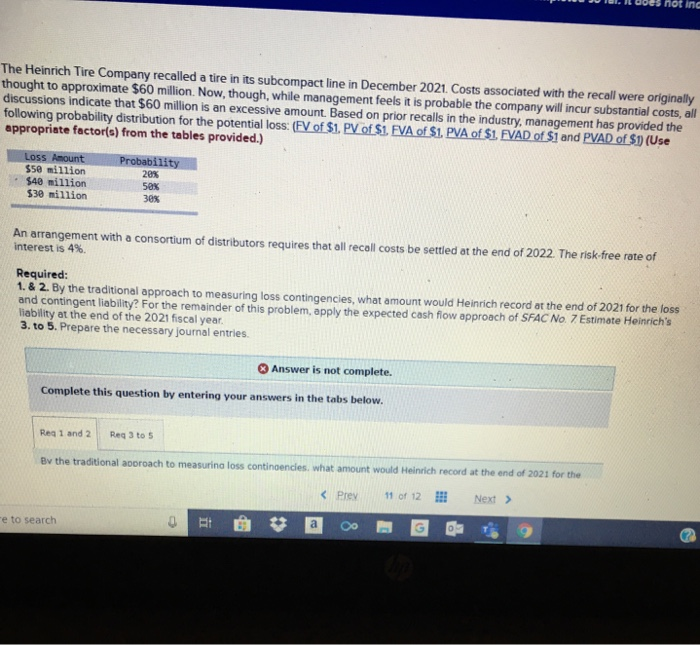

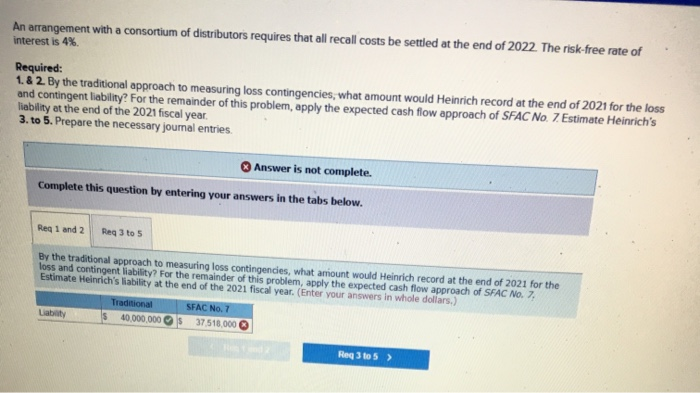

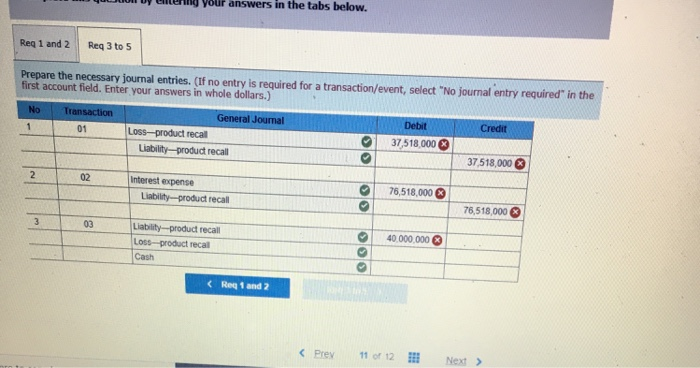

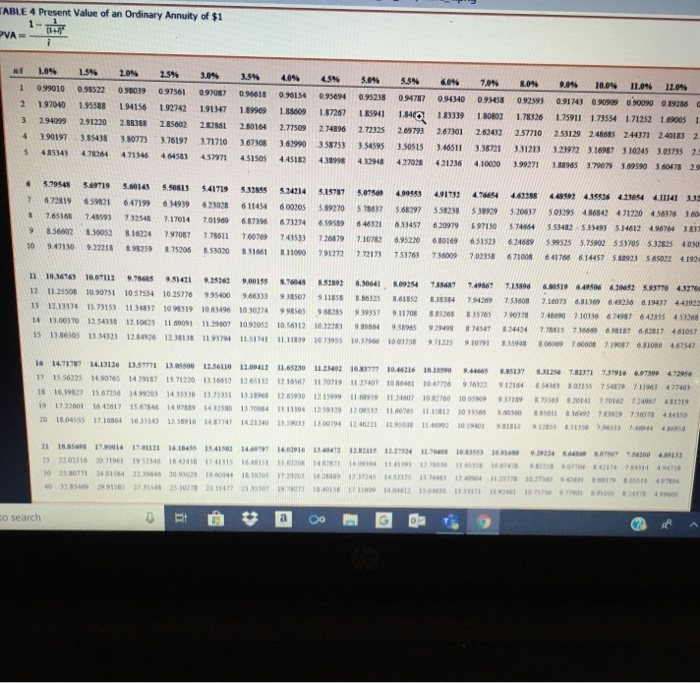

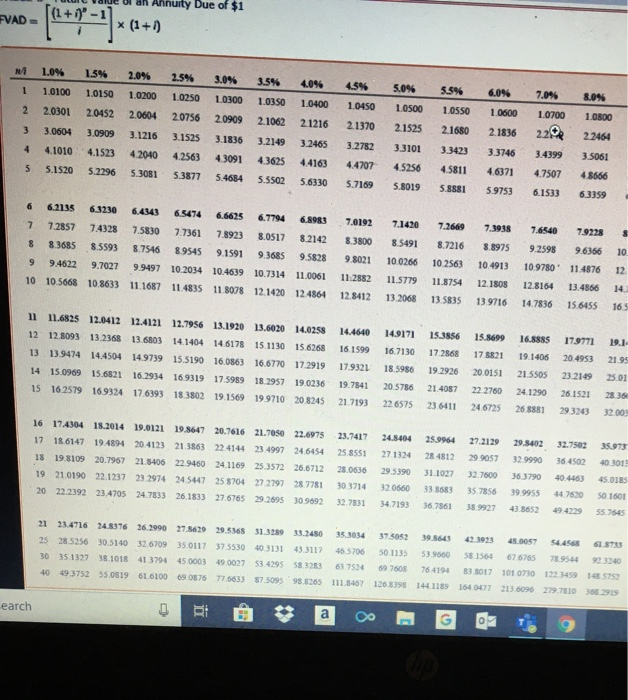

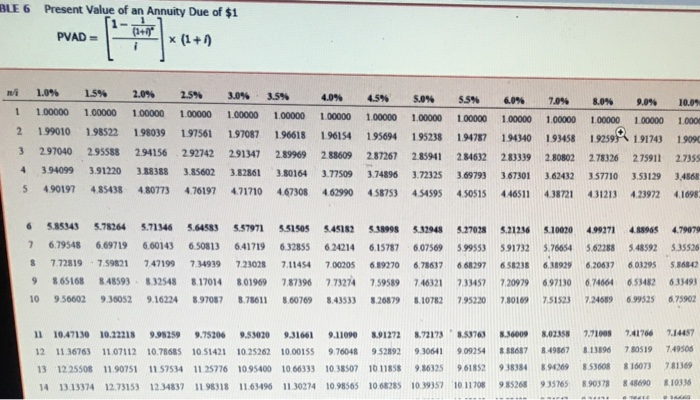

me Heinrich Tire Company recalled a tire in its subcompact line in December 2021. Costs associated with the recall were originally nought to approximate $60 million. Now, though, while management feels it is probable the company will incur substantial costs, all iscussions indicate that $60 million is an excessive amount. Based on prior recalls in the industry, management has provided the ollowing probability distribution for the potential loss: (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $i and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Probability 201 Loss Amount $50 million $40 million $30 million SAK 30% An arrangement with a consortium of distributors requires that all recall costs be settled at the end of 2022. The risk-free rate of interest is 4% Required: 1. & 2. By the traditional approach to measuring loss contingencies, what amount would Heinrich record at the end of 2021 for the loss and contingent liability? For the remainder of this problem, apply the expected cash flow approach of SFAC No. 7 Estimate Heinrich's liability at the end of the 2021 fiscal year. 3. to 5. Prepare the necessary journal entries Answer is not complete. Complete this question by entering your answers in the tabs below. Red 1 and 2 Reg 3 to 5 By the traditional approach to measuring loss contingencies, what amount would Heinrich record at the end of 2021 for the le to search An arrangement with a consortium of distributors requires that all recall costs be settled at the end of 2022. The risk-free rate of interest is 4%. Required: 1.& 2 By the traditional approach to measuring loss contingencies, what amount would Heinrich record at the end of 2021 for the loss and contingent liability? For the remainder of this problem, apply the expected cash flow approach of SFAC No. 7 Estimate Heinrich's liability at the end of the 2021 fiscal year. 3. to 5. Prepare the necessary joumal entries. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg1 and 2 Red 3 to 5 By the traditional approach to measuring loss contingencies, what amount would Heinrich record at the end of 2021 for the loss and contingent liability for the remainder of this problem, apply the expected cash flow approach of SFAC No. 7. Estimate Heinrich's liability at the end of the 2021 fiscal year. (Enter your answers in whole dollars.) Labaty $ Traditional 40,000,000 SFAC No. 7 $ 37518.000 Reg 3 to 5 > - your answers in the tabs below. Req 1 and 2 Req 3 to 5 Prepare the necessary journal entries. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in whole dollars.) No Debit Credit Transaction 01 General Journal LOSS-product recal Liability product recall 37 518 000 37518,000 76,518,000 Interest expense Liability product recall 76,518 000 X 40.000.000 Liability product recall Lost-product recal Cash BLE 4 Present Value of an ordinary Annuity of $1 A. Mi 10% 1.5% 20% 2.5% 3.04 3.51 40 724 0 0 100 110 12 1 099010095522 093099 097561 097 090018 0.90154 095094 0.95238 077 094340 09458 092593 091743099 019286 2 197010 1.95588 94156 1.9274219117 1.89969188609 187267 185941 1840 183339 1 80802 178326 175911173554 171252 690051 3 294099 291220 233 235602 2001 200164 2.77509274896 2.72335 269 793 2.67301 2.694 2.57710 253129 240 241371 240132 4 3.90197 3.85438 33077376197 71710 36730816299015253545950515140511121312039923109? 10245 303735 21 $ 485148470364 471546 484583 457 4515s 44518 4 499 42708421236 4100003.99271 3.865 3.7907369580 360478 28 6 5.79545 5.61719 5.60143 5.508135.41719 5.33865 $34314 3157875.075 40943 413 414 469 7 672219 21 647199819992611494 8000S 0S S S 19 2017 # 7.65165 748193 33548 17014 7010068295671274 6958940121811457 62099 S 97110 9 8.56602 36052 16234 97087778611 76079743533 6 90 610169 6513 109.4713022218 2259 75206 53020831661 11090 7912727 72173 751763 09 70218 671008 41436 433054 411141 SOUM 7120456176 180 5 51483 ) 5146126764383 5.995.35 3.75055370553200340 641106614457 5892365022 4193 110.1678 1672.865140238 019 35803 SI TANGY 797 12 11.25508 10.90751 10.57534 10.25776 9.95400966333 9385079.11858 8.86325 13 13,13374 11.73153 11.34837 1098319 10 6496 1030714993565 9 110 1155 14100054111 110 111 110 109 10 12 101 1547 15 13.6505 13 12 12.50136 12.38138 1193794 1111 1111839 1073955 10 100178912910791 8. 403 40 10 .1360 0492119437443921 7410116 6 40355 IN 637 41057 700 100 101 74434 73371710250 77 16 14 136 137 13 11.6110 11 0 1110011 1001110 2 17155625 1490765 14 2017 117120111661213651 165671107010 1 0 070312164 18 161) 156716401411631535111 111 19 1720 16 43611164 110 11111111111111100 TO 1504555 1716364 1635143 15 58916 143 1421340 13.07412 1 9514 100 S 3156 7 . 00 111 0 110 1811 10 11 12 13 1 0 11961 19 04111411516 2015 1 search - D. (1+1)-U af Annuity Due of $1 (1+1) W 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 55% 60% 7.045 8.04 1 2 3 4 5 1.0100 2.0301 3.0604 4.1010 5.1520 1.0150 2.0452 3.0909 4.1523 5.2296 1.0200 2.0604 3.1216 42040 5.3081 1.0250 1.0300 1.0350 2.0756 2.0909 2.1062 3.15253.1836 3.2149 42563 430914.3625 5.3877 54684 5.5502 1.0400 1.0450 2.1216 2.1370 2.1525 3.2465 3.2782 3.3101 4416344707 4.5256 5.6330 5.71695.8019 2.1680 2.1836 3.342 3.3746 4.5811 4.6371 5.888159753 220 3.4399 4.7507 6.1533 22464 3.5061 48666 6.3359 701927.1420726697.3938 79228 9.6366 10. 6 7 $ 9 10 6.2135 72857 83685 94622 10 5668 6.3230 74328 8.5593 9.7027 10.8633 6.4343 6.5474 7.5830 7.7361 8.754689545 9.9497 10.2034 11.1687 11.4835 6.6625 7.8923 9.1591 10.4639 11.8078 6.7794 6.8983 8.0517 8.2142 9.36859 .5828 10.7314 11.0061 121420 12.4864 9.8021 11:2582 12.8412 10.0266 11.5779 13.2068 10.2563 11.8754 13.5835 10.4913 12.1808 13.9716 76540 9.2598 10.9780 12.8164 14.7836 13.4866 14.. 15.645516 11 11.6825 12.0412 12.4121 12.7956 13.1920 13.6020 14.0258 14.4640 12 12 8093 13.2368 13.6803 14.1404 14.6178 15.1130 15.6268 16 1599 13 139474 14.4504 14.9739 15.5190 16.0863 16.6770 17.291917.9321 14 15.0969 15.6821 16.2934 16.9319 17.5989 18.2957 19.0236 19.7541 15 16.2579 169324 17.6393183802 19.1569 19.9710208245 21.7193 149171 16.7130 18.5986 20.5786 226575 15.3856 17.2868 19.2926 214087 236411 15.8699 16.8885 17.9771 19.1 175821 19.1406 20.495321.95 20.0151 21.5505 23.2149 25.01 22 2760 24.1290 26.152128.36 24672526388129336 32.00 16 174304 15.2014 19.012119.8647 20.7616 21.7050 22.697523.7417 24.5404 25.9964 27.2129 29.540232.7502 35.979 17 18 6147 19.4894 20 4123213863 22414423 4997 24645425 5551 271324 28 4812299057 32 9990 36.4502 4030 18 19.8109 20.7967 21.540622 9460 24.1169 25 3572 26.6712280636 29.5390 31.1027 32.7600 36.3790 40.4463 45.012 19 21.0190 22.1237 23 2974 245447 25870427 2792 287781 303714320660338683 35 7856 39.99554 7630 50 160 20 22.2392 23.4705 24.7833 26 1533 27.6765 29.269530969232.7831 34.7193367361389927 43.365249.422955.754 21 23.4716 34.8376 26.2990 27.862029.5368 31.3189 33348053034 37 50513936436.3923 45.0057 4.4568 25 28.5256 30.5140326709350117 37.553040.3131433112465706 50.113553.9660581564 676765789544 923340 3035132781018 41379445000 490027 53.42955832363752469 76087641943 8017101073012234598575 40 19375255.051961.610069087677563357.509 98.836511134671360981441189 1640477213 60962797810 29 0 # a earch + a O H 6 0 1 9 BLE 6 Present Value of an Annuity Due of $1 PVAD | Porx (1+) * 1 .0% 1 1.00000 2 1.99010 3 297040 4 394099 5 490197 2.5% 1.00000 1.98522 2.95588 3.91220 485438 2.0% 2.5% 100000 100000 1.98039197561 294156 2.92742 388338 3.85602 480773 476197 3.0% 100000 1.97087 291347 3.82861 471710 3.5% 4.0% 4.5% 1.00000 100000 100000 196618 196154 195694 2.89969288609287267 3.80164 3.77509 3.74896 467308 462990458753 5.0% 5.5% 6.0% 1.00000 100000 100000 195238 1.94787 1.94340 285941 284632 283339 3.72325 3.69793 3.67301 4.54595450515446511 70% 8.0% 0.0% 10.09 1.00000 100000 100000 1.000 1.93458 15 2.80802 2.78326 2.75911 2.7358 3.62432357710 3.531293,4868 4.38721 4312134.29972 41098 6 85343 78364 5.71346 5.54583 57971351503545182 3809883948 7038 7 6.795486.69719 6.60143 6.50813 6.417196.32855624214 6.157876.07569 5.99553591732 5.76654 5.62258545592535526 8 7728197.59821 747199 734939 721038 7.11454 700205 6.19270 6.78637661297 658238 6.38929 6,20637 6.012955.86342 9 8651683848593832548 8.17014 8.01909 787396 273274 759589 7.46321 733457 720919 6971306746646.53482633493 10 956602 9360529162248.97087878611 607698.4353326879 10782795330 7.801697.51533724896.9952575902 11 1047130 10.11118 9.95159 9.752069.53030 9.31661 9.11090 3.91272 3.7217 8.58703 .36009 12 1136763 1107112 10.78655 10 51421 10.25262 10.00155 9.760489528929.306419.09354 858687 13 1225508 11 90751 1157534 1125776 1095400 1066333 1038507 101185893032561852938384 14 13.13374 12.73153 12.34837 1198318 11.63496 11.3077410985651068235 10.39357 1011706 3.62358 7.7100374176614457 849867 813896 780519 749506 53608816073781369 O