Answered step by step

Verified Expert Solution

Question

1 Approved Answer

me of sales is equivalent. However, due to the difference Product A has higher variable costs and Product B has agement is ca erating loss

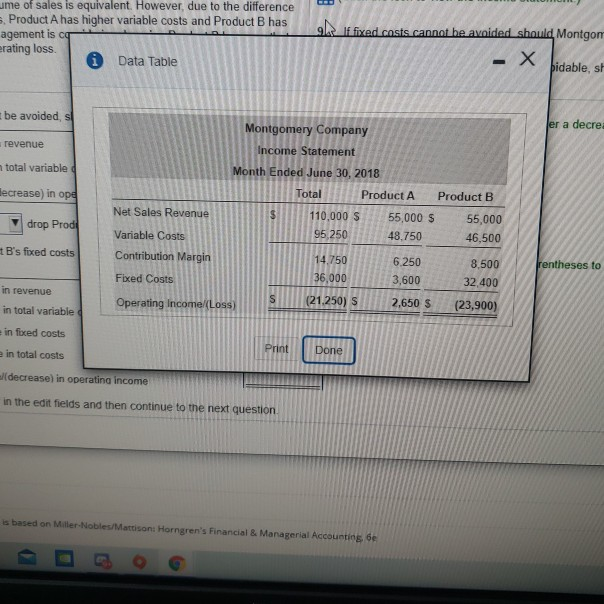

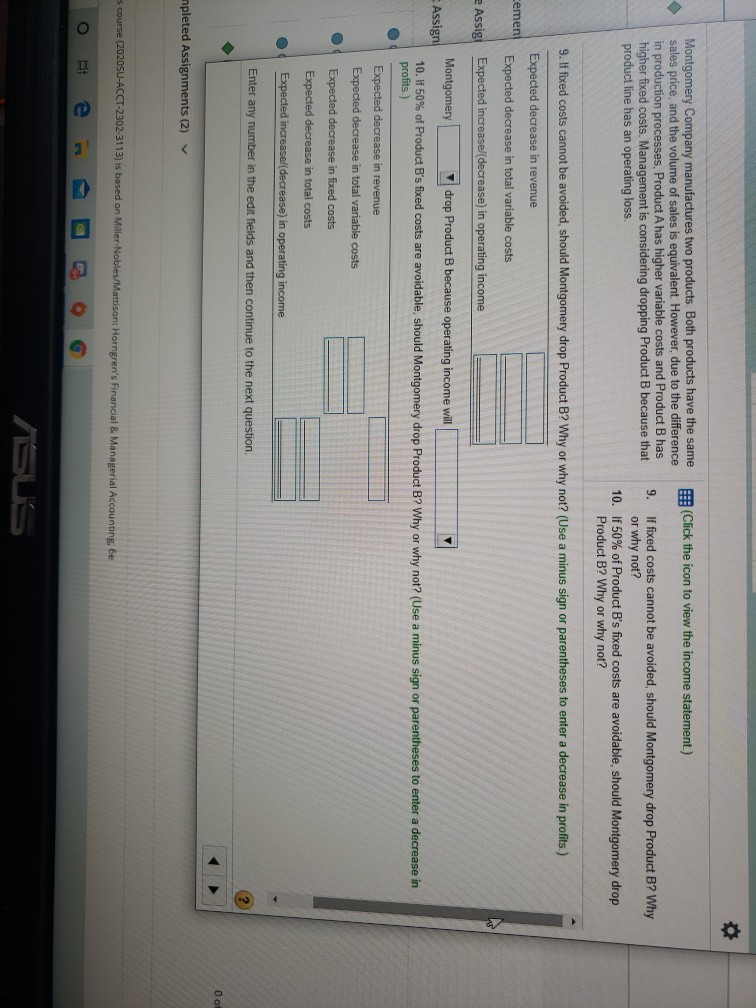

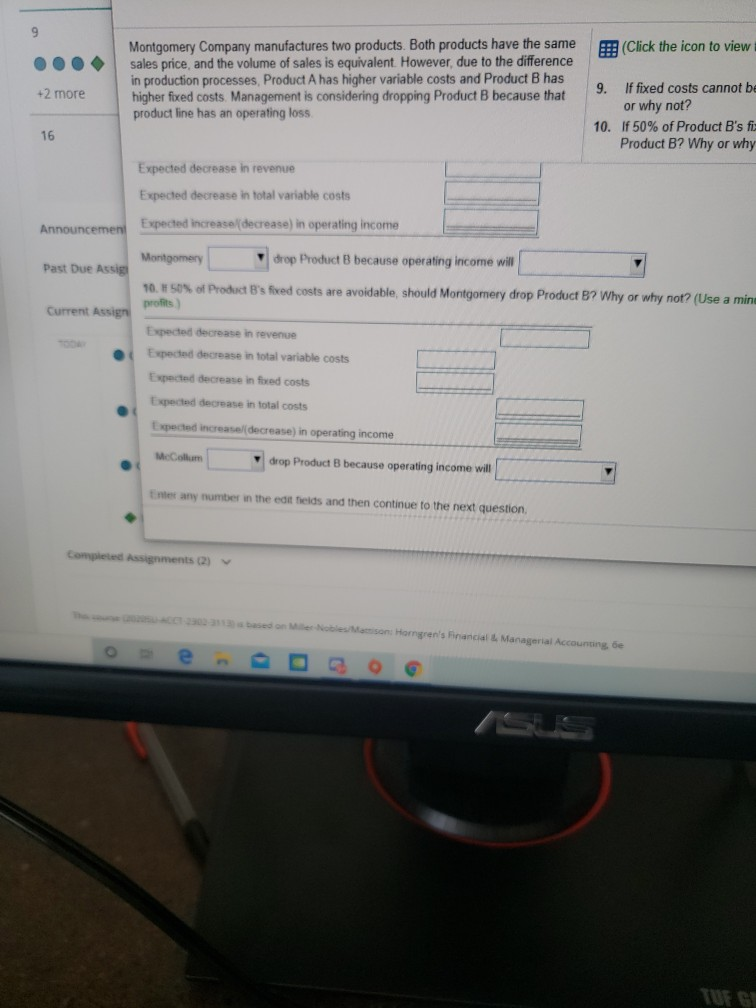

me of sales is equivalent. However, due to the difference Product A has higher variable costs and Product B has agement is ca erating loss Data Table Os if fixed costs cannot be avoided should Montgom - X bidable, st be avoided, se Montgomery Company er a decre revenue Income Statement n total variable Month Ended June 30, 2018 lecrease) in op Total Product A Product B Net Sales Revenue $ drop Prodil 110,000 $ 95,250 55,000 $ 48.750 55,000 46,500 B's foxed costs Variable Costs Contribution Margin 14.750 36,000 rentheses to 6.250 3,600 Fixed Costs 8,500 32.400 in revenue S Operating Income (Loss) (21.250) S in total variable 2,650 $ (23,900) in foxed costs in total costs Print Done alldecrease) in operating income in the edit fields and then continue to the next question is based on Miller-Nobles/Mattison: Horngren's Financial & Managerial Accounting 6 FE: (Click the icon to view the income statement.) Montgomery Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference in production processes, Product A has higher variable costs and Product B has higher fixed costs. Management is considering dropping Product because that product line has an operating loss. 9. If fixed costs cannot be avoided, should Montgomery drop Product B? Why or why not? 10. If 50% of Product B's fixed costs are avoidable, should Montgomery drop Product B? Why or why not? 9. If fixed costs cannot be avoided, should Montgomery drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue cemeni Expected decrease in total variable costs Assig! Expected increasel decrease) in operating income Montgomery drop Product B because operating income will Assign 10. If 50% of Product B's fixed costs are avoidable, should Montgomery drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decrease in profits.) Expected decrease in revenue Expected decrease in total variable costs Expected decrease in fixed costs Expected decrease in total costs Expected increasel decrease) in operating income Enter any number the edit fields and then continue to the next question. O of mpleted Assignments (2) s course (20205U-ACCT-2302 3113) is based on Miller-Nobles/Mattison: Horngren's Financial & Managerial Accounting, be O .: (Click the icon to view Montgomery Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference in production processes Product A has higher variable costs and Product B has higher fixed costs Management is considering dropping Product B because that product line has an operating loss +2 more 9. If fixed costs cannot be or why not? 10. If 50% of Product B's fi Product B? Why or why 16 Expected decrease in revenue Expected decrease in total variable costs Announcement Expected increase(decrease) in operating income Montgomery drop Product B because operating income will Past Due Assig 10.50% of Product B's fixed costs are avoidable, should Montgomery drop Product B? Why or why not? (Use a mine profits Current Assign Expected decrease in revenue Expected decrease in total variable costs Expected decrease in fred costs Expected decrease in total costs Expected increased decrease) in operating income McCollum drop Product B because operating income will net any number in the edit telds and then continue to the next question, Completed Assignments (2) Noblessioni Horngren's Financial Managerial Accounting, 6e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started