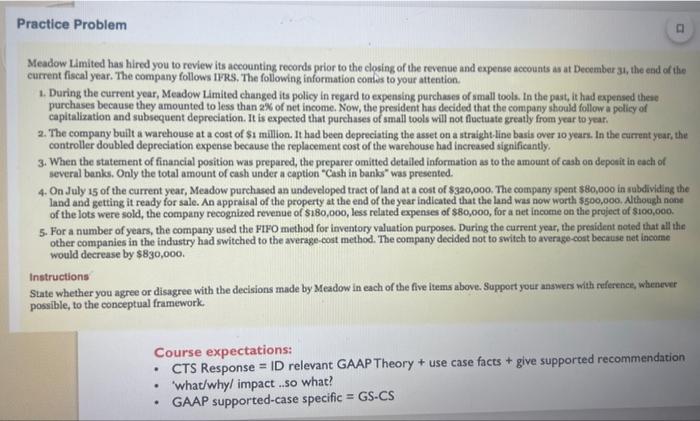

Meadow Limited has hired you to review its accounting records prior to the closing of the revenue and expense aceounts as at December 3 , the end of the current fiscal year. The company follows IHRS. The following information contes to your attention. 1. During the current year, Meadow Limited changed its policy in regard to expensing purchases of small tools. In the past, it had expensed theae purchases because they amounted to less than 2% of net income. Now, the president has decided that the company should follow a policy of capitalization and subsequent depreciation. It is expected that purchases of small tools will not floctuate greatly from year to year. 2. The company built a warehouse at a cost of $ a million. It had been depreciating the asset on a straight line basis over ao years. In the earrent year, the controller doubled depreciation expense because the replacement cost of the warehouse had increased significantly. 3. When the staternent of financial position was prepared, the preparer omitted detailed information as to the amount of casb on deponit in each of several banks, Only the total amount of cash under a caption "Cash in banks" was presented. 4. On July 15 of the current year, Meadow purchased an undeveloped tract of land at a cost of $320,000. The company spent $80,000 in subdividing the land and getting it ready for sale. An appraisal of the property at the end of the year indlicated that the land was now worth $500,000, Alhongh none of the lots were sold, the company recognired revenue of $180,000, less related expenses of $80,000, for a net income on the project of \$100,000. 5. For a number of years, the company used the FIFO method for inventory valuation purposes. During the current year, the president noted that all the other companies in the industry had switched to the average-cost method. The company decided not to switeh to average-cost because net income would decrease by $830,000. Instructions State whether you agree or disagree with the decisions made by Meadow in each of the five items above. Support your answers with rulerence, whenever possible, to the conceptual framework. Course expectations: - CTS Response = ID relevant GAAP Theory + use case facts + give supported recommendation - 'what/whyl impact ..so what? - GAAP supported-case specific = GS-CS