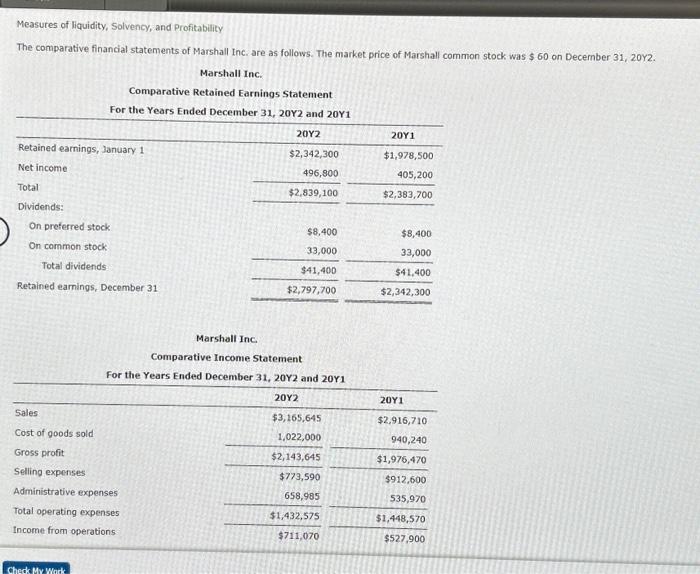

Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $60 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 $2,342,300 496,800 $2,839,100 Retained earnings, January 1 Net income Total Dividends: On preferred stock On common stock Total dividends Retained earnings, December 31 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Check My Work Marshall Inc. $8,400 33,000 $41,400 $2,797,700 Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 $3,165,645 1,022,000 $2,143,645 $773,590 658,985 $1,432,575 $711,070 20Y1 $1,978,500 405,200 $2,383,700 $8,400 33,000 $41,400 $2,342,300 20Y1 $2,916,710 940,240 $1,976,470 $912,600 535,970 $1,448,570 $527,900

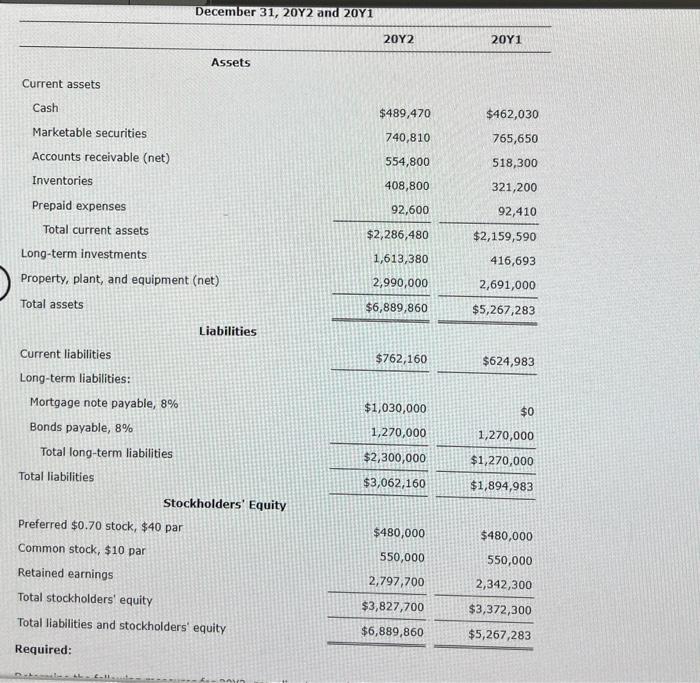

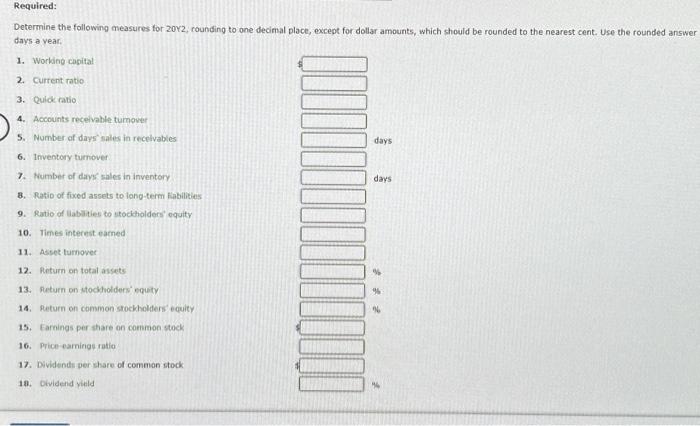

Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $60 on Decernber 31,20y2. Marshall Inc. Marshall Inc Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 December 31,20Y2 and 20Y1 \begin{tabular}{|c|c|c|} \hline & 20Y2 & 20Y1 \\ \hline As & & \\ \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline Cash & $489,470 & $462,030 \\ \hline Marketable securities & 740,810 & 765,650 \\ \hline Accounts receivable (net) & 554,800 & 518,300 \\ \hline Inventories & 408,800 & 321,200 \\ \hline Prepaid expenses & 92,600 & 92,410 \\ \hline Total current assets & $2,286,480 & $2,159,590 \\ \hline Long-term investments & 1,613,380 & 416,693 \\ \hline Property, plant, and equipment (net) & 2,990,000 & 2,691,000 \\ \hline Total assets & $6,889,860 & $5,267,283 \\ \hline \multicolumn{3}{|c|}{ Liabilities } \\ \hline Current liabilities & $762,160 & $624,983 \\ \hline \multicolumn{3}{|l|}{ Long-term liabilities: } \\ \hline Mortgage note payable, 8% & $1,030,000 & $0 \\ \hline Bonds payable, 8% & 1,270,000 & 1,270,000 \\ \hline Total long-term liabilities & $2,300,000 & $1,270,000 \\ \hline Total liabilities & $3,062,160 & $1,894,983 \\ \hline \multicolumn{3}{|c|}{ Stockholders' Equity } \\ \hline Preferred $0.70 stock, $40 par & $480,000 & $480,000 \\ \hline Common stock, \$10 par & 550,000 & 550,000 \\ \hline Retained earnings & 2,797,700 & 2,342,300 \\ \hline Total stockholders' equity & $3,827,700 & $3,372,300 \\ \hline Total liabilities and stockholders' equity & $6,889,860 & $5,267,283 \\ \hline \end{tabular} Determine the following measures for 20%2, counding to one decimal place, except for dollar amounts, which should be rounded to the nearest cent, Use the rounded answer dave a vear Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $60 on Decernber 31,20y2. Marshall Inc. Marshall Inc Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 December 31,20Y2 and 20Y1 \begin{tabular}{|c|c|c|} \hline & 20Y2 & 20Y1 \\ \hline As & & \\ \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline Cash & $489,470 & $462,030 \\ \hline Marketable securities & 740,810 & 765,650 \\ \hline Accounts receivable (net) & 554,800 & 518,300 \\ \hline Inventories & 408,800 & 321,200 \\ \hline Prepaid expenses & 92,600 & 92,410 \\ \hline Total current assets & $2,286,480 & $2,159,590 \\ \hline Long-term investments & 1,613,380 & 416,693 \\ \hline Property, plant, and equipment (net) & 2,990,000 & 2,691,000 \\ \hline Total assets & $6,889,860 & $5,267,283 \\ \hline \multicolumn{3}{|c|}{ Liabilities } \\ \hline Current liabilities & $762,160 & $624,983 \\ \hline \multicolumn{3}{|l|}{ Long-term liabilities: } \\ \hline Mortgage note payable, 8% & $1,030,000 & $0 \\ \hline Bonds payable, 8% & 1,270,000 & 1,270,000 \\ \hline Total long-term liabilities & $2,300,000 & $1,270,000 \\ \hline Total liabilities & $3,062,160 & $1,894,983 \\ \hline \multicolumn{3}{|c|}{ Stockholders' Equity } \\ \hline Preferred $0.70 stock, $40 par & $480,000 & $480,000 \\ \hline Common stock, \$10 par & 550,000 & 550,000 \\ \hline Retained earnings & 2,797,700 & 2,342,300 \\ \hline Total stockholders' equity & $3,827,700 & $3,372,300 \\ \hline Total liabilities and stockholders' equity & $6,889,860 & $5,267,283 \\ \hline \end{tabular} Determine the following measures for 20%2, counding to one decimal place, except for dollar amounts, which should be rounded to the nearest cent, Use the rounded answer dave a vear