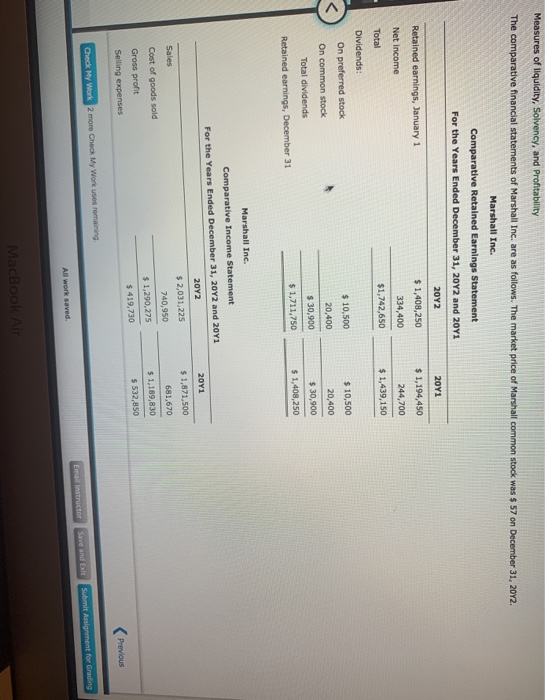

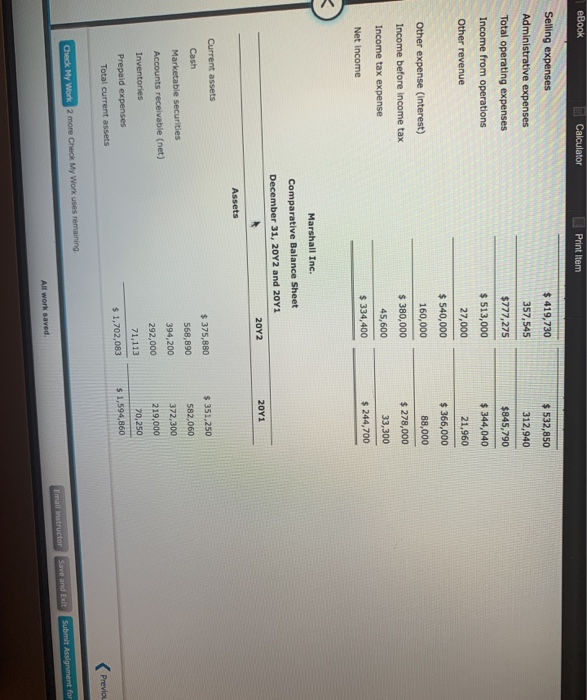

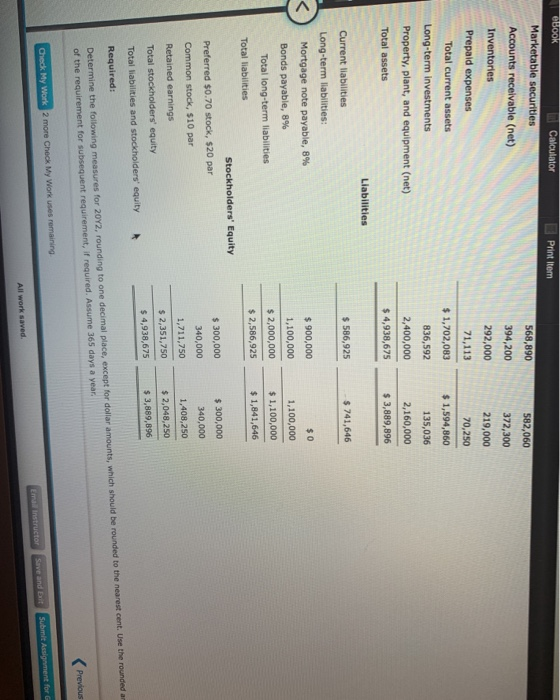

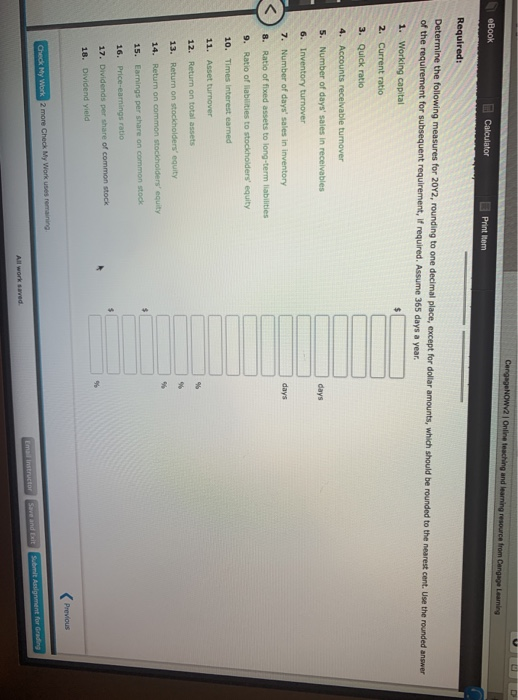

Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 57 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 $1,408,250 334,400 $1,742,650 s 1,194,450 Net Income Total Dividends: 244,700 $ 1,439,150 On preferred stock On common stock Total dividends $ 10,500 20,400 $30,900 $ 1,408,250 10,500 20,400 $ 30,900 $ 1,711,750 Retained earnings, December 31 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20V 20Y1 20Y2 $ 1,871,500 681,670 $1,189,830 s 532,850 $ 2,031,225 740,950 $ 1,290,275 $ 419,730 Cost of goods sold Gross proft Previous Check My Work 2 more Check May weork uses nomang Calculator Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue 419,730 357,545 $777,275 $ 513,000 27,000 $ 540,000 160,000 $ 380,000 45,600 $ 334,400 $532,850 312,940 $845,790 344,040 21,960 $366,000 88,000 $278,000 33,300 Other expense (interest) Income before income tax Income tax expense Net income $244,700 Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 20Y1 Assets Current assets s 351,250 582,060 372,300 $ 375,880 568,890 394,200 292,000 71,113 $ 1,702,083 Cash Marketable securities Accounts receivable (net) Inventories Prepaid expenses 70,250 $ 1,594,860 Total current assets CHA 2 rmore check My work uses remaning Print Item Marketable securities Accounts receivable (net) Inventories Prepaid expenses 568,890 394,200 292,000 71,113 $1,702,083 836,592 2,400,000 $ 4,938,675 582,060 372,300 219,000 70,250 $ 1,594,860 135,036 2,160,000 $ 3,889,896 Total current assets Long-term investments Property, plant, and equipment (net) Total assets Liabilities Current liabilities s 586,925 s 741,646 Long-term liabilities 900,000 1,100,000 $ 2,000,000 $ 2,586,925 Mortgage note payable, 8% Bonds payable, 8% 1,100,000 $ 1,100,000o $ 1,841,646 Total long-term liabilities Total liabilities Stockholders Equity 300,000 340,000 1,711,750 s 2,351,750 $4,938,675 $ 300,000 340,000 1,408,250 s 2,048,25o $ 3,889,89e Preferred $0.70 stock, $20 par Common stock, $10 par Retained earnings Total stockholders' equity Determine the following measures for 20Y2, rounding to one decimal place, except for dollar amounts, which should be rounded to the nearest cent. Use the rounded a of the requirement for subsequent requirement, if required. Assume 365 days a year Required: Previous Dheck My Work 2 more Check Mey Wwrks emaring and e from eBook Print Rem Required: Determine the following measures for 20v2, rounding to one decimal of the requirement for subsequent requirement, if required. Assume 365 days a year. except for dollar amounts, which should be rounded to the nearest cent. Use the rounded answer 1. Working capital 3. Quick ratio 4. Accounts recelvable turmover days 6. Inventory turnover 7. Number of days' sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of iabilities to stockholders' equity days 11. Asset turnover Return on total assets 12. 14. Returm on 16. P 18. Dividend yield lheck hy Work 2 more Check May Weark uss