Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Measures of Risk (2.1) Consider the following two random variables: X has a (continuous) uni- form density on [-1, +1], while Y is a

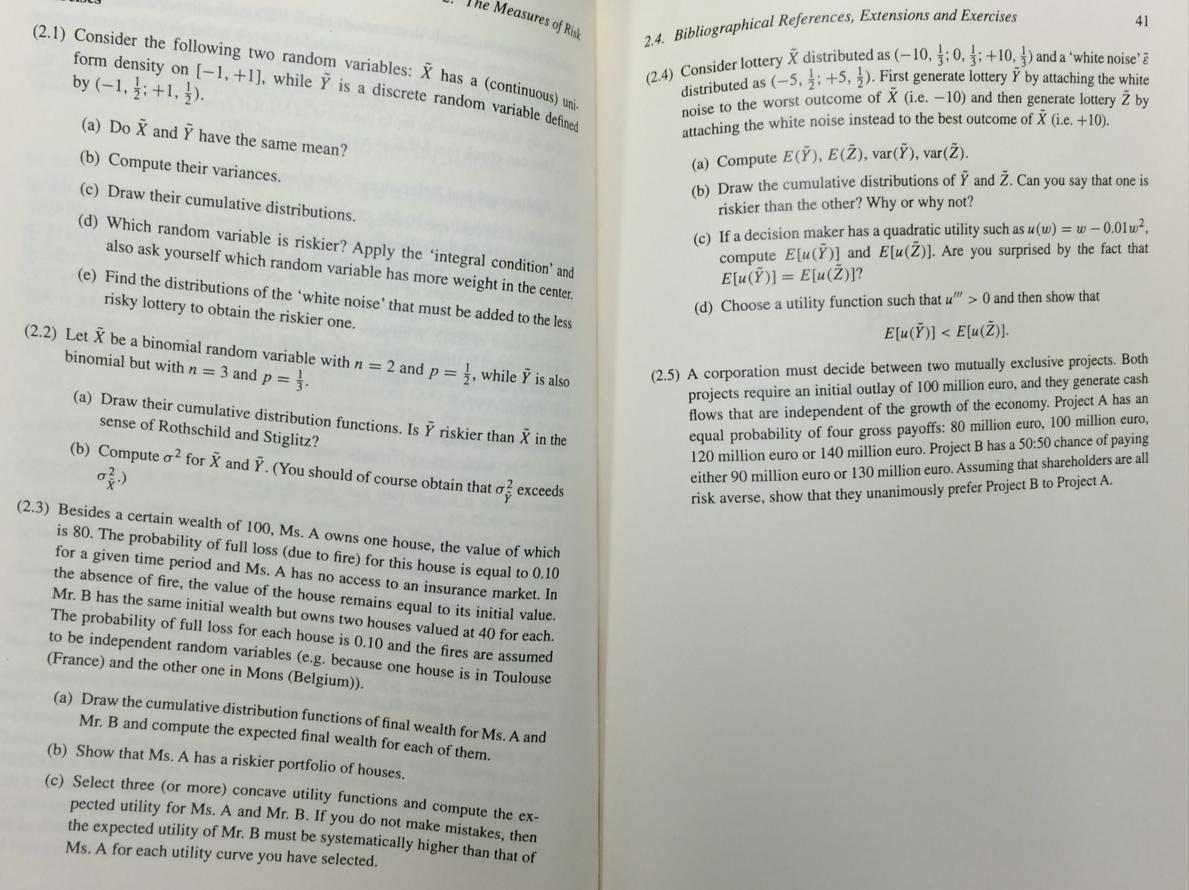

Measures of Risk (2.1) Consider the following two random variables: X has a (continuous) uni- form density on [-1, +1], while Y is a discrete random variable defined by (-1,1; +1,1). (a) Do X and Y have the same mean? (b) Compute their variances. (c) Draw their cumulative distributions. (d) Which random variable is riskier? Apply the 'integral condition' and also ask yourself which random variable has more weight in the center. (e) Find the distributions of the 'white noise' that must be added to the less risky lottery to obtain the riskier one. (2.2) Let X be a binomial random variable with n = 2 and p = 1, while Y is also binomial but with n = 3 and p = 1. (a) Draw their cumulative distribution functions. Is Y riskier than X in the sense of Rothschild and Stiglitz? (b) Compute o for X and Y. (You should of course obtain that o exceeds (2.3) Besides a certain wealth of 100, Ms. A owns one house, the value of which is 80. The probability of full loss (due to fire) for this house is equal to 0.10 for a given time period and Ms. A has no access to an insurance market. In the absence of fire, the value of the house remains equal to Mr. B has the same initial wealth but owns two houses valued at 40 for each. The probability of full loss for each house is 0.10 and the fires are assumed initial value. to be independent random variables (e.g. because one house is in Toulouse (France) and the other one in Mons (Belgium)). (a) Draw the cumulative distribution functions of final wealth for Ms. A and Mr. B and compute the expected final wealth for each of them. (b) Show that Ms. A has a riskier portfolio of houses. (c) Select three (or more) concave utility functions and compute the ex- pected utility for Ms. A and Mr. B. If you do not make mistakes, then the expected utility of Mr. B must be systematically higher than that of Ms. A for each utility curve you have selected. 2.4. Bibliographical References, Extensions and Exercises (2.4) Consider lottery X distributed as (-10, 0, +10,) and a 'white noise' distributed as (-5, +5,3). First generate lottery Y by attaching the white noise to the worst outcome of X (i.e. -10) and then generate lottery 2 by attaching the white noise instead to the best outcome of X (i.e. +10). (a) Compute E(Y), E (), var(), var(). (b) Draw the cumulative distributions of Y and . Can you say that one is riskier than the other? Why or why not? 41 (c) If a decision maker has a quadratic utility such as u(w) = w-0.01w, compute E[u(Y)] and E[u(2)]. Are you surprised by the fact that E[u(Y)] = E[u()]? (d) Choose a utility function such that u"> 0 and then show that E[u(Y)] < E[u()]. (2.5) A corporation must decide between two mutually exclusive projects. Both projects require an initial outlay of 100 million euro, and they generate cash flows that are independent of the growth of the economy. Project A has an equal probability of four gross payoffs: 80 million euro, 100 million euro, 120 million euro or 140 million euro. Project B has a 50:50 chance of paying either 90 million euro or 130 million euro. Assuming that shareholders are all risk averse, show that they unanimously prefer Project B to Project A.

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer a If A Uab then EA a b VarA 112ba In the given question a1 b1 Thu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started