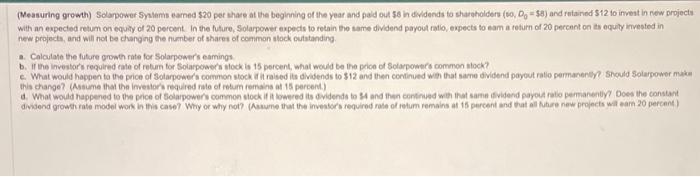

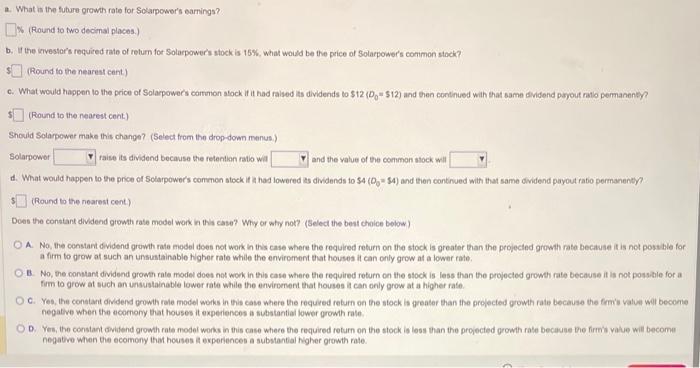

(Measuring greath) Solapower Synlems eamed $20 per ahace at the beginning of the year and pald out 58 h divdends to sharaholders (co, D0=$5 ) and ratained $12 io inveat in rew projects with an expected retum on equity of 20 peroent. in the future, Solarpower expects to retain the same dividend payout ratlo, expects to eam a return of 20 percent on as equily invested in new projects, and will not be changing the number of shares of conmon slock outatanding. a. Calculate the future gromch rate for Solarpower's eamings b. It the investors required eate of retum for Solarpowers atock is 15 percent, what would be the poice of Solarpowifs common atock? c. What would happen to the price of Solarpewer's common stock i it rabed its divesends to $12 and then continued with that same dividend payout ratlo permaneney? Should Solarpower muke this change? (Asume that the imestor requipd rile of retum remains at is percent.) a. What is the fubure growh rate for Solampower's earnings? (Round to two decimal places.) b. It the itvestar's roquited tate of retum for Solarpowers stock is 15%, what woild be the price of Solarpower's common stock? (Round to the nearest cent) c. What would happen to the price of Solarpowers common alock if it had ralsed its dividends to $12(D0=512) and then continued with that same dividend payout rato permaneney? (Round to the nearest cent.) Shouid Solapower make this change? (Select from the drop-down menus.) Solarpowor faise its dividend because the retention rato wil and the value of the common atock will d. What would happen to the price of Solarpowers common stock it a had lowered as dividends to 54(D9=54) and then continued with that same dividend payout ratio permanenty? (Round th the nearest cent) Does the constant dividend growth rale model work in this case? Why or why not? (Select the beat chaice below) A. No, the constant dividend gruwh rate model does not work in this case where the required returm on the stock is greater than the projected growith rate bectule it is not posstile a firm to grow at such an unsustainable higher rate while the enviroment that houses it can only grow at a lower rate. B. No, the constant dividend growth rate model does not wok in this case where the required return on the stock is less than the projected growth rate bectuse it ia not possible for a firm to grow at such an unsustainable lowor rate while the enviroment that houses it can only grow at a higher rate. c. Yes, the constart didend growh rale model works in this case where the requived retum on the stock is greater than the projected growh rate because the frmis value wil becon negative when the acomony that houses it experiences a subatantial lower gromh rale. D. Yes, the conslant dovidend growh rate model works in this case whece the required return on the stock is less than the projected growh rale beciluse the firmi value will become negative when the ecomeny that houses il experiences a substantial higher growth rate