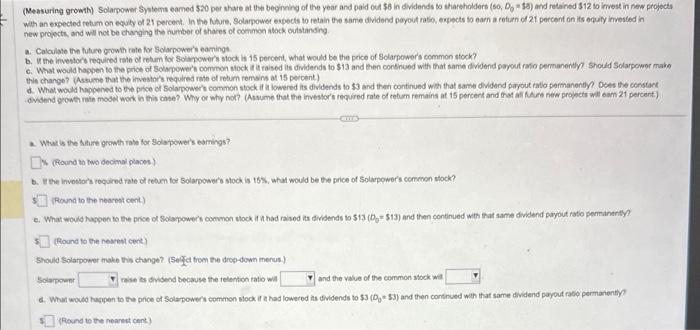

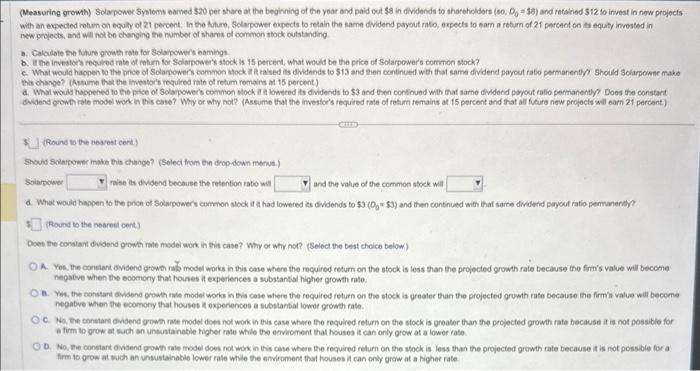

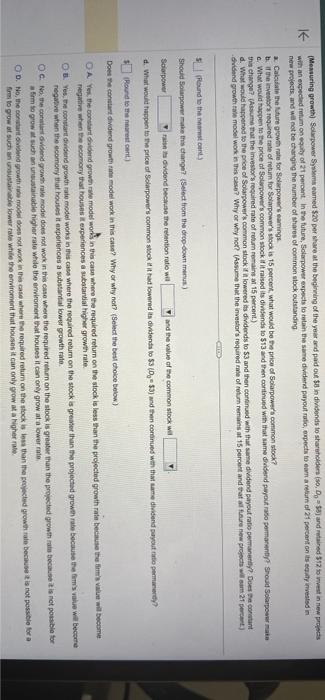

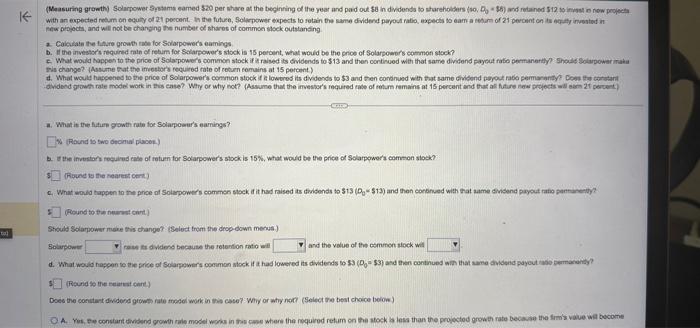

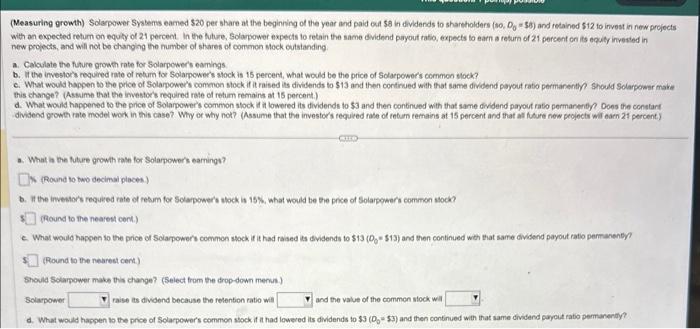

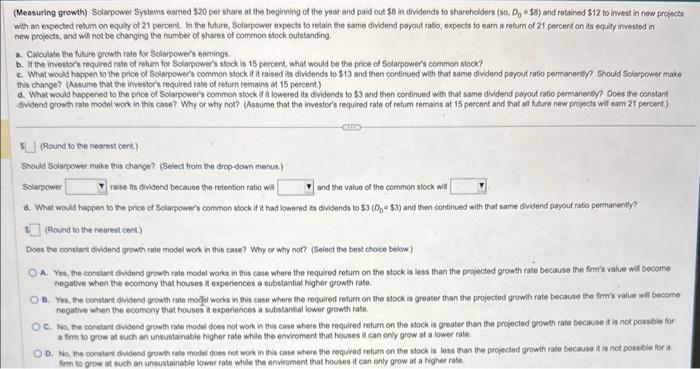

(Measuring growth) Solarpower Syntems 6amed $20 per ahare at the beginning of the year and paid out 56 in divdends to shareholders (so, D. $3 ) and retained $12 io imvest in new proiects whth an expected return on equty of 21 percect. In the future, Solarpower expects to retain the same dividend payout ratio, expects to earn a cofurn of 21 percent on its equily irvested in new proiocth, and will not be changing the number of thares of common thock ovistanding. a. Caloulste the future grow th rate for Solarpowoik eaming b. In the inventore requined rate of retum for Solapowers stock is 15 percent, what would be the pecce of Solarpower's common stock? c. What would happen to the proe of Solapowern common siock if it raised its divdends to $13 and then conenued with that same divend paryout rafo permanently? should Solarpower make this change? (Assume that the investors required rate of retum remwins at 15 percent) d. What would happened to ene proe of Solapowere common stock it a lowered its dividends to $3 and then continued wath that same divdend payout tato permanently Does the constart. What is the Aiture growth rabe for Solapower's earmings? (Round to two dechnal places) b. Et the invottors required tate of rebum for Solarpoweres stock is 15%, what would be the price of Solarpower's common stock? (Found to the nearest cent) c. What would hapen to the prce of Solapower's coovnon tock it t had rased at divdends to $13(D5=$13) and then continued with that same dividend payout rato parmanertiy? (Round to the nesrest cent) Should Solapower make this change? (Seffet trom the drog-down menus) (Found to the nearect onnt) (Measuring grewh) Solarpower Syoloms earned $20 per share at the beginning of the yoar and paid out $8 in dividends to shareholders (so, D0=$ S.) and rataired $12 to invest in new projects with an expectod rotum on eqully of 21 percent. In the Mare, solarposer expects to retain the aame dividend payyout nato, expects to tarn a raburn of 21 percent on ta equity invested in new proiects, and will not be changing the number of thares of common stock outatinding B. Calaiate the fiture atvath rate for Folaposert eamingt. b. it the investors reguled rate of metum for Soldpower's stock is is pereert, what would be the price of Solarpower's common sock? c. What would hagpen to the phoe of Solamowers common block it is ralved is dividends to $13 and then continued with that same divdend payout rabo permanenty? Should Solarpowne make Bas change? (Antume thot the imveutoris required ralb of retum remains at 15 percent) a. What would hocpeped to the pree or Solapowers common block if a lowered ts divdends to $3 and then condoued with that same dividend poyout ratio permanently Does the constart (Round to the nearest cert) Showd Solarpower make this change? (Select from Ein dropdown menus.) Silapower rase ts dividend becasuse the retention ratio will and the value of the common stock will 1 (Round to the nobred cont) Does the conslam cwoond growh rale model work in eit case? Why or why not? (Select the best choice below) 2. Yes, the conelart dydend gown nab model works in this case where the required refurn on the stock is less than the projocted growth rate becavse the fimn's value will become negative when the eocenony that hounes it experiences a substantial higher growth rate. 8. Yes, the constart aydene gowh rate model works in this case where the reguired return on the stock ia grealer than the projected grumth rate because the firm'in value will become negabe when the ecomony that houses it oxperences a substartial lowor growet rate. C. Wo, the conetare dibend gowh rase model doet not wook in this case where the required retum on the stock is greater than the projected growth rate because it is not possible for a firm to grow at wich an untustainable higher rate while the erviroment that hovses it can only grow at a lower rate D. No, Ene constart Gvisend gowth rale model does not wok in this case whece the required return on the sook is less than the projected growh rate because it is not possible for a frm io grow at tich an unsustainabie lower rale whlle the enviroment that houses in can only grow at a higher rate. note profocts, and will not be changing the number of thares of contimon slock outstanding 1. Calcaiate the latue goweth rate for Sclarpowers eamings b. If the inyeotor fequirod tate of retam for Solarpower'i stook is 15 pereent, what would be the price of solarpowerl common mlock? c. What wevd happen th the proe of Solspowers common stock if it raised its dividends to 513 and then cortinued with that same dididend payout rabo pormarentip? Should Solapower mata this chacpe? (Alsument that the imessor's reguired rate of roturn remains an 15 percent.) Peand to the nharnst cend Shodd Soiapowe rake thes charge? (Seiect trom the drop-down inenuat) Sciatpoweil raite ta didens beckase the rebention ratio wil and the value of the common stock wa Pourd to then nearest cent] Does the coretart divderd growth rine model work in this case? Why or why not? (Select the best choloe below). negatir matien the ecomony that houses it expecienoes a muatantial higher growth rate. regative when the ecomony that houles it axperiences a substantal lower growth rale. c. No: the conslert owibend gromth rale mede does not work in this ease where the required retuen on the stock is greater than the propestod arowth rain becinse it is not poksibie for A Firm to grow at wuth an uneustainable higher rate while the erviloment that houses it can enly grow at a lower eate 0. Ho, the corutart covideno srowth tine mejeri boes not wokk in thia case whert the required retum cn the stock is lesa than the pmiacted arowth raie becikie is is not pessiblo lor a form to grow at such an unsustainable lower tale white the emoirement that houses it can only grow at a ligher male. Petw propech, and wil not be chatring the number of sharos of commoe slock outntanding. 2. Culevate the ficure growti rabe for Solarpowers eamings. b. If the investor's requined matn of retim for Selarpower's stock is 15 perbent, what would be the price of Solarpower's common stock? F. What would tappen th the price of Solapowers common stock if it raised is oividends to 513 and then contisuod with that same dividend payeut rafo permanerty? Shaile Solarpower iraka This change? (Assume kat the imvertors required rate of return comains at 15 porcent) a. What is the fithen growth rute foe Solapoour's eamings? 4. RRound to swo droinal placon.) b. of the investors requirud tide of raturn for Solarpower's stock is 15%, what would be the price of Solarpowora comenon sigck? (Ripunet is the nearent oent) c. What wouda thappen to the price of Solarpowers commen stock a it had raised ts divisonds to 513(Q0=513) and then corkinued with that aame divisend pxyout rato parnuneetly? Should Solappower mace this change? iSeled trom the drop-down menus) Solapowe and the vilue of the cemmentsiteck wit (FRound to the neiarest chrt) Doee the conitart dividend grown rate trodel work in this case? Whiy or why not? (Select the best chaice beion) (Measuring grewth) Solarpower Sysbems eamed $20 per share at the begining of the year and paid eut $8 in dividends to shareholders (so, D0=56 ) and robained $12 to invest in new projects with an expected retum on equily of 21 perceet. In the Auture, Solapower expects to retain the same divdend piyout rafio, expects to eaen a return of 21 percent on is equity invested in new propects, and wifl not bo changing the number of shares of corrmon stock ovisianding a. Calculate the ficure growh rate for Solarpower's eamings b. It the investors required rate of retum for solapower's slock is 15 percent, what would be the price of Solarpowors common slock? c. What would happen to the price of Solamowers common stock if it raised its divibends to $13 and then continued with that same dividend poyout ratio permanently? should Solarpowsr make this change? (Assume that the imestors required rase of retum remains at 15 percent.) d. What would happened to the price of Solarpower's common slock if a lowered its dividends to 53 and then continued with that same dividend payout rato permanereg? Dons the constart dividend growth rate mode work in this case? Why or why not? (Assume that the investor's required rade of retum remains at 15 percent and that at fudure new projects wil earn 21 percent) a. What is be tuture growt rash for Solarpower's earningu? (Round to two decimai places) b. It the investors requied rate of resum for Solapowers tock is 15%, what would be Fhe pnce of Solarpowers common ssock? (Round to the nearest cori.) C. What would hapsen so the price of Soiapowers common sock if it had rased is divende to $13(D0=$13) and then continued weh that same divisend poyout ratio permaneney? (Pound to the nearest cent) Shovld Solarpower make this change? (Select from the drop-down menuie) Solarpower raise ts divoend because the relention ratio wit and the value of the common slock wil d. What would happen to the price of Solarpewers common stock it at had lowered its dividends to $3(D0=$3) and then continued with that same divdend puyout rato pemmanerty? (Measuring growth) Solarpower Systems eamed $20 per share at the beginning of the year and paid out 56 in dividends to shareholdors (so, D0=$6 ) and retained $12 to imvest in new proikcts with an expected retum on equily of 21 percent, th the future, Solarpower expects to retain the same dividend poyout rabo, oxpects to earn a retum of 21 percent on its equily insested in new projects, and wil not be changing the number of shares of common stock outstanding. a. Calculate the future growth rate for Solarpower's earnings b. It the investor's required rate of retur for Solarpower's shock is 15 percent, what would be the price of Solarpewer's common thock? c. What would hagpen to the price of Solampower's common stock if it raised is dividends to $13 and then continued with that same dividend payout ratio permanende? shoudd Solarpower make this change? (Assume that the irvestor's required rate of retum remains at 15 percent.) d. What would happened to the price of Solarpowers common stock i A kowered its dividends to $3 and then continued with that same dividend payout ratio permanenil? Does the constant dividend growth rate model work in this case? Why or why not? (Assume that the investor's required rato of refurn remains at 15 percent and that al fuare new proipcts wil nam 21 percert.) (Round to the noareticent) Should Solarpower make this change? (Select from the drop-down menus.) Solamower raise at dividend because the retention ratio wa and the value of the common stock will a. What would happen to the price of solarpowers common stock it it had lowered ts divdends to $3(O0=$3) and then continued with that same dividend poycut ratio permarently? (Round to the nearest cect.) Does the constart divigend growth rate model wok in this case? Wyy or why not? (Select the best choice below) A. Yes, the constart dividend growth rale model works in this case where the required retum on the stock is less than the projected growth rate because the firm's value wil become negative when the ecomony that houses it experiences a substantial higher growth rate. A. Yes, the conitart divdend growth rate modhol woks in this case where the required return on the slock is greaser than the projectod growth rate becaute the fremis value will beceme negative when the ecomony that houses in experiences a subtantal lower gromth rate. c. No, the conatart dvidend growth rase model dobs not wok in tis case where the required return on the stock is greater than the projected growet rate because it is not possble for a firm to grow at such an unsustainabie higher rate while the enviroment that houses it can only grow at a lower rate. D. Wo, the consiant dividend growth rate model does not wok in thit case where the required retim on the slock is less than the projected growth rate because it is not ponsibie for a frem to orow at wuch an unsustainable lower rate while the emvroment that houses it can only grow at a Nighar rate