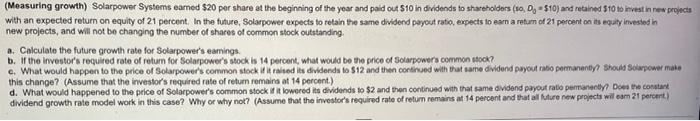

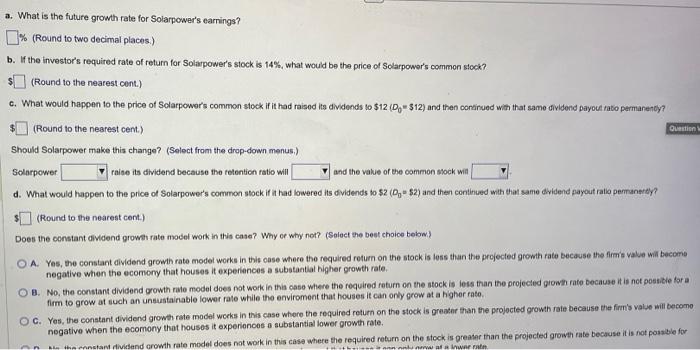

(Measuring growth) Solarpower Systems eamed $20 por share at the beginning of the year and paid out $10 in dwidends to shareholders (so, D0=$10 ) and retained $10 io intest in new prowcts with an expected return on equity of 21 percent, In the future, Solarpower expects to relain the same dividend peyout ratio, expects lo eam a retum of 21 peroent on its equaty imesiod in new projects, and will not be changing the number of shares of common stock outstanding. a. Calculate the future growh rate for Solarpower's eamings. b. If the investor's required rate of retum for Solarpower's stock is 14 percent, what would be the grice of Solarpowers common stock? this change? (Assume that the investor's required rate of retum remairs at 14 percent.) d. What would happened to the price of Solorpower's oommon stock it it lowered its dividends to $2 and then continued with that same olvidend pajout rabo pemananely Dees the cosatart dividend growth rate model work in this case? Why or why not? (Assume that the investor's required rate of retum remains at 14 percent and that all fulure new propects will eam 21 pereert. a. What is the future growth rate for Solarpower's earnings? % (Round to two decimal places.) b. If the investor's required rale of retum for Solappower's slock is 14%, what would be the price of Solarpowar's common stock? (Round to the nearest cent.) c. What would happen to the price of Sclarpower's common stock if it had raisod its divionds so $12(D0=$12) and then conairued with that same dividend payoul rato permarency? (Round to the nearest cent.) Should Solarpower make this change? (Select from the drop-down menus.) Solarpower raise its dividend because the rotention ratio will and the value of the common sock wil d. What would happen to the price of Solarpower's common stock if it had lowered its dividends to $2(D0=$2 ) and then continued with thai same dividend payout ratio permanerdy? (Round to the nearest cent) Does the oonstant dividend growth rate model work in this case? Why or why not? (Solect the beat choice below.) A. Yes, the constant dividend growth rate modet works in this oase where the required rotum on the stock is less than the projected gromth rate because the firmi value wif become negative when the ecomony that houses it experiances a substantal higher growth rate. 8. No, the constant dividend growth rale model does not work in thia case where the required return on the stock is less than the projecied gionih rate because it is not possitie for a firm to grow at such an unsustainable lower rate while the enviroment that houses it can only grow at a higher fato. C. Yes, the constant dividend grow rate model works in this case whore the required return on the stock is greater than the projocted growh rate because the firm's valje will become negative when the ecomony that houses it experionces a substantial lower growth rate