Answered step by step

Verified Expert Solution

Question

1 Approved Answer

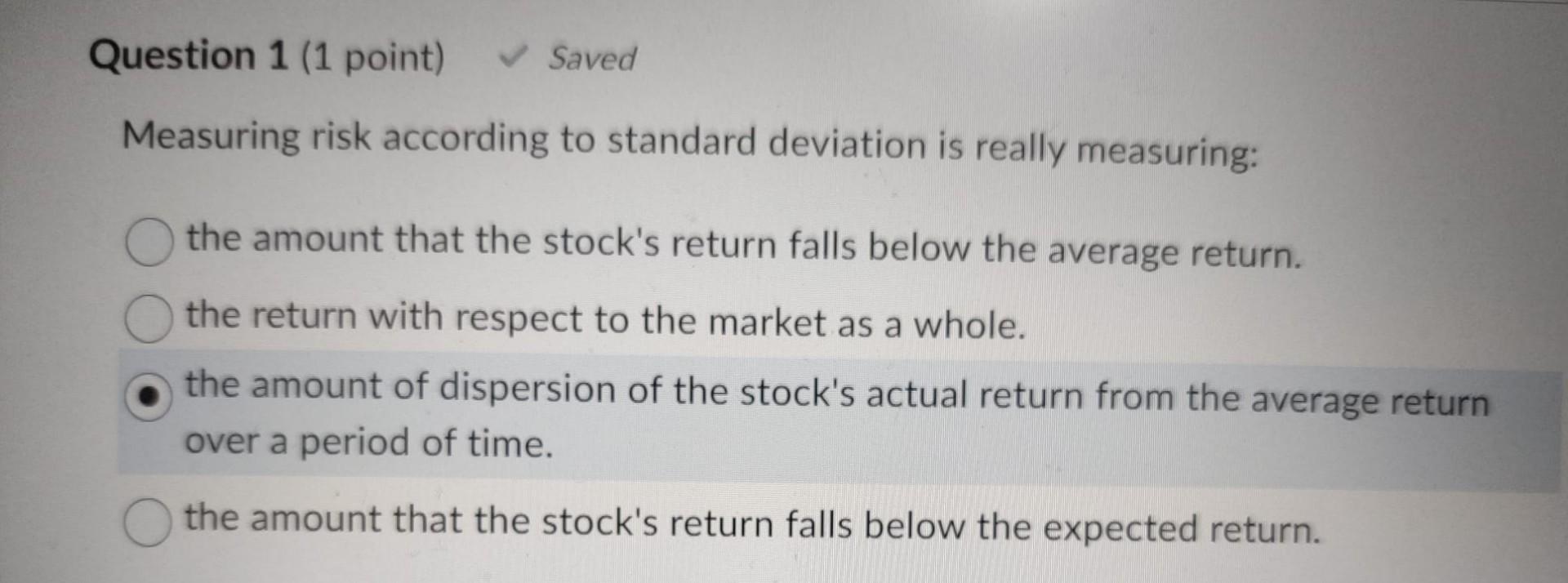

Measuring risk according to standard deviation is really measuring: the amount that the stock's return falls below the average return. the return with respect to

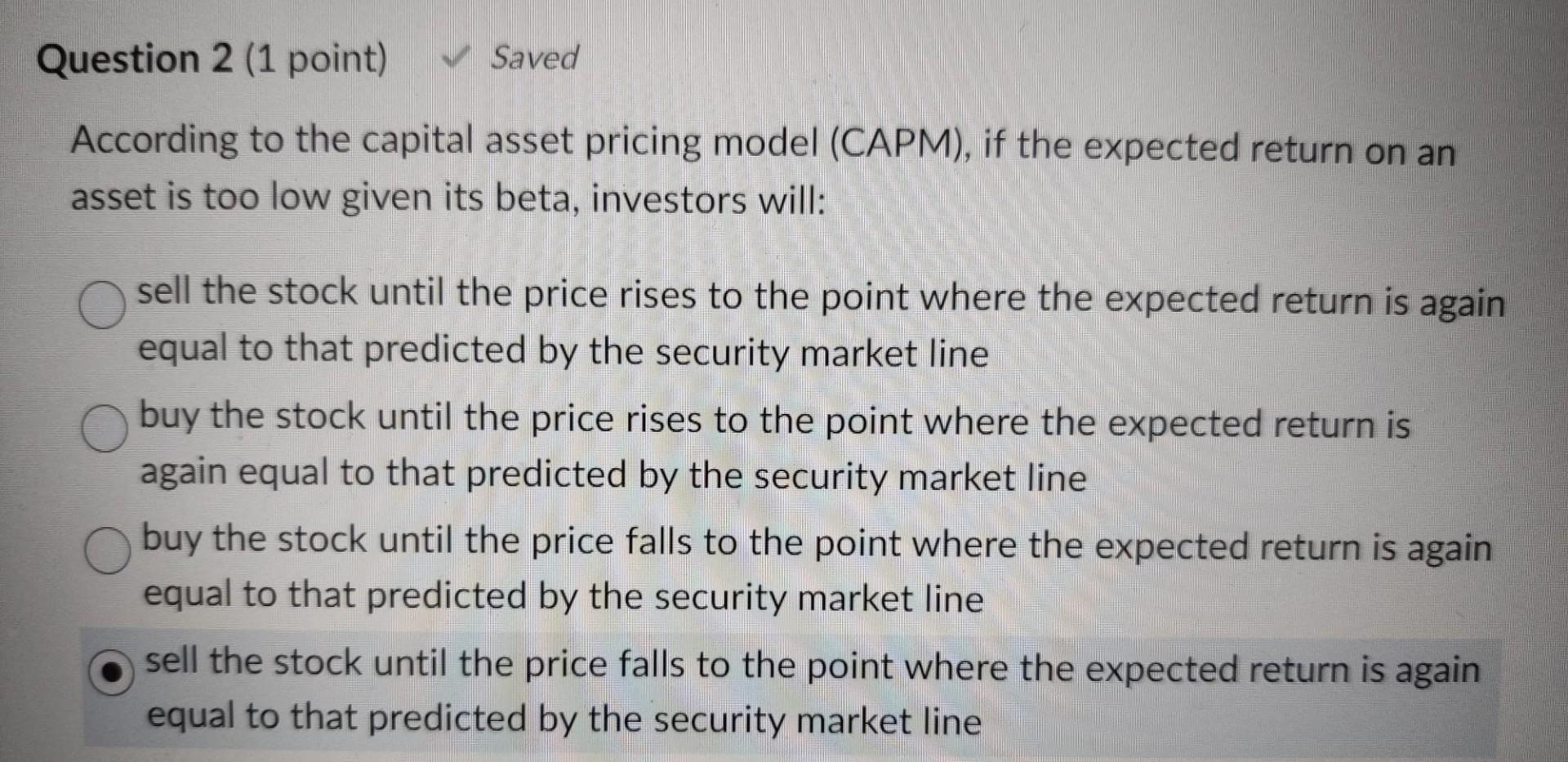

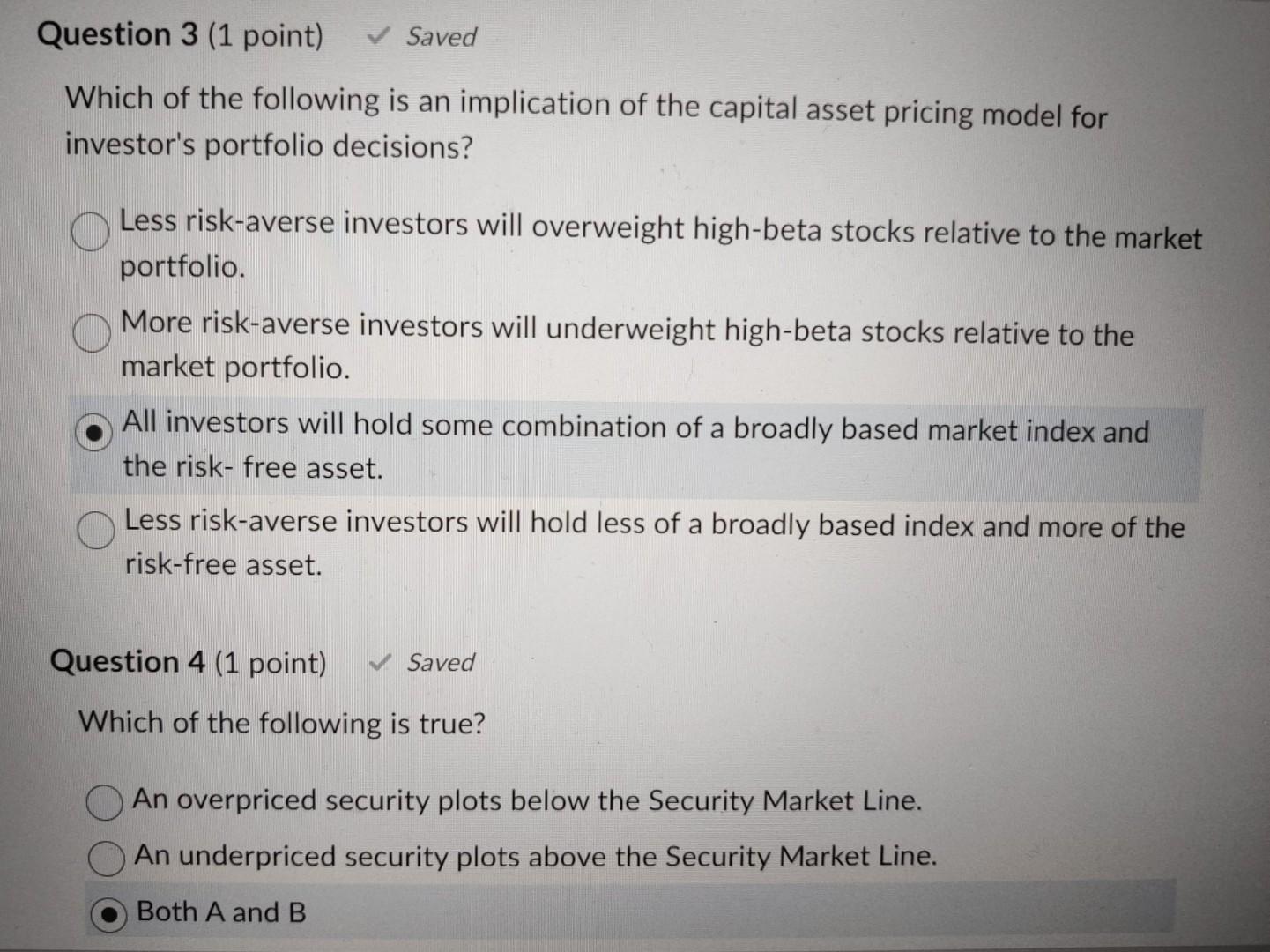

Measuring risk according to standard deviation is really measuring: the amount that the stock's return falls below the average return. the return with respect to the market as a whole. the amount of dispersion of the stock's actual return from the average return over a period of time. the amount that the stock's return falls below the expected return. According to the capital asset pricing model (CAPM), if the expected return on an asset is too low given its beta, investors will: sell the stock until the price rises to the point where the expected return is again equal to that predicted by the security market line buy the stock until the price rises to the point where the expected return is again equal to that predicted by the security market line buy the stock until the price falls to the point where the expected return is again equal to that predicted by the security market line sell the stock until the price falls to the point where the expected return is again equal to that predicted by the security market line Which of the following is an implication of the capital asset pricing model for investor's portfolio decisions? Less risk-averse investors will overweight high-beta stocks relative to the market portfolio. More risk-averse investors will underweight high-beta stocks relative to the market portfolio. All investors will hold some combination of a broadly based market index and the risk- free asset. Less risk-averse investors will hold less of a broadly based index and more of the risk-free asset. Question 4 (1 point) Saved Which of the following is true? An overpriced security plots below the Security Market Line. An underpriced security plots above the Security Market Line. Both A and B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started