Answered step by step

Verified Expert Solution

Question

1 Approved Answer

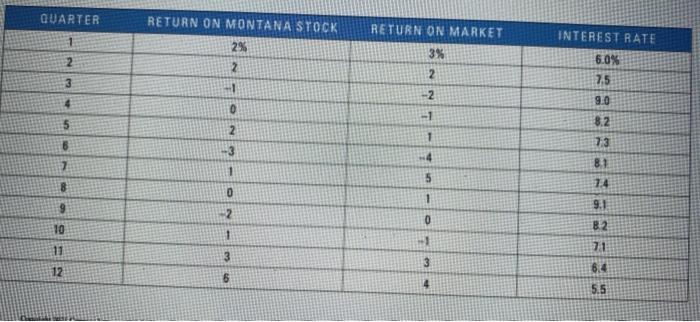

Measuring Risk Montana Bank wants to determine the sensitivity of its stock returns to QUARTER interest rate movements, based on the following information: Use a

Measuring Risk Montana Bank wants to

determine the sensitivity of its stock returns to

QUARTER interest rate movements, based on the following information:

Use a regression model in which Montana's stock return is a function of the stock market return and the interest rate. Determine the relationship between the interest rate and Montana's stock return by assessing the regression coefficient applied to the interest rate. Is the sign of the coefficient positive or negative? What does it suggest about the bank's exposure to interest rate risk? Should Montana Bank be concerned about rising or declining interest rate movements in the future?

(*** Kindly read the full question carefully and answer this question. Also, show me all the workings. Use excel function for regression)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started