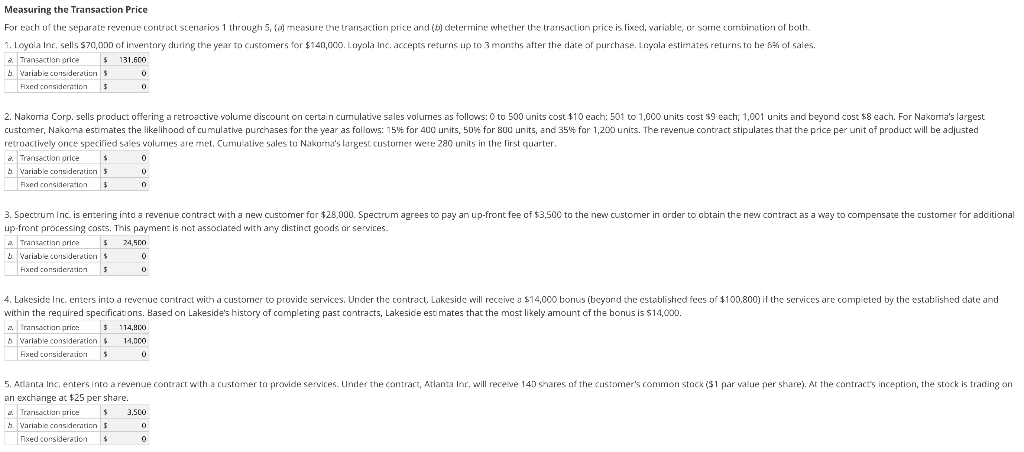

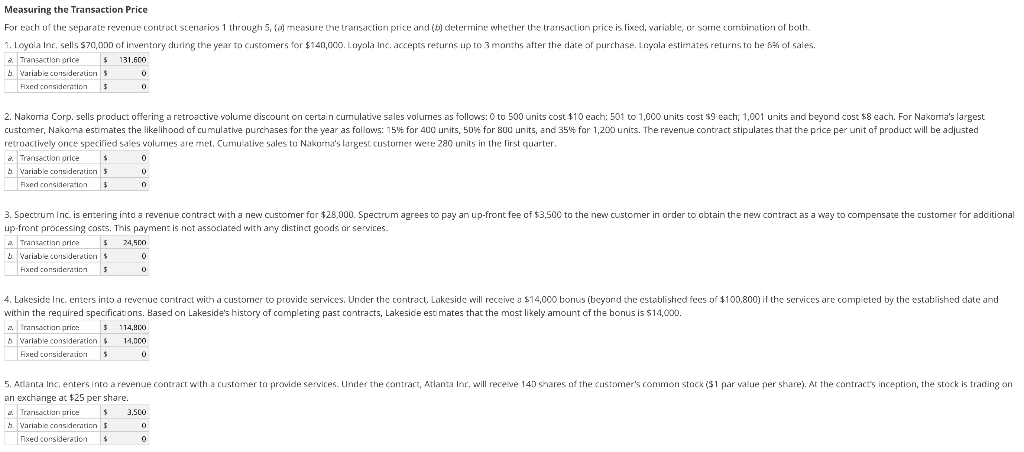

Measuring the Transaction Price For each of the separate revenue contract scenarios 1 through 5, (a) measure the transaction price and (b) determine whether the transaction price is fixed, variable, or some combination of both. 1. Loyola Inc, sells $70,000 of inventory during the year to customers for $140,000. Layola Inc, accepts returns up to 3 months after the date of purchase. Loyola estimates returns to be 5% of sales a Transaction price $ 131,600 Variable consideration $ 0 Fixed consideration $ 2. Nakoma Corp. sells product offering a retroactive volume discount on certain cumulative sales volumes as follows: 0 to 500 units cost $10 each: 501 to 1,000 units cost $9 each; 1,001 units and beyond cost $8 each. For Nakoma's largest customer, Nakama estimates the likelihood of cumulative purchases for the year as follows: 159 for 400 units, 50% for 800 units, and 359 for 1,200 units. The revenue contract stipulates that the price per unit of product will be adjusted retroactively once specified sales volumes are mel. Cumulative sales to Nakuma's largest customer were 280 units in the first quarter. a. Transaction price $ 0 Variable consideration $ 0 Fixed consideration $ 0 3. Spectrum Inc. is entering into a revenue contract with a new customer for $28,000. Spectrum agrees to pay an up-front fee of $3.500 to the new customer in order to obtain the new contract as a way to compensate the customer for additional up-front processing costs. This payment is not associated with any distinct goods or services. Transaction price $ 24,500 Variable consideration $ 0 Fixed consideration $ 0 4. Lakeside Incenters into a revenue contract with a customer to provide services. Under the contract, Lakeside will receive a $14,000 bonus (beyond the established fees of $100,800) if the services are completed by the established date and within the required specifications. Based on Lakeside's history of completing past contracts, Lakeside estimates that the most likely amount of the bonus is 514,000. .. Transactionarice $ 114,400 Variable consideration $ 14.000 Fixed consideration 5 0 5. Atlanta Inc, enters into a revenue contract with a customer to provide services. Under the contract, Atlanta Inc, will receive 140 shares of the customer's common stack ($1 par value per share). At the contrace's inception, the stock is trading on an exchange at $25 per share. 2. Transaction price $ 3.500 Variable consideration 5 0 Fixed consideration $ 0 Measuring the Transaction Price For each of the separate revenue contract scenarios 1 through 5, (a) measure the transaction price and (b) determine whether the transaction price is fixed, variable, or some combination of both. 1. Loyola Inc, sells $70,000 of inventory during the year to customers for $140,000. Layola Inc, accepts returns up to 3 months after the date of purchase. Loyola estimates returns to be 5% of sales a Transaction price $ 131,600 Variable consideration $ 0 Fixed consideration $ 2. Nakoma Corp. sells product offering a retroactive volume discount on certain cumulative sales volumes as follows: 0 to 500 units cost $10 each: 501 to 1,000 units cost $9 each; 1,001 units and beyond cost $8 each. For Nakoma's largest customer, Nakama estimates the likelihood of cumulative purchases for the year as follows: 159 for 400 units, 50% for 800 units, and 359 for 1,200 units. The revenue contract stipulates that the price per unit of product will be adjusted retroactively once specified sales volumes are mel. Cumulative sales to Nakuma's largest customer were 280 units in the first quarter. a. Transaction price $ 0 Variable consideration $ 0 Fixed consideration $ 0 3. Spectrum Inc. is entering into a revenue contract with a new customer for $28,000. Spectrum agrees to pay an up-front fee of $3.500 to the new customer in order to obtain the new contract as a way to compensate the customer for additional up-front processing costs. This payment is not associated with any distinct goods or services. Transaction price $ 24,500 Variable consideration $ 0 Fixed consideration $ 0 4. Lakeside Incenters into a revenue contract with a customer to provide services. Under the contract, Lakeside will receive a $14,000 bonus (beyond the established fees of $100,800) if the services are completed by the established date and within the required specifications. Based on Lakeside's history of completing past contracts, Lakeside estimates that the most likely amount of the bonus is 514,000. .. Transactionarice $ 114,400 Variable consideration $ 14.000 Fixed consideration 5 0 5. Atlanta Inc, enters into a revenue contract with a customer to provide services. Under the contract, Atlanta Inc, will receive 140 shares of the customer's common stack ($1 par value per share). At the contrace's inception, the stock is trading on an exchange at $25 per share. 2. Transaction price $ 3.500 Variable consideration 5 0 Fixed consideration $ 0