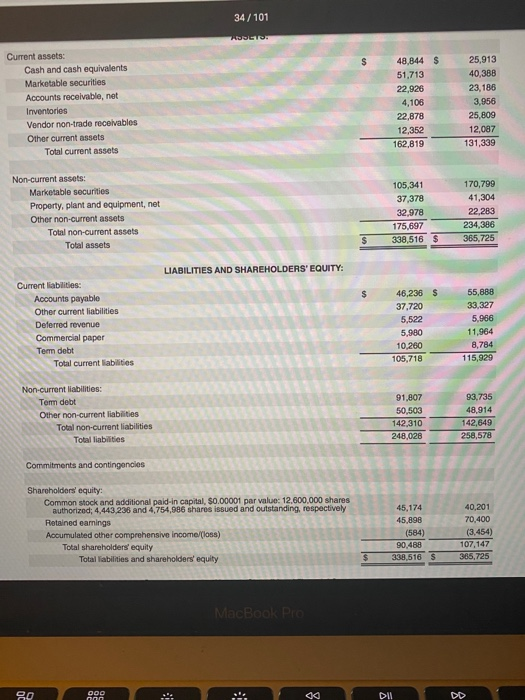

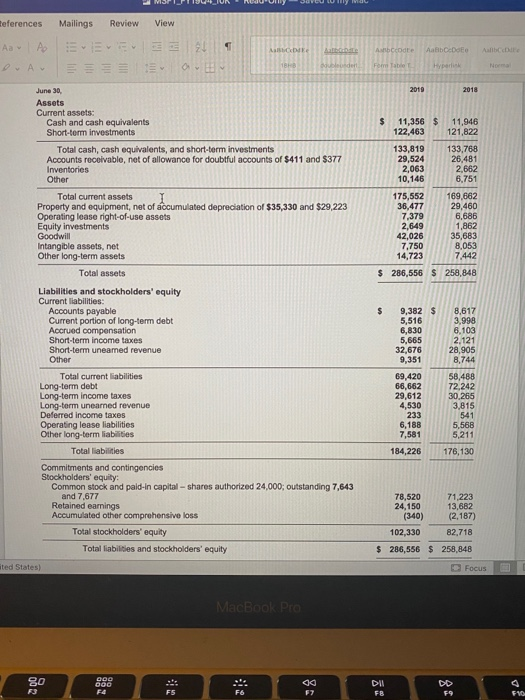

Measuring turnover and cash conversion cycle: Evaluate the ability to sell inventory, collect receivables, and manage payments. Which company appears to be the most efficient with managing its cash conversion cycle? (Note:You will need to use some balance sheet balances from three years, even though the balance sheet only includes two years of balances. To find one year earlier than the two years presented on the balance sheet, find the Form 10-K for the earlier year.) Use Apple and Microsoft as an example. Find their balance sheets in their 10-K's.

34/101 HDCT. Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 48,844 $ 51,713 22,926 4,106 22,878 12,352 162,819 25,913 40,388 23,186 3,956 25,809 12,087 131,339 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 105,341 37 378 32,978 175,697 338,516 170,799 41,304 22,283 234,386 365,725 $ LIABILITIES AND SHAREHOLDERS' EQUITY: S Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 46,236 37.720 5,522 5.980 10,260 105,718 55,888 33,327 5,966 11,964 8,784 115,929 Non-current liabilities: Tem debt Other non-current liabilities Total non-current liabilities Total liabilities 91.807 50,503 142,310 248,028 93,735 48.914 142,649 258,578 Commitments and contingencies Shareholders' equity: Common stock and additional paid in capital, $0.00001 par value: 12,600,000 shares authorized: 4,443,238 and 4,754,986 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 45,174 45,898 (584) 90.489 338,516 40,201 70,400 (3.454) 107,147 385,725 $ 20 . 00 Dil DD References Mailings Review View Aa Aveva 2 DA ESO ABCD Albite 2019 2018 June 30, Assets Current assets Cash and cash equivalents Short-term investments $ 11,356 122,463 11,946 121,822 Total cash, cash equivalents, and short-term investments Accounts receivable, net of allowance for doubtful accounts of $411 and $377 Inventories Other 133,819 29.524 2,063 10,146 133,768 26,481 2.662 6.751 Total current assets Y Property and equipment, not of accumulated depreciation of $35,330 and $29,223 Operating lease right-of-use assets Equity Investments Goodwill Intangible assets, net Other long-term assets Total assets 175,552 169,662 36.477 29.460 7.379 6,686 2,649 1.862 42,026 35,683 7,750 8.053 14,723 7.442 $ 286,556 S 258,848 S 8,617 Liabilities and stockholders' equity Current liabilities: Accounts payable Current portion of long-term debt Accrued compensation Short-term income taxes Short-term uneamed revenue Other 9,382 5,516 6,830 5,665 32,676 9.351 3,998 6.103 2.121 28,905 8,744 58,488 72,242 30.265 3.815 Total current liabilities Long-term debt Long-term income taxes Long-term unearned revenue Deferred income taxes Operating lease liabilities Other long-term liabilities 69,420 66.662 29.612 4.530 233 6.188 7,581 5,56B 5211 176,130 Total liabilities 184,226 Commitments and contingencies Stockholders' equity: Common stock and paid-in capital - shares authorized 24,000; outstanding 7,643 and 7,677 Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity 78,520 24.150 (340) 102,330 102 210 71,223 13.682 12.187) 82,718 $ 286,556 $ 258,848 ited States) Focus MacBook Pro 34/101 HDCT. Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 48,844 $ 51,713 22,926 4,106 22,878 12,352 162,819 25,913 40,388 23,186 3,956 25,809 12,087 131,339 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 105,341 37 378 32,978 175,697 338,516 170,799 41,304 22,283 234,386 365,725 $ LIABILITIES AND SHAREHOLDERS' EQUITY: S Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 46,236 37.720 5,522 5.980 10,260 105,718 55,888 33,327 5,966 11,964 8,784 115,929 Non-current liabilities: Tem debt Other non-current liabilities Total non-current liabilities Total liabilities 91.807 50,503 142,310 248,028 93,735 48.914 142,649 258,578 Commitments and contingencies Shareholders' equity: Common stock and additional paid in capital, $0.00001 par value: 12,600,000 shares authorized: 4,443,238 and 4,754,986 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 45,174 45,898 (584) 90.489 338,516 40,201 70,400 (3.454) 107,147 385,725 $ 20 . 00 Dil DD References Mailings Review View Aa Aveva 2 DA ESO ABCD Albite 2019 2018 June 30, Assets Current assets Cash and cash equivalents Short-term investments $ 11,356 122,463 11,946 121,822 Total cash, cash equivalents, and short-term investments Accounts receivable, net of allowance for doubtful accounts of $411 and $377 Inventories Other 133,819 29.524 2,063 10,146 133,768 26,481 2.662 6.751 Total current assets Y Property and equipment, not of accumulated depreciation of $35,330 and $29,223 Operating lease right-of-use assets Equity Investments Goodwill Intangible assets, net Other long-term assets Total assets 175,552 169,662 36.477 29.460 7.379 6,686 2,649 1.862 42,026 35,683 7,750 8.053 14,723 7.442 $ 286,556 S 258,848 S 8,617 Liabilities and stockholders' equity Current liabilities: Accounts payable Current portion of long-term debt Accrued compensation Short-term income taxes Short-term uneamed revenue Other 9,382 5,516 6,830 5,665 32,676 9.351 3,998 6.103 2.121 28,905 8,744 58,488 72,242 30.265 3.815 Total current liabilities Long-term debt Long-term income taxes Long-term unearned revenue Deferred income taxes Operating lease liabilities Other long-term liabilities 69,420 66.662 29.612 4.530 233 6.188 7,581 5,56B 5211 176,130 Total liabilities 184,226 Commitments and contingencies Stockholders' equity: Common stock and paid-in capital - shares authorized 24,000; outstanding 7,643 and 7,677 Retained earnings Accumulated other comprehensive loss Total stockholders' equity Total liabilities and stockholders' equity 78,520 24.150 (340) 102,330 102 210 71,223 13.682 12.187) 82,718 $ 286,556 $ 258,848 ited States) Focus MacBook Pro