Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mecca Ltd. an industrial product factory has been operating for several years and closed its accounts on 30 June annualy. During the FY2022, Mecca

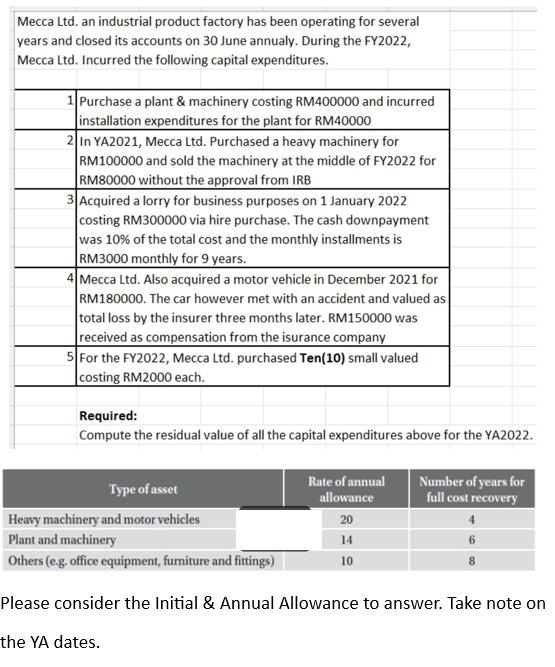

Mecca Ltd. an industrial product factory has been operating for several years and closed its accounts on 30 June annualy. During the FY2022, Mecca Ltd. Incurred the following capital expenditures. 1 Purchase a plant & machinery costing RM400000 and incurred installation expenditures for the plant for RM40000 2 In YA2021, Mecca Ltd. Purchased a heavy machinery for RM100000 and sold the machinery at the middle of FY2022 for RM80000 without the approval from IRB 3 Acquired a lorry for business purposes on 1 January 2022 costing RM300000 via hire purchase. The cash downpayment was 10% of the total cost and the monthly installments is RM3000 monthly for 9 years. 4 Mecca Ltd. Also acquired a motor vehicle in December 2021 for RM180000. The car however met with an accident and valued as total loss by the insurer three months later. RM150000 was received as compensation from the isurance company 5 For the FY2022, Mecca Ltd. purchased Ten(10) small valued costing RM2000 each. Required: Compute the residual value of all the capital expenditures above for the YA2022. Type of asset Heavy machinery and motor vehicles Plant and machinery Others (e.g. office equipment, furniture and fittings) Rate of annual allowance 20 14 10 Number of years for full cost recovery Please consider the Initial & Annual Allowance to answer. Take note on the YA dates.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To compute the residual value of the capital expenditures for the YA2022 calculate the initial allowance and annual allowance for each asset 1 Purchase of plant machinery Cost RM400000 Rate of annual ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started