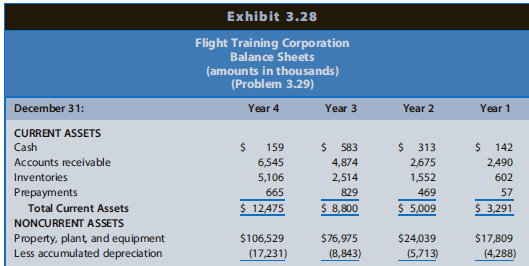

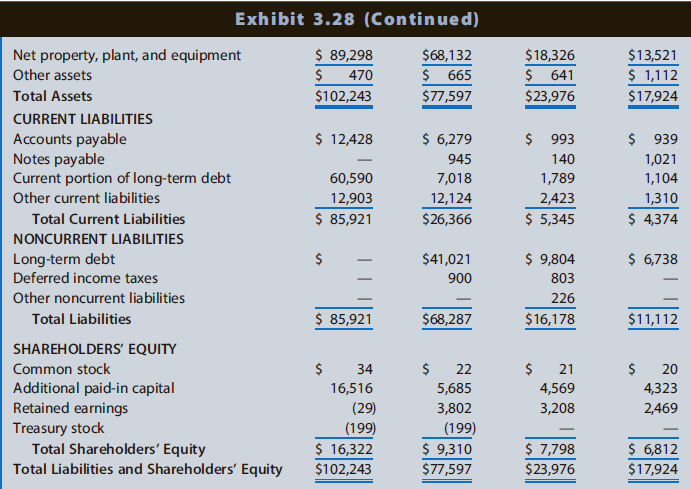

Flight Training Corporation is a privately held firm that provides fighter pilot training under contracts with the

Question:

REQUIRED

a. Prepare a worksheet for the preparation of a statement of cash flows for Flight Training Corporation for each of the years ending December 31, Year 2 through Year 4. Follow the format of Exhibit 3.12 in the text. Notes to the financial statements indicate the following:

(1) The firm did not sell any aircraft during the three-year period.

(2) Changes in other non current assets are investing transactions.

(3) Changes in deferred income taxes are operating transactions.

(4) Changes in other non current liabilities and treasury stock are financing transactions.

(5) The firm violated covenants in its borrowing agreements during Year 4. Therefore, the lenders can require Flight Training Corporation to repay its long-term debt immediately. Although the banks have not yet demanded payment, the firm reclassified its long-term debt as a current liability.

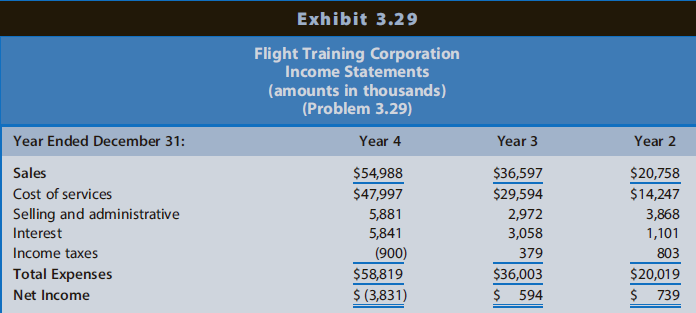

b. Prepare a comparative statement of cash flows for Flight Training Corporation for each of the years ending December 31, Year 2 through Year 4.

c. Comment on the relations among net income and cash flow from operations and the pattern of cash flows from operating, investing, and financing activities for each of the three years.

d. Describe the likely reasons for the cash flow difficulties of Flight Training Corporation.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw