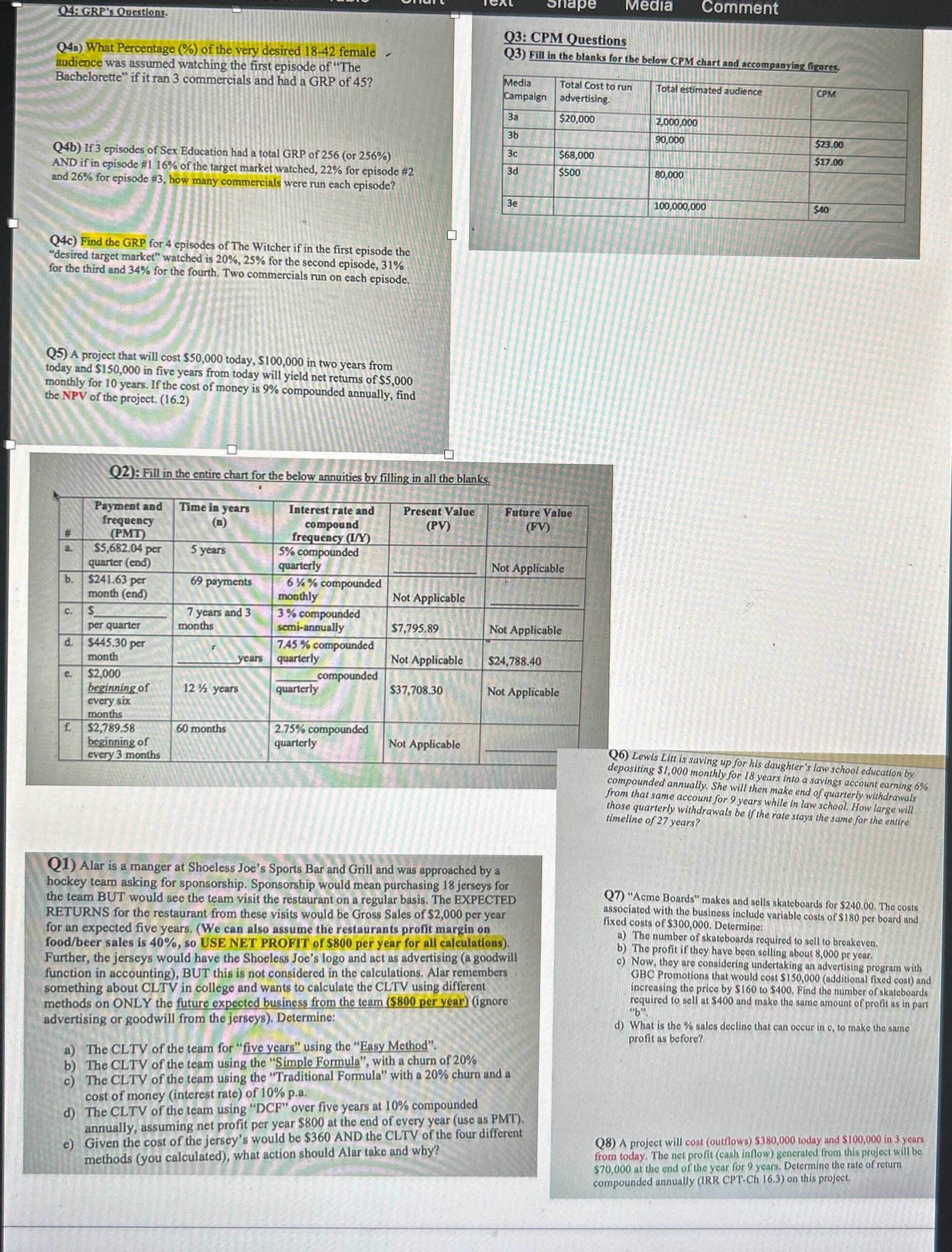

Media Comment Q4. GRP's Questions. Q3: CPM Questions Q4a) What Percentage (%) of the very desired 18-42 female . Q3) Fill in the blanks for the below CPM chart and accompanying figures. audience was assumed watching the first episode of "The Bachelorette" if it ran 3 commercials and had a GRP of 45? Media Total Cost to run Total estimated audience CPM Campaign advertising 3a $20,000 2,000,000 3b 90,000 $23.00 Q4b) If 3 episodes of Sex Education had a total GRP of 256 (or 256%) 3c $68,000 $17.00 AND if in episode #1 16% of the target market watched, 22% for episode #2 3d $500 80,000 and 26% for episode #3, how many commercials were run each episode? 3e 100,000,000 $40 Q4c) Find the GRP for 4 episodes of The Witcher if in the first episode the "desired target market" watched is 20%, 25% for the second episode, 31% for the third and 34% for the fourth. Two commercials run on each episode Q5) A project that will cost $50,000 today, $100,000 in two years from today and $150,000 in five years from today will yield net returns of $5,000 monthly for 10 years. If the cost of money is 9% compounded annually, find the NPV of the project. (16.2) Q2): Fill in the entire chart for the below annuities by filling in all the blanks. Payment and Time in years Interest rate and Present Value Future Value frequency compound (PV) (FV) (PMT frequency (I/Y $5,682.04 per S years 5% compounded quarter (end) quarterly Not Applicable $241.63 per 69 payments 6 14 % compounded month (end) monthly Not Applicable C. 7 years and 3 3 % compounded per quarter months semi-annually $7,795.89 Not Applicable d. $445.30 per 745 % compounded month years quarterly Not Applicable $24,788.40 C. $2,000 compounded beginning of 12 /2 years quarterly $37,708.30 Not Applicable every six months $2,789.58 60 months 2.75% compounded beginning of quarterly Not Applicable every 3 months Q6) Lewis Litt is saving up for his daughter's law school education by depositing $1,000 monthly for 18 years into a savings account earning 6% compounded annually. She will then make end of quarterly withdrawals from that same account for 9 years while in law school. How large will those quarterly withdrawals be if the rate stays the same for the entire timeline of 27 years? Q1) Alar is a manger at Shoeless Joe's Sports Bar and Grill and was approached by a hockey team asking for sponsorship. Sponsorship would mean purchasing 18 jerseys for the team BUT would see the team visit the restaurant on a regular basis. The EXPECTED Q7) "Acme Boards" makes and sells skateboards for $240.00. The costs RETURNS for the restaurant from these visits would be Gross Sales of $2,000 per year associated with the business include variable costs of $180 per board and fixed costs of $300,000, Determine for an expected five years. (We can also assume the restaurants profit margin on a) The number of skateboards required to sell to breakeven food/beer sales is 40%, so USE NET PROFIT of $800 per year for all calculations). b) The profit if they have been selling about 8,000 pr year. Further, the jerseys would have the Shoeless Joe's logo and act as advertising (a goodwill c) Now, they are considering undertaking an advertising program with function in accounting), BUT this is not considered in the calculations. Alar remembers GBC Promotions that would cost $150,000 (additional fixed cost) and something about CLTV in college and wants to calculate the CLTV using different increasing the price by $160 to $400, Find the number of skateboards methods on ONLY the future expected business from the team ($800 per year) (ignore required to sell at $400 and make the same amount of profit as in part "b". advertising or goodwill from the jerseys). Determine: d) What is the % sales decline that can occur in c, to make the same profit as before? a) The CLTV of the team for "five years" using the "Easy Method". b) The CLTV of the team using the "Simple Formula", with a churn of 20% c) The CLTV of the team using the "Traditional Formula" with a 20% churn and a cost of money (interest rate) of 10% p.a. d) The CLTV of the team using "DCF" over five years at 10% compounded annually, assuming net profit per year $800 at the end of every year (use as PMT). Given the cost of the jersey's would be $360 AND the CLTV of the four different Q8) A project will cost (outflows) $380,000 today and $100,000 in 3 years methods (you calculated), what action should Alar take and why? from today, The net profit (cash inflow) generated from this project will be $70,000 at the end of the year for 9 years, Determine the rate of return compounded annually (IRR CPT-Ch 16.3) on this project