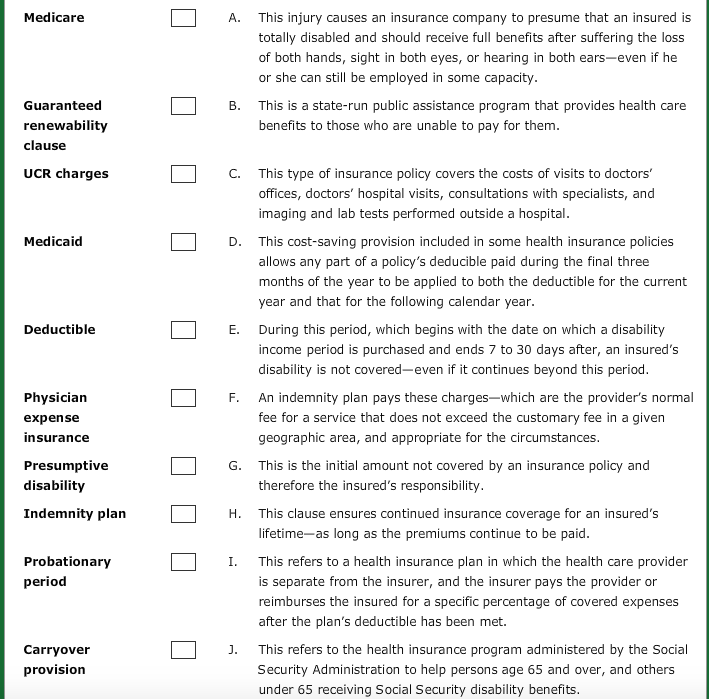

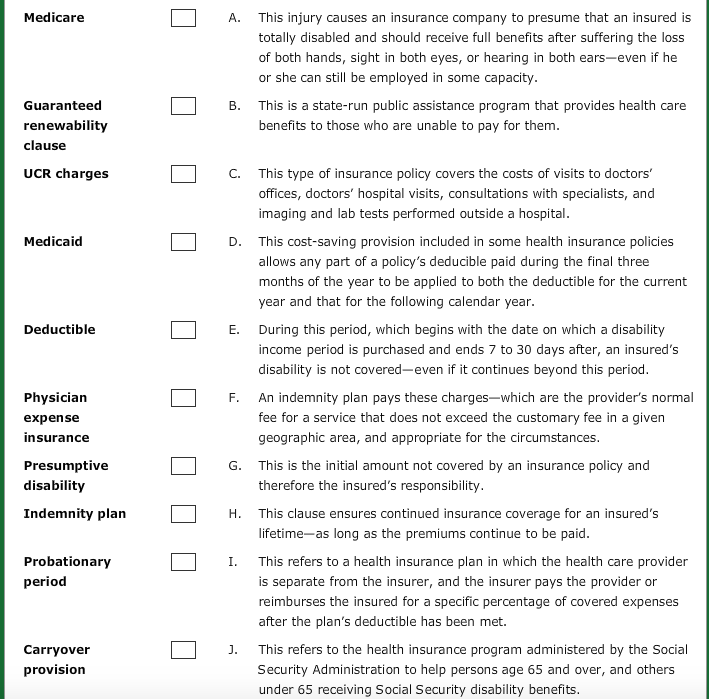

Medicare A. This injury causes an insurance company to presume that an insured is totally disabled and should receive full benefits after suffering the loss of both hands, sight in both eyes, or hearing in both ears-even if he or she can still be employed in some capacity. B. Guaranteed renewability clause This is a state-run public assistance program that provides health care benefits to those who are unable to pay for them. UCR charges Medicaid C. This type of insurance policy covers the costs of visits to doctors' offices, doctors' hospital visits, consultations with specialists, and imaging and lab tests performed outside a hospital. D. This cost-saving provision included in some health insurance policies allows any part of a policy's deducible paid during the final three months of the year to be applied to both the deductible for the current year and that for the following calendar year. E. During this period, which begins with the date on which a disability income period is purchased and ends 7 to 30 days after, an insured's disability is not covered-even if it continues beyond this period. F. An indemnity plan pays these charges-which are the provider's normal fee for a service that does not exceed the customary fee in a given geographic area, and appropriate for the circumstances. Deductible Physician expense insurance Presumptive disability This is the initial amount not covered by an insurance policy and therefore the insured's responsibility. Indemnity plan H. This clause ensures continued insurance coverage for an insured's lifetime-as long as the premiums continue to be paid. I. Probationary period This refers to a health insurance plan in which the health care provider is separate from the insurer, and the insurer pays the provider or reimburses the insured for a specific percentage of covered expenses after the plan's deductible has been met. Carryover provision This refers to the health insurance program administered by the Social Security Administration to help persons age 65 and over, and others under 65 receiving Social Security disability benefits