Medicare had not yet paid Mrs. Marples hospital bill, but the hospital was confident that Medicare would do so soon at the DRG amount noted above; Mr. Chans situation as a charity patient was identified by the hospital and they expected no payment for his services. Attempts to collect Mr. Fridays bills had ended and the hospital did not believe that they would receive any payment. Where, if anywhere, would you find on the Balance Sheet the amounts owed by these patients and how would these be displayed?

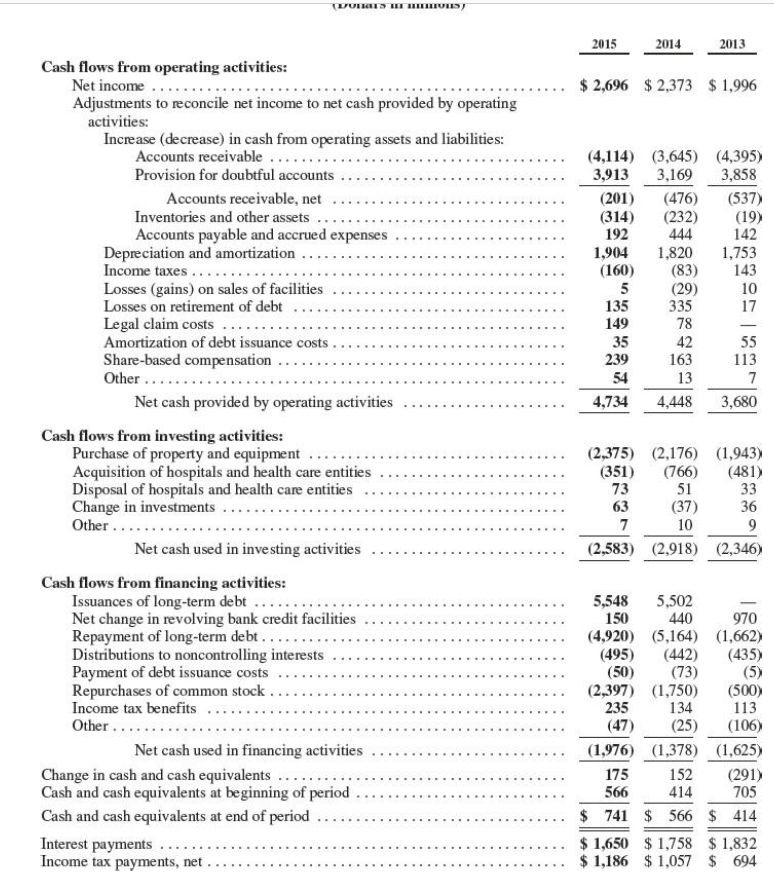

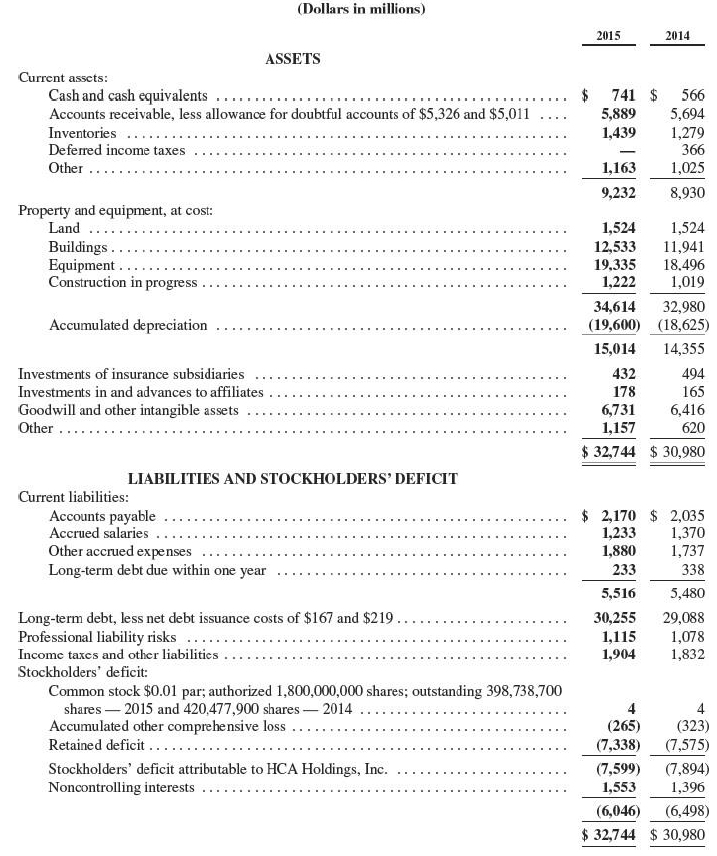

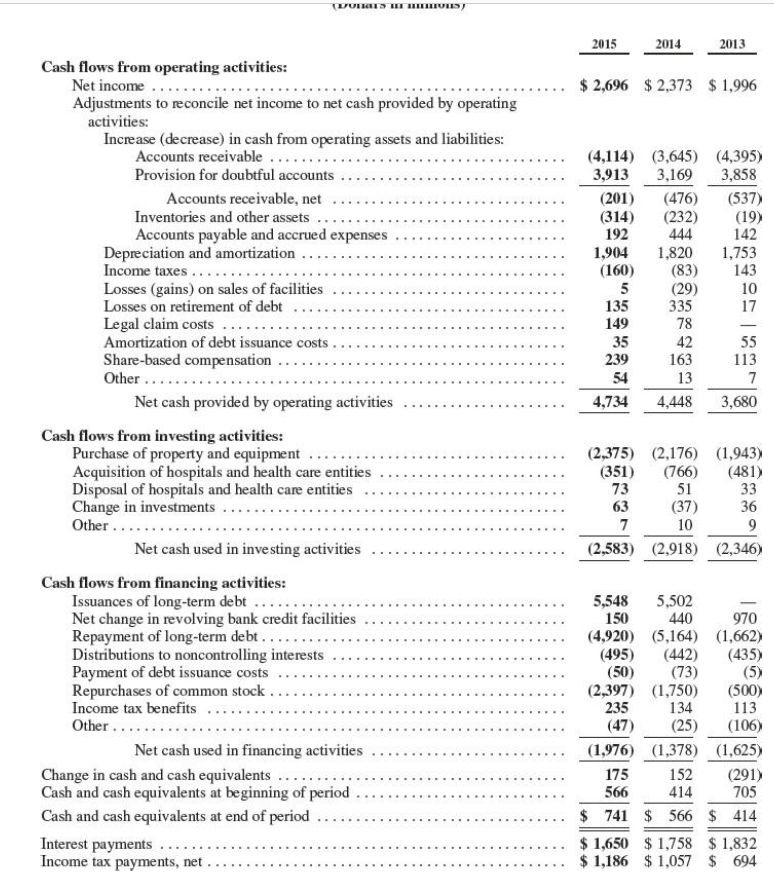

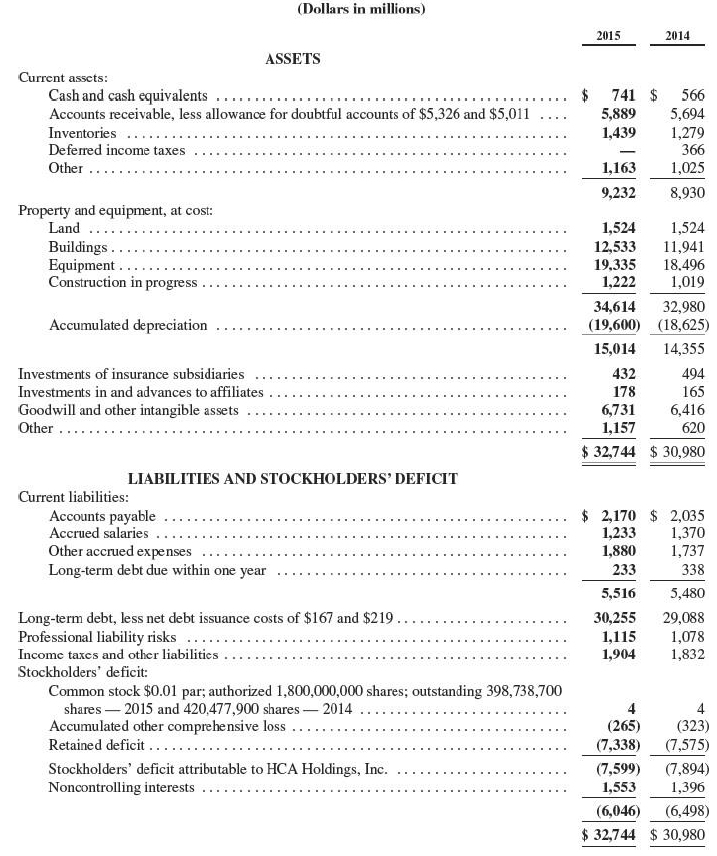

(DUIRE I LLLLILLIS 2015 2014 2013 $ 2,696 $ 2,373 $ 1,996 (4,114) (3,645) (4,395) 3,913 3,169 3,858 (201) (476) (537) (314) (232) (19) 192 444 142 1,904 1,820 1,753 (160) (83) 143 5 (29) 10 135 335 17 149 78 55 239 163 113 54 13 7 4,734 4,448 3,680 35 42 Cash flows from operating activities: Net income ... Adjustments to reconcile net income to net cash provided by operating activities: Increase (decrease) in cash from operating assets and liabilities: Accounts receivable ..... Provision for doubtful accounts Accounts receivable, net Inventories and other assets Accounts payable and accrued expenses Depreciation and amortization ... Income taxes... Losses (gains) on sales of facilities Losses on retirement of debt Legal claim costs ... Amortization of debt issuance costs Share-based compensation Other ...... Net cash provided by operating activities Cash flows from investing activities: Purchase of property and equipment Acquisition of hospitals and health care entities Disposal of hospitals and health care entities Change in investments .... Other ... Net cash used in investing activities Cash flows from financing activities: Issuances of long-term debt ... Net change in revolving bank credit facilities Repayment of long-term debt .. Distributions to noncontrolling interests Payment of debt issuance costs Repurchases of common stock. Income tax benefits Other ... Net cash used in financing activities Change in cash and cash equivalents ... Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Interest payments Income tax payments, net 73 (2,375) (2,176) (1,943) (351) (766) (481) 51 33 63 (37) 36 7 10 9 (2,583) (2,918) (2,346) 5,548 5,502 150 440 970 (4,920) (5,164) (1,662) (495) (442) (435) (50) (73) (5) (2,397) (1,750) (500) 235 134 113 (47) (25) (106) (1,976) (1,378) (1,625) 175 152 (291) 566 414 705 $ 741 $ 566 $ 414 $ 1,650 $ 1,758 $ 1,832 $ 1,186 $ 1,057 $ 694 (Dollars in millions) 2015 2014 $ ASSETS Current assets: Cash and cash equivalents .... Accounts receivable, less allowance for doubtful accounts of $5,326 and $5,011 Inventories ... Deferred income taxes Other 741 $ 5,889 1,439 566 5,694 1,279 366 1,025 8,930 1,163 9,232 Property and equipment, at cost: Land .... Buildings. Equipment Construction in progress Accumulated depreciation 1,524 1,524 12,533 11,941 19,335 18.496 1,222 1,019 34,614 32,980 (19,600) (18,625) 15,014 14,355 432 494 178 165 6,731 6,416 1,157 620 $ 32,744 $ 30,980 Investments of insurance subsidiaries Investments in and advances to affiliates Goodwill and other intangible assets Other .. LIABILITIES AND STOCKHOLDERS' DEFICIT Current liabilities: Accounts payable Accrued salaries Other accrued expenses Long-term debt due within one year $ 2,170 $ 2,035 1,233 1,370 1,880 1,737 233 338 5,516 5,480 30,255 29,088 1,115 1,078 1,904 1,832 Long-term debt, less net debt issuance costs of $167 and $219.. Professional liability risks Income taxes and other liabilities Stockholders' deficit: Common stock $0.01 par; authorized 1,800,000,000 shares; outstanding 398,738,700 shares 2015 and 420,477,900 shares 2014 Accumulated other comprehensive loss Retained deficit ... Stockholders' deficit attributable to HCA Holdings, Inc. Noncontrolling interests 4 (265) (323) (7,338) (7,575) (7,599) (7,894) 1,553 1,396 (6,046) (6,498) $ 32,744 $ 30,980