Question

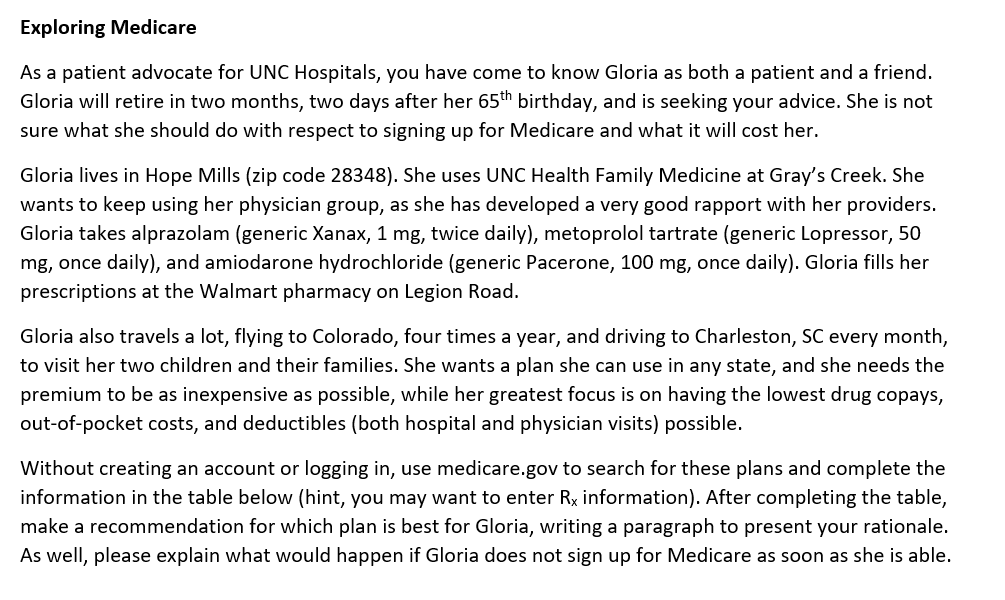

Medicare Parts A, B, and D Combined AARP Medicare Advantage Plan 3 (HMO-POS) UnitedHealthcare | Plan ID: H5253-117-0 FirstMedicare Direct POS Standard (HMO-POS) FirstMedicare Direct

|

| Medicare Parts A, B, and D Combined | AARP Medicare Advantage Plan 3 (HMO-POS) UnitedHealthcare | Plan ID: H5253-117-0 | FirstMedicare Direct POS Standard (HMO-POS) FirstMedicare Direct | Plan ID: H6306-012-1 | Humana Gold Plus H6622-060 (HMO-POS) Humana | Plan ID: H6622-060-0

| Blue Medicare Essential Plus (HMO-POS) Blue Cross and Blue Shield of North Carolina | Plan ID: H3449-023-2 |

| Total Monthly Premium | |||||

| Total 2023 Drug Costs (all three drugs, least expensive) | |||||

| Health Deductible | |||||

| Drug Deductible | |||||

| In-Network Maximum | |||||

| Out-of-Network Maximum | |||||

| Primary Care Copay | |||||

| Specialist Care Copay | |||||

| Emergency Care Copay | |||||

| Urgent Care Copay | |||||

| Inpatient Costs (seven-day stay) and Disclose Coinsurance Percentage | |||||

| Outpatient Costs (seven-day stay) and Disclose Coinsurance Percentage |

Exploring Medicare As a patient advocate for UNC Hospitals, you have come to know Gloria as both a patient and a friend. Gloria will retire in two months, two days after her 65th birthday, and is seeking your advice. She is not sure what she should do with respect to signing up for Medicare and what it will cost her. Gloria lives in Hope Mills (zip code 28348). She uses UNC Health Family Medicine at Gray's Creek. She wants to keep using her physician group, as she has developed a very good rapport with her providers. Gloria takes alprazolam (generic Xanax, 1mg, twice daily), metoprolol tartrate (generic Lopressor, 50 mg, once daily), and amiodarone hydrochloride (generic Pacerone, 100mg, once daily). Gloria fills her prescriptions at the Walmart pharmacy on Legion Road. Gloria also travels a lot, flying to Colorado, four times a year, and driving to Charleston, SC every month, to visit her two children and their families. She wants a plan she can use in any state, and she needs the premium to be as inexpensive as possible, while her greatest focus is on having the lowest drug copays, out-of-pocket costs, and deductibles (both hospital and physician visits) possible. Without creating an account or logging in, use medicare.gov to search for these plans and complete the information in the table below (hint, you may want to enter Rx information). After completing the table, make a recommendation for which plan is best for Gloria, writing a paragraph to present your rationale. As well, please explain what would happen if Gloria does not sign up for Medicare as soon as she is able

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started