Question

Medium-sized financial business Mnotho Capital Group offers clients a selection of financial goods and services. The company has hired a team of business analysts to

Medium-sized financial business Mnotho Capital Group offers clients a selection of financial goods and services. The company has hired a team of business analysts to aid them in developing a strategy as they attempt to diversify their service offerings to include online banking. Three different business analysts make up the team, each bringing their own perspective from the viewpoints of businesses, consumers, and information.

Organisational Perspective

The business analyst with a business point of view looks at the current business model of Mnotho Capital Group and identifies potential challenges and rewards in implementing online banking. To determine how online banking can fit into the present company structure, they thoroughly analyse the company's value proposition, revenue sources, and consumer categories. They also recognise potential dangers, such as the exploitation of already existing items, and create mitigation plans. Based on this analysis, the business analyst suggests that Mnotho Capital Group develop online banking in phases, considering user uptake and engagement.

Stakeholder Perspective

The team's stakeholder analyst assesses the various stakeholders, such as clients, employees of the company, and regulators, who are likely to be impacted by the implementation of online banking. They determine their preferences, goals, and issues, and then create plans to meet them. Additionally, they assess how online banking impacts the company's name and reputation. According to this study, the stakeholder analyst advises Mnotho Capital Group to implement online banking in a transparent and customer-centric manner, giving emphasis on the privacy and security of customer data.

Information Perspective

The team's information analyst focuses on the technological readiness and technology architecture required for enabling online banking. To find potential flaws and dangers, they examine the company's existing data management systems, network design, and security precautions. Additionally, they look at the client information required for supporting online banking and evaluate how prepared the company is to handle and protect this information. To guarantee the privacy and 22; 23; 24 2023 The Independent Institute of Education (Pty) Ltd 2023 Page 4 of 9 confidentiality of consumer information, the information analyst encourages Mnotho Capital Group to upgrade its IT infrastructure and systems for managing data.

Conclusion:

The many perspectives of the business analysis team have assisted Mnotho Capital Group in developing a thorough plan for implementing online banking. The team has identified potential challenges and opportunities, key stakeholders, and issues, as well as the information architecture required to successfully implement online banking by incorporating the business, stakeholder, and information perspectives. This plan assures that it is comprehensive and sustainable for Mnotho Capital Group

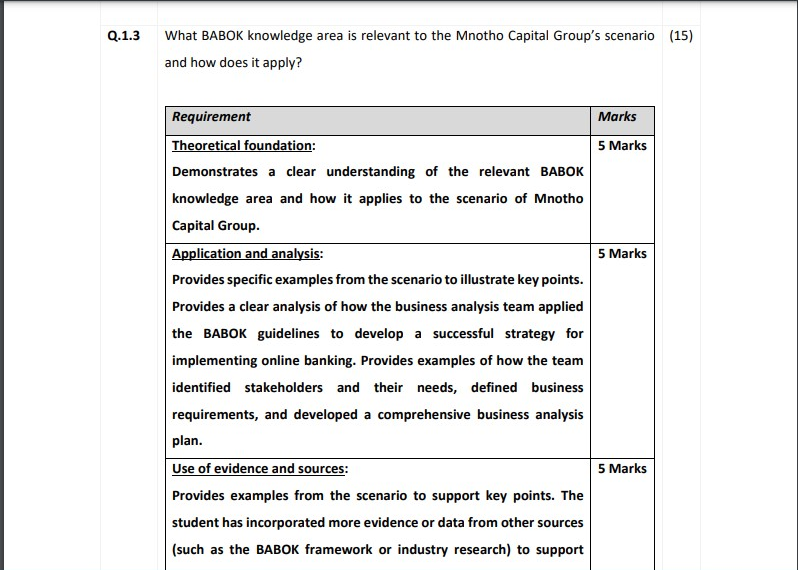

What BABOK knowledge area is relevant to the Mnotho Capital Group's scenario and how does it apply

What BABOK knowledge area is relevant to the Mnotho Capital Group's scenario and how does it apply Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started