Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MEDMAD Inc is a highly geared pharmaceutical company that is looking to expand its product offerings. MEDMAD have identified six new product lines which

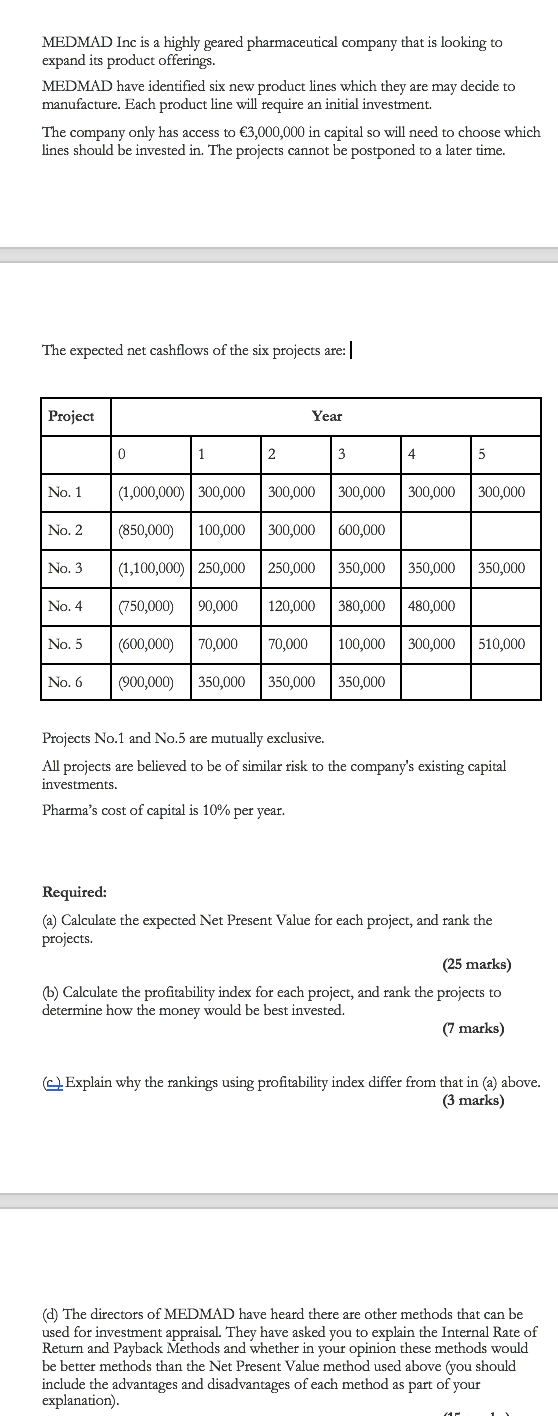

MEDMAD Inc is a highly geared pharmaceutical company that is looking to expand its product offerings. MEDMAD have identified six new product lines which they are may decide to manufacture. Each product line will require an initial investment. The company only has access to 3,000,000 in capital so will need to choose which lines should be invested in. The projects cannot be postponed to a later time. The expected net cashflows of the six projects are: | Project Year 0 1 2 3 5 No. 1 (1,000,000) 300,000 300,000 300,000 300,000 300,000 No. 2 (850,000) 100,000 300,000 600,000 No. 3 (1,100,000) 250,000 250,000 350,000 350,000 350,000 No. 4 (750,000) 90,000 120,000 380,000 480,000 No. 5 (600,000) 70,000 70,000 100,000 300,000 510,000 No. 6 (900,000) 350,000 350,000 350,000 Projects No.1 and No.5 are mutually exclusive. All projects are believed to be of similar risk to the company's existing capital investments. Pharma's cost of capital is 10% per year. Required: (a) Calculate the expected Net Present Value for each project, and rank the projects. (25 marks) (b) Calculate the profitability index for each project, and rank the projects to determine how the money would be best invested. (7 marks) Explain why the rankings using profitability index differ from that in (a) above. (3 marks) (d) The directors of MEDMAD have heard there are other methods that can be used for investment appraisal. They have asked you to explain the Internal Rate of Return and Payback Methods and whether in your opinion these methods would be better methods than the Net Present Value method used above (you should include the advantages and disadvantages of each method as part of your explanation).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

MEDMAD Investment Appraisal a Net Present Value NPV and Ranking To calculate the NPV well use the NPV formula NPV CFt 1rt Initial Investment where CFt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started