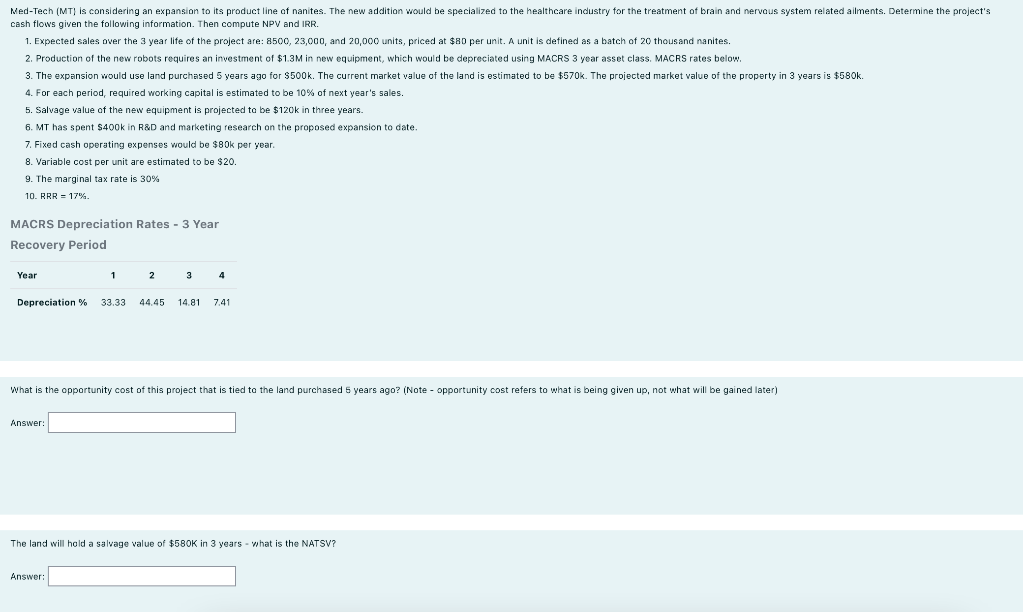

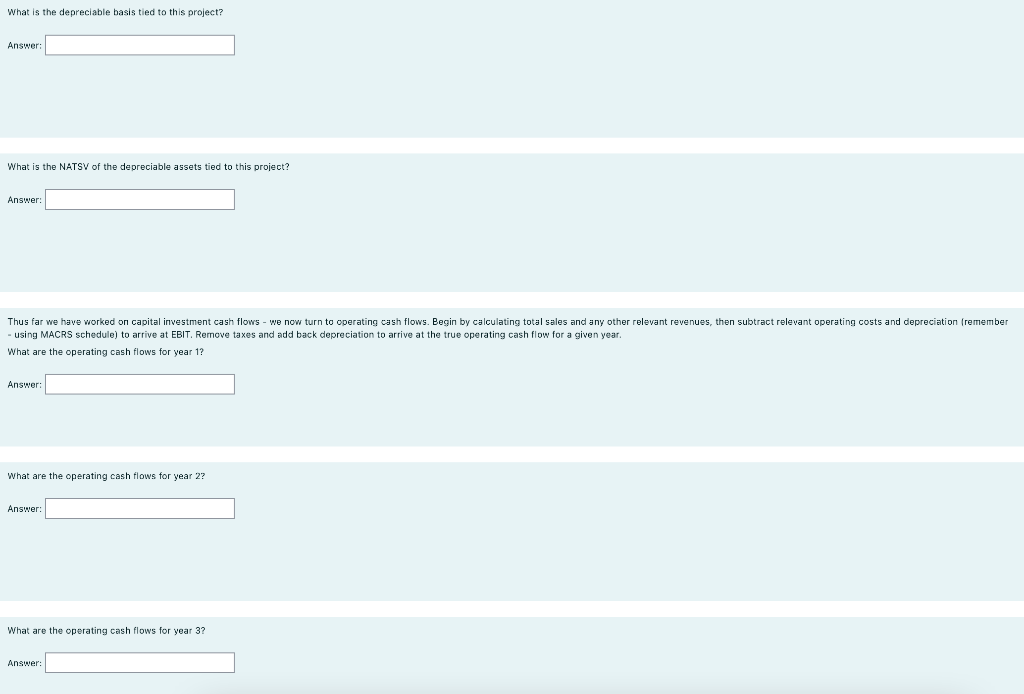

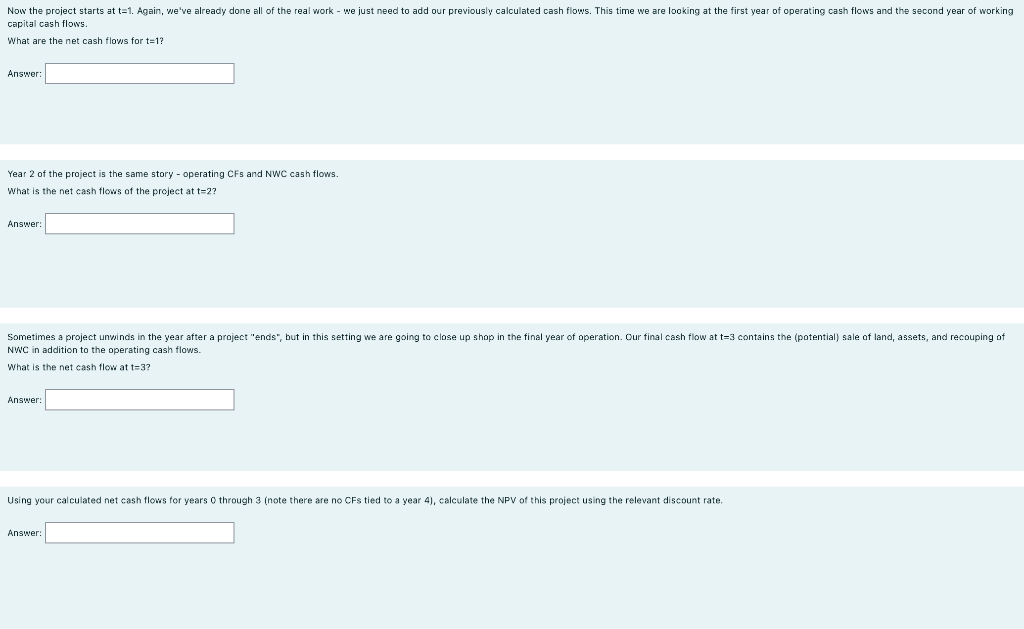

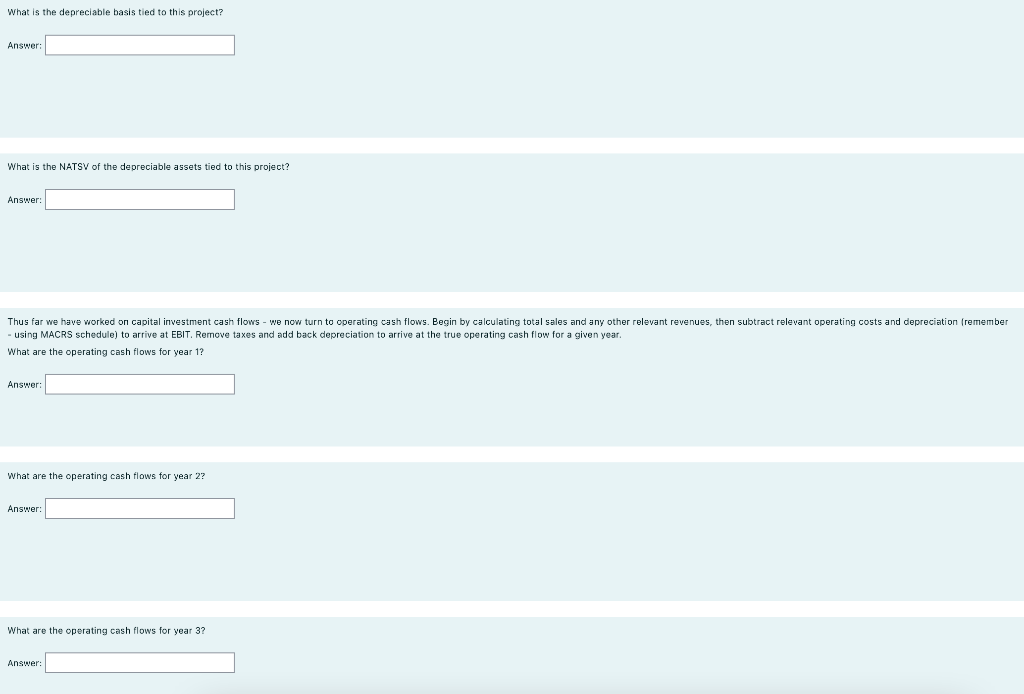

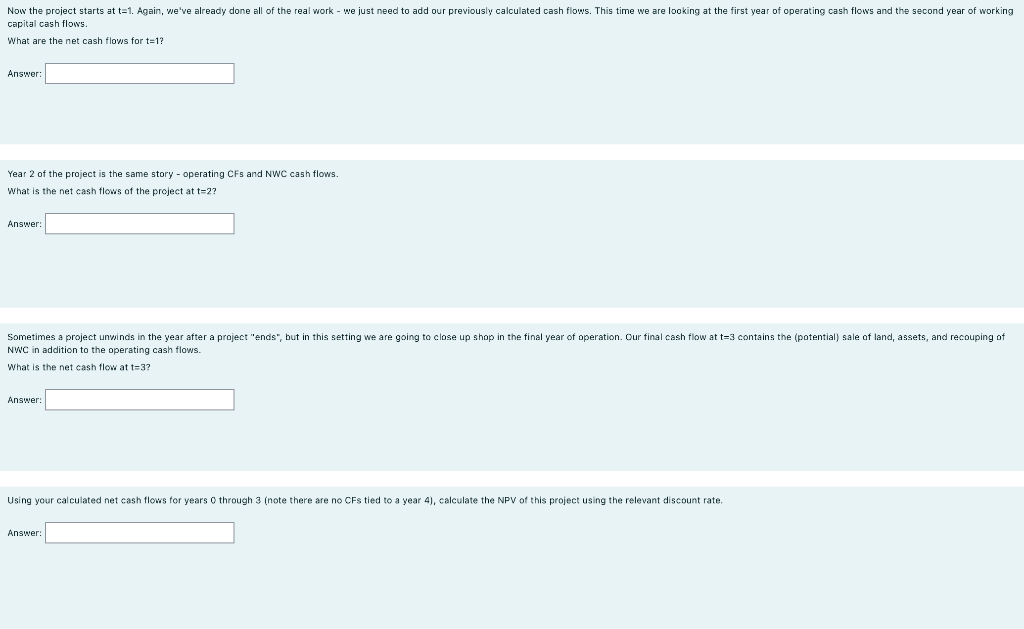

Med-Tech (MT) is considering an expansion to its product line at nanites. The new addition would be specialized to the healthcare industry for the treatment of brain and nervous system related ailments. Determine the project's cash flows given the following information. Then compute NPV and IRR. 1. Expected sales over the 3 year life of the project are: 8500, 23,000, and 20,000 units, priced at $80 per unit. A unit is defined as a batch of 20 thousand nanites. 2. Production of the new robots requires an investment of $1.3M in new equipment, which would be depreciated using MACRS 3 year asset class. MACRS rates below. 3. The expansion would use land purchased 5 years ago for $500k. The current market value of the land is estimated to be $570k. The projected market value of the property in 3 years is $580k. 4. For each period, required working capital is estimated to be 10% of next year's sales. 5. Salvage value of the new equipment is projected to be $120k in three years. 6. MT has spent $400k in R&D and marketing research on the proposed expansion to date. 7. Fixed cash operating expenses would be $80k per year. 8. Variable cost per unit are estimated to be $20. 9. The marginal tax rate is 30% 10. RRR = 17% MACRS Depreciation Rates - 3 Year Recovery Period Year 1 2 3 4 Depreciation% 33.33 44.45 14.81 7.41 What is the opportunity cost of this project that is tied to the land purchased 5 years ago? (Note - opportunity cost refers to what is being given up, not what will be gained later) Answer: The land will hold a salvage value of $580K in 3 years - what is the NATSV? Answer: What is the depreciable basis tied to this project? Answer: What is the NATSV of the depreciable assets tied to this project? Answer: Thus far we have worked on capital investment cash flows - we now turn to operating cash flows. Begin by calculating total sales and any other relevant revenues, then subtract relevant operating costs and depreciation (remember using MACRS schedule) to arrive at EBIT. Remove taxes and add back depreciation to arrive at the true operating cash flow for a given year. What are the operating cash flows for year 1? Answer: What are the operating cash flows for year 2? Answer: What are the operating cash flows for year 3? Answer: Working capital will be required for this project - start by calculating the working capital required for year 0. Since the project requires none beforehand, we can also take this as the change in NWC. What is the cash flow at time o tied to this change? Answer: Working capital continues to be necessary throughout the project - start by calculating the needed NWC in year 1. What is the CF tied to NWC for year 1? (Remember that we are looking at changes, and that a positive change means a cost for the project) Answer: Working capital continues to be necessary throughout the project - start by calculating the needed NWC in year 2. What is the CF tied to NWC for year 2? (Remember that we are looking at changes, and that a positive change means a cost for the project) Answer: recouped by the end of the project - start by calculating the needed NWC in year 3. What is the CF tied to NWC for year 3? (Remember that we are looking at changes, and that a positive change means a cost for Working capital the project) Answer: It is time to start adding rows together to arrive at the total net cash flows tied to this project. We will start by calculating NINV (Net Investment), which in reality is simply the Net Cash Flows of the project at time zero (t=0). What are the net cash flows at t=0? (Note - you shouldn't see any operating expenses yet, as the project has not "started outside of prep. You should only be seeing expenses tied to capital investments and working capital) Answer: Now the project starts at t=1. Again, we've already done all of the real work - we just need to add our previously calculated cash flows. This time we are looking at the first year of operating cash flows and the second year of working capital cash flows What are the net cash flows for t=1? Answer: Year 2 of the project is the same story - Operating CFs and NWC cash flows. What is the net cash flows the project at t=27 Answer: Sometimes a project unwinds in the year after a project "ends", but in this setting we are going to close up shop in the final year of operation. Our final cash flow at t=3 contains the (potential) sale of land, assets, and recouping of NWC in addition to the operating cash flows. What is the net cash flow at t=3? Answer: Using your calculated net cash flows for years o through 3 (note there are no CFs tied to a year 4), calculate the NPV of this project using the relevant discount rate