Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mega Properties Berhad is evaluating its long term sources of financing. The sources of financing are as follows: 1) 11) 111) Issuing new preferred

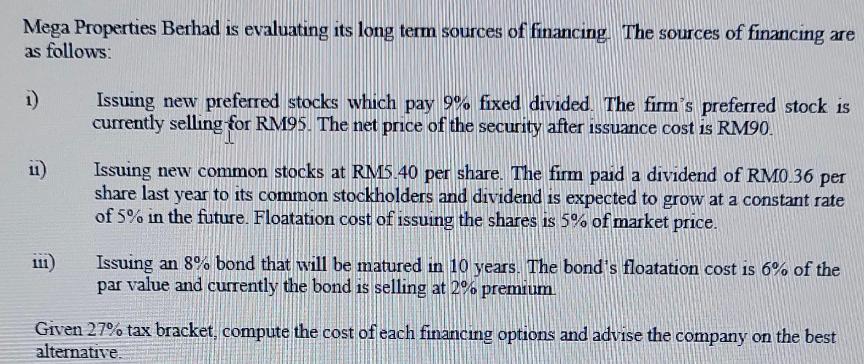

Mega Properties Berhad is evaluating its long term sources of financing. The sources of financing are as follows: 1) 11) 111) Issuing new preferred stocks which pay 9% fixed divided. The firm's preferred stock is currently selling for RM95. The net price of the security after issuance cost is RM90. Issuing new common stocks at RM5.40 per share. The firm paid a dividend of RM0.36 per share last year to its common stockholders and dividend is expected to grow at a constant rate of 5% in the future. Floatation cost of issuing the shares is 5% of market price. Issuing an 8% bond that will be matured in 10 years. The bond's floatation cost is 6% of the par value and currently the bond is selling at 2% premium Given 27% tax bracket, compute the cost of each financing options and advise the company on the best alternative.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 Issuing new preferred stocks C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started