Answered step by step

Verified Expert Solution

Question

1 Approved Answer

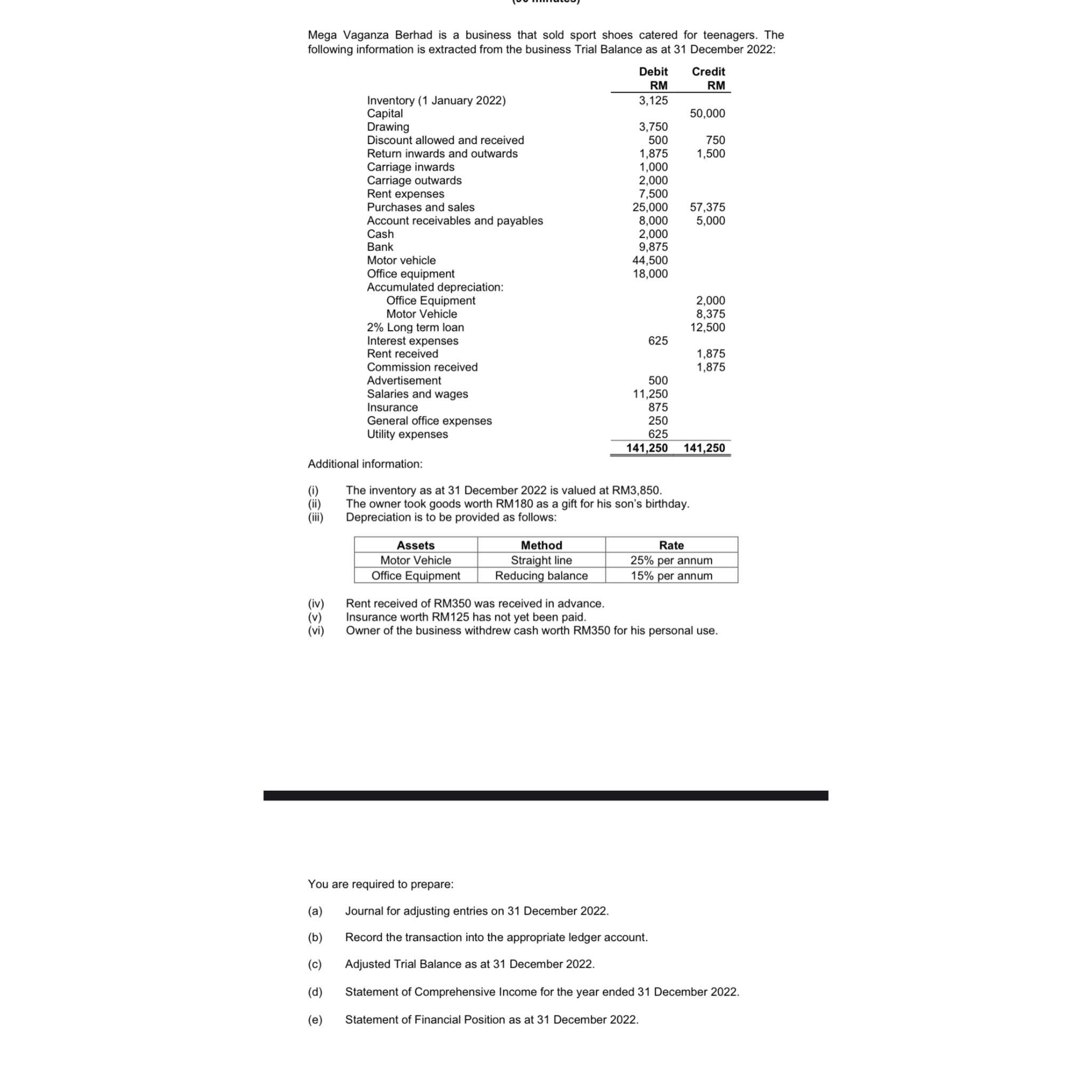

Mega Vaganza Berhad is a business that sold sport shoes catered for teenagers. The following information is extracted from the business Trial Balance as

Mega Vaganza Berhad is a business that sold sport shoes catered for teenagers. The following information is extracted from the business Trial Balance as at 31 December 2022: Debit RM Credit RM Inventory (1 January 2022) 3,125 Capital 50,000 Drawing 3,750 Discount allowed and received 500 750 Return inwards and outwards 1,875 1,500 Carriage inwards 1,000 Carriage outwards 2,000 Rent expenses 7,500 Purchases and sales 25,000 57,375 Account receivables and payables 8,000 5,000 Cash 2,000 Bank 9,875 Motor vehicle 44,500 Office equipment 18,000 Accumulated depreciation: Office Equipment 2,000 Motor Vehicle 8,375 2% Long term loan 12,500 Interest expenses 625 Rent received 1,875 Commission received 1,875 Advertisement 500 Salaries and wages 11,250 Insurance 875 General office expenses 250 625 141,250 141,250 Utility expenses Additional information: (i) The inventory as at 31 December 2022 is valued at RM3,850. The owner took goods worth RM180 as a gift for his son's birthday. Depreciation is to be provided as follows: (ii) (!!!) 333 (vi) (iv) Assets Motor Vehicle Office Equipment Method Straight line Reducing balance Rent received of RM350 was received in advance. Insurance worth RM125 has not yet been paid. Rate 25% per annum 15% per annum Owner of the business withdrew cash worth RM350 for his personal use. You are required to prepare: (a) Journal for adjusting entries on 31 December 2022. (b) Record the transaction into the appropriate ledger account. () Adjusted Trial Balance as at 31 December 2022. (d) Statement of Comprehensive Income for the year ended 31 December 2022. (e) Statement of Financial Position as at 31 December 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Journal for adjusting entries on 31 December 2022 1 To record depreciation expense for the year Depreciation Expense Motor Vehicle 8375 Depreciation Expense Office Equipment 300 Accumulated Deprecia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started