Answered step by step

Verified Expert Solution

Question

1 Approved Answer

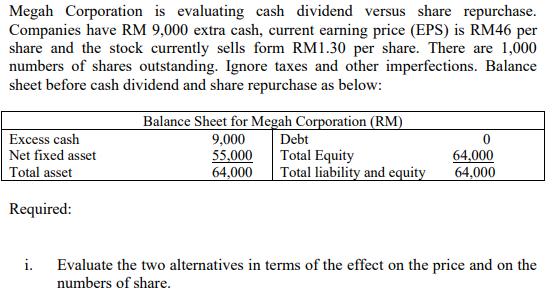

Megah Corporation is evaluating cash dividend versus share repurchase. Companies have RM 9,000 extra cash, current earning price (EPS) is RM46 per share and

Megah Corporation is evaluating cash dividend versus share repurchase. Companies have RM 9,000 extra cash, current earning price (EPS) is RM46 per share and the stock currently sells form RM1.30 per share. There are 1,000 numbers of shares outstanding. Ignore taxes and other imperfections. Balance sheet before cash dividend and share repurchase as below: Excess cash Net fixed asset Total asset Required: i. Balance Sheet for Megah Corporation (RM) 9,000 55,000 64,000 Debt Total Equity Total liability and equity 64,000 64,000 Evaluate the two alternatives in terms of the effect on the price and on the numbers of share.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A Cash Dividend The cash dividend will reduce the excess cash of Megah Corporation to zero with a di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started