Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Megan, an auditor working on the audit of Weisz Enterprises, is currently testing the client's internal controls related to loans payabl and associated interest expense.

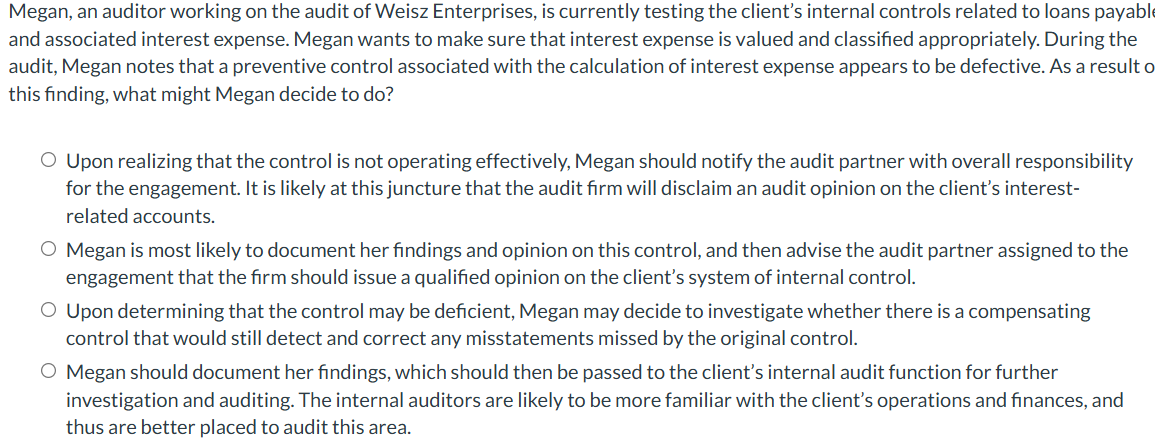

Megan, an auditor working on the audit of Weisz Enterprises, is currently testing the client's internal controls related to loans payabl and associated interest expense. Megan wants to make sure that interest expense is valued and classified appropriately. During the audit, Megan notes that a preventive control associated with the calculation of interest expense appears to be defective. As a result o this finding, what might Megan decide to do

Upon realizing that the control is not operating effectively, Megan should notify the audit partner with overall responsibility for the engagement. It is likely at this juncture that the audit firm will disclaim an audit opinion on the client's interestrelated accounts.

Megan is most likely to document her findings and opinion on this control, and then advise the audit partner assigned to the engagement that the firm should issue a qualified opinion on the client's system of internal control.

Upon determining that the control may be deficient, Megan may decide to investigate whether there is a compensating control that would still detect and correct any misstatements missed by the original control.

Megan should document her findings, which should then be passed to the client's internal audit function for further investigation and auditing. The internal auditors are likely to be more familiar with the client's operations and finances, and thus are better placed to audit this area.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started