Megan is a proprietor and owns a hair salon. Determine the total Canada Pension Plan (CPP) and Employment Insurance (El) premiums Megan must pay

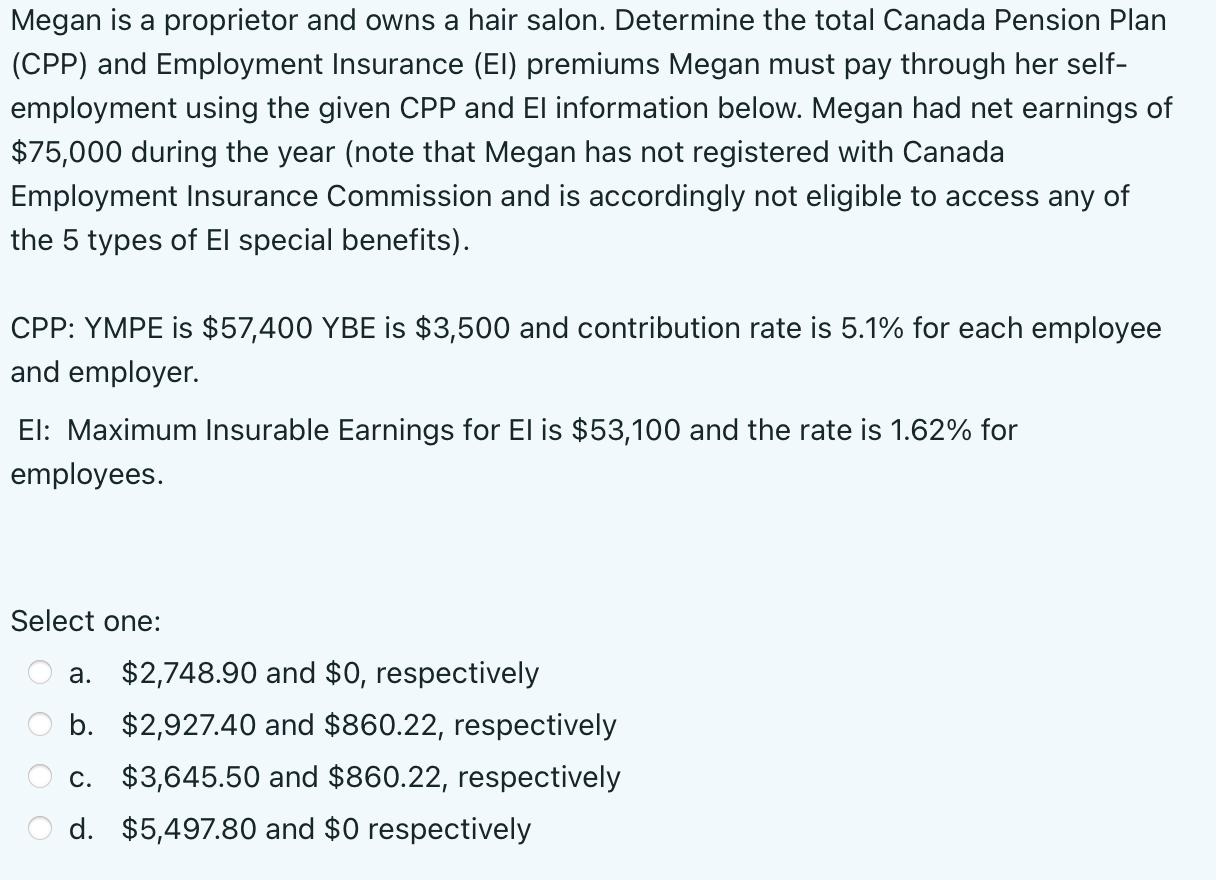

Megan is a proprietor and owns a hair salon. Determine the total Canada Pension Plan (CPP) and Employment Insurance (El) premiums Megan must pay through her self- employment using the given CPP and El information below. Megan had net earnings of $75,000 during the year (note that Megan has not registered with Canada Employment Insurance Commission and is accordingly not eligible to access any of the 5 types of El special benefits). CPP: YMPE is $57,400 YBE is $3,500 and contribution rate is 5.1% for each employee and employer. El: Maximum Insurable Earnings for El is $53,100 and the rate is 1.62% for employees. Select one: a. $2,748.90 and $0, respectively b. $2,927.40 and $860.22, respectively c. $3,645.50 and $860.22, respectively d. $5,497.80 and $0 respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Canada Pension Plan CPP and Employment Insurance EI premiums that Megan must pay we ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started