You work for Tamimi Industries, which purchased robotics equipment for $500,000 six years ago. The equipment is in place today, has a total 10-year

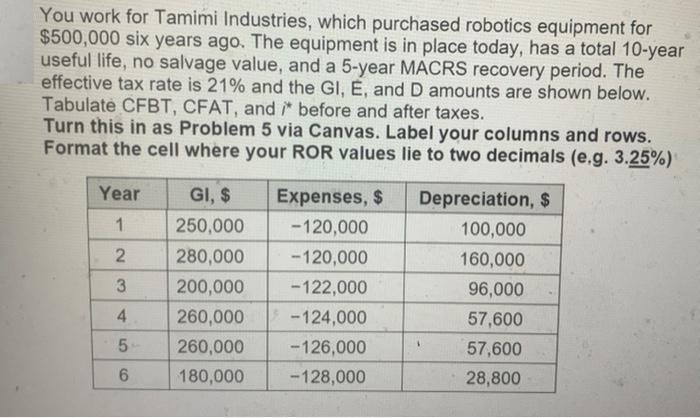

You work for Tamimi Industries, which purchased robotics equipment for $500,000 six years ago. The equipment is in place today, has a total 10-year useful life, no salvage value, and a 5-year MACRS recovery period. The effective tax rate is 21% and the GI, E, and D amounts are shown below. Tabulate CFBT, CFAT, and before and after taxes. Turn this in as Problem 5 via Canvas. Label your columns and rows. Format the cell where your ROR values lie to two decimals (e.g. 3.25%) Year 1 2 3 4 5 6 GI, $ 250,000 280,000 200,000 260,000 260,000 180,000 Expenses, $ -120,000 -120,000 -122,000 -124,000 -126,000 -128,000 Depreciation, $ 100,000 160,000 96,000 57,600 57,600 28,800

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Cost of Robotics earuipment 6 years ago 500 000 useful li...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started