Answered step by step

Verified Expert Solution

Question

1 Approved Answer

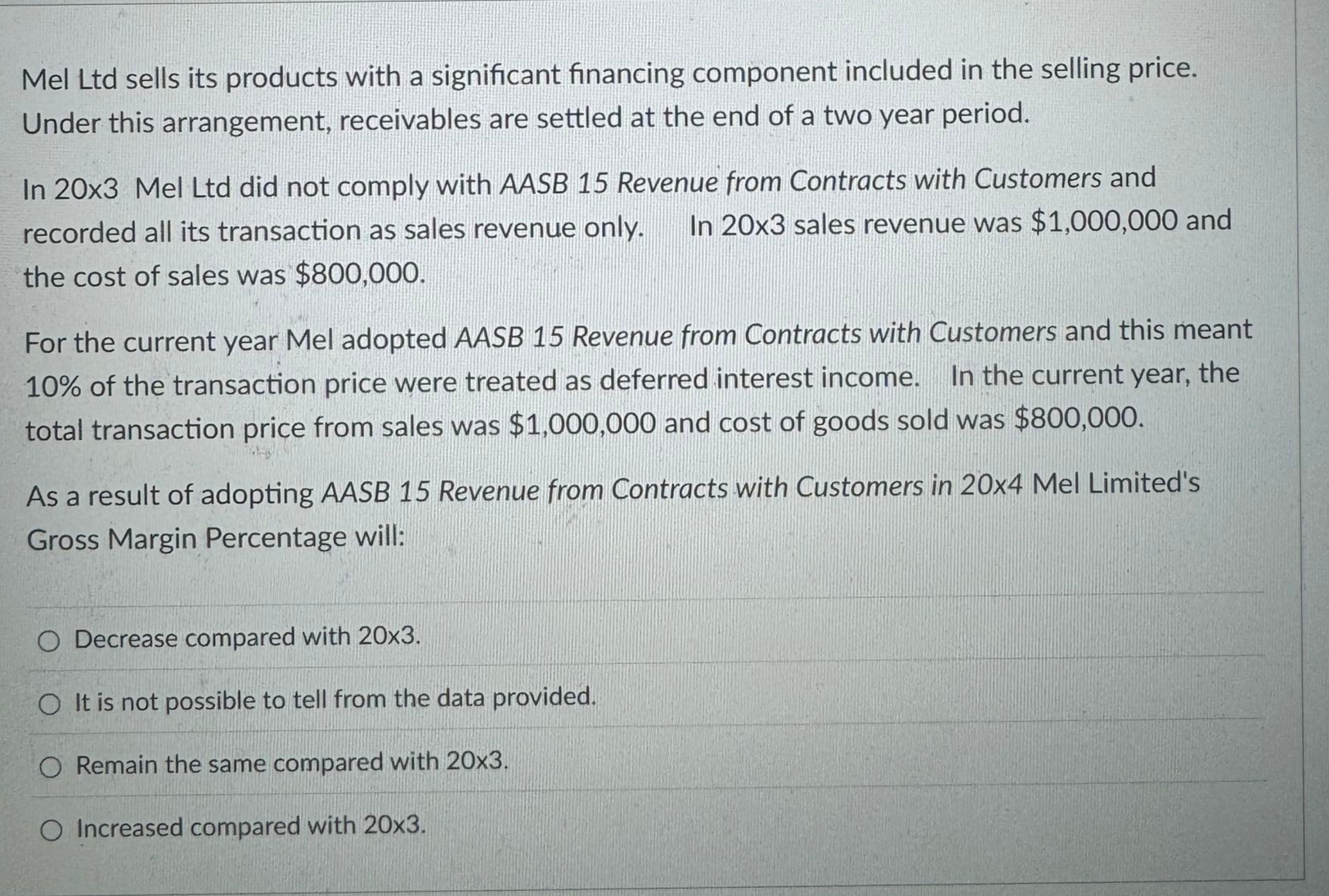

Mel Ltd sells its products with a significant financing component included in the selling price. Under this arrangement, receivables are settled at the end of

Mel Ltd sells its products with a significant financing component included in the selling price.

Under this arrangement, receivables are settled at the end of a two year period.

In x Mel Ltd did not comply with AASB Revenue from Contracts with Customers and

recorded all its transaction as sales revenue only. In x sales revenue was $ and

the cost of sales was $

For the current year Mel adopted AASB Revenue from Contracts with Customers and this meant

of the transaction price were treated as deferred interest income. In the current year, the

total transaction price from sales was $ and cost of goods sold was $

As a result of adopting AASB Revenue from Contracts with Customers in x Mel Limited's

Gross Margin Percentage will:

Decrease compared with

It is not possible to tell from the data provided.

Remain the same compared with

Increased compared with

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started