Answered step by step

Verified Expert Solution

Question

1 Approved Answer

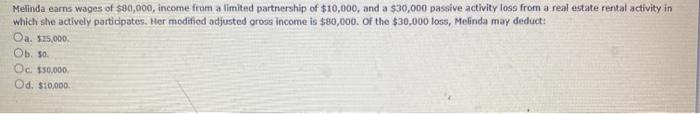

Melinda earns wages of $80,000, income from a limited partnership of $10,000, and a $30,000 passive activity loss from a real estate rental activity in

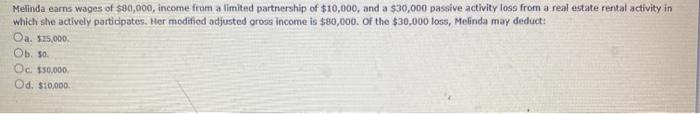

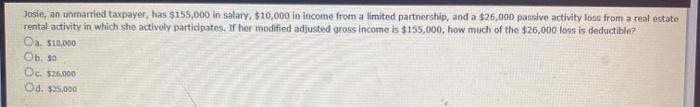

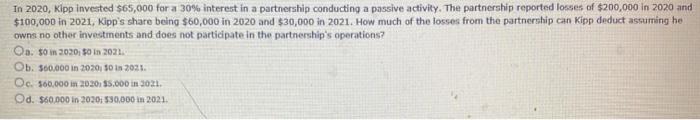

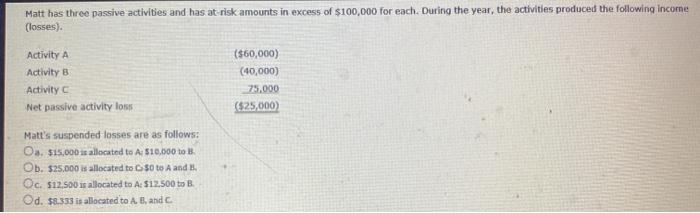

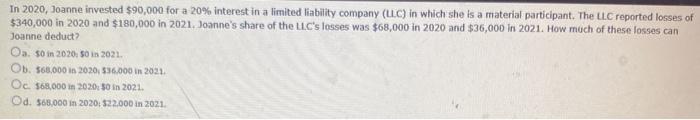

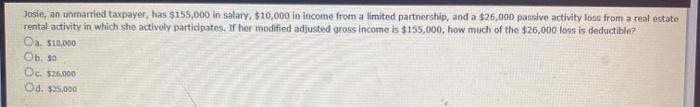

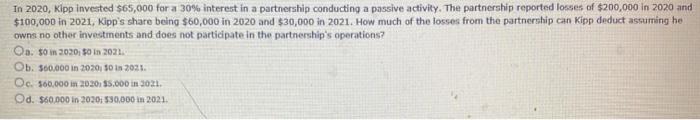

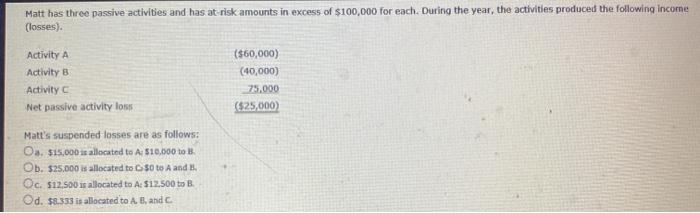

Melinda earns wages of $80,000, income from a limited partnership of $10,000, and a $30,000 passive activity loss from a real estate rental activity in which she actively participates. Her modified adjusted gross income is $80,000. of the $30,000 loss, Melinda may deduct: Oa. $35.000 Ob 50 Oc $50,000 Od. 5:0.000 Josie, an unmarried taxpayer, has $155,000 in salary, $10,000 in income from a limited partnership, and a $26,000 passive activity lons from a real estate rental activity in which she actively participates. If her modified adjusted gross income is $155,000, how much of the $26,000 loss is deductible? Oa. 510,000 Ob. 30 Oc. $26.000 Od. $25.000 In 2020, Kipp invested $65,000 for a 30% interest in a partnership conducting a passive activity. The partnership reported losses of $200,000 in 2020 and $100,000 in 2021, Kipp's share being $60,000 in 2020 and $30,000 in 2021. How much of the fosses from the partnership can Kipp deduct assuming he owns no other investments and does not participate in the partnership's operations? Oa. $0 in 2020, 30 in 2021 Ob. $60,000 in 2020,10 in 2021. Oc. 566.000 in 2020, 5.000 in 30. Od. $60.000 in 2020. 590,000 in 2021 Matt has three passive activities and has at risk amounts in excess of $100,000 for each. During the year, the activities produced the following income (losses). Activity A Activity B Activity Net passive activity los ($60,000) (40,000) 75,000 $25,000 Matt's suspended losses are as follows: Os $15.000 is allocated to A: $10,000 to B. Ob. $25,000 us allocated to 50 to A and B. Oc. $12.500 is allocated to A: $12.500 to B. Od. $8.393 is allocated to A. B, and C

Melinda earns wages of $80,000, income from a limited partnership of $10,000, and a $30,000 passive activity loss from a real estate rental activity in which she actively participates. Her modified adjusted gross income is $80,000. of the $30,000 loss, Melinda may deduct: Oa. $35.000 Ob 50 Oc $50,000 Od. 5:0.000 Josie, an unmarried taxpayer, has $155,000 in salary, $10,000 in income from a limited partnership, and a $26,000 passive activity lons from a real estate rental activity in which she actively participates. If her modified adjusted gross income is $155,000, how much of the $26,000 loss is deductible? Oa. 510,000 Ob. 30 Oc. $26.000 Od. $25.000 In 2020, Kipp invested $65,000 for a 30% interest in a partnership conducting a passive activity. The partnership reported losses of $200,000 in 2020 and $100,000 in 2021, Kipp's share being $60,000 in 2020 and $30,000 in 2021. How much of the fosses from the partnership can Kipp deduct assuming he owns no other investments and does not participate in the partnership's operations? Oa. $0 in 2020, 30 in 2021 Ob. $60,000 in 2020,10 in 2021. Oc. 566.000 in 2020, 5.000 in 30. Od. $60.000 in 2020. 590,000 in 2021 Matt has three passive activities and has at risk amounts in excess of $100,000 for each. During the year, the activities produced the following income (losses). Activity A Activity B Activity Net passive activity los ($60,000) (40,000) 75,000 $25,000 Matt's suspended losses are as follows: Os $15.000 is allocated to A: $10,000 to B. Ob. $25,000 us allocated to 50 to A and B. Oc. $12.500 is allocated to A: $12.500 to B. Od. $8.393 is allocated to A. B, and C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started