Answered step by step

Verified Expert Solution

Question

1 Approved Answer

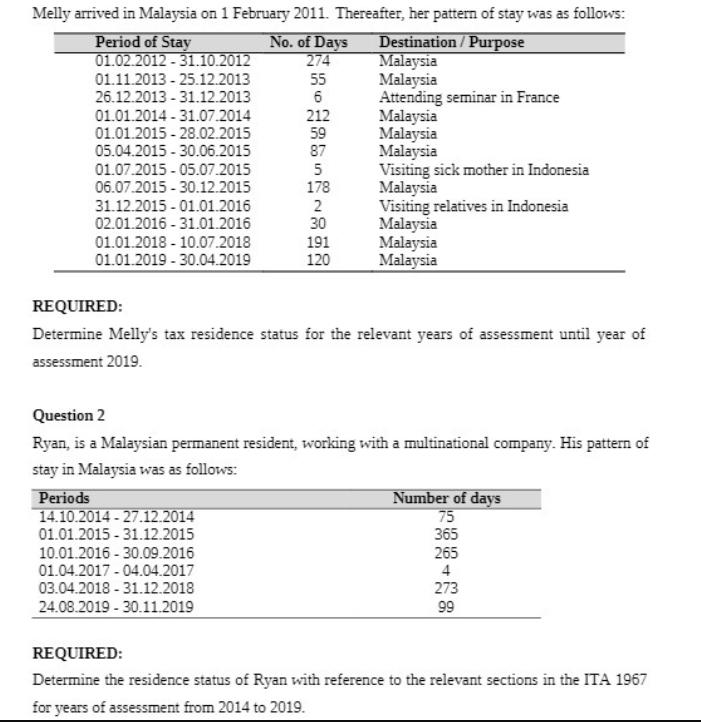

Period of Stay No. of Days Melly arrived in Malaysia on 1 February 2011. Thereafter, her pattern of stay was as follows: Destination/Purpose 01.02.2012

Period of Stay No. of Days Melly arrived in Malaysia on 1 February 2011. Thereafter, her pattern of stay was as follows: Destination/Purpose 01.02.2012 31.10.2012 274 Malaysia 01.11.2013 25.12.2013 55 Malaysia 26.12.2013 31.12.2013 6 Attending seminar in France 01.01.2014 31.07.2014 212 Malaysia 01.01.2015 28.02.2015 59 Malaysia 05.04.2015 30.06.2015 87 Malaysia 01.07.2015 05.07.2015 5 06.07.2015-30.12.2015 178 Visiting sick mother in Indonesia Malaysia 31.12.2015 01.01.2016 2 Visiting relatives in Indonesia 02.01.2016 - 31.01.2016 30 Malaysia 01.01.2018 10.07.2018 191 Malaysia 01.01.2019-30.04.2019 120 Malaysia REQUIRED: Determine Melly's tax residence status for the relevant years of assessment until year of assessment 2019. Question 2 Ryan, is a Malaysian permanent resident, working with a multinational company. His pattern of stay in Malaysia was as follows: Periods 14.10.2014-27.12.2014 01.01.2015 - 31.12.2015 10.01.2016 30.09.2016 01.04.2017 04.04.2017 Number of days 75 365 265 4 273 99 03.04.2018 31.12.2018 24.08.2019-30.11.2019 REQUIRED: Determine the residence status of Ryan with reference to the relevant sections in the ITA 1967 for years of assessment from 2014 to 2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the tax residence status of Melly and Ryan for the relevant years of assessment we need to consider their pattern of stay in Malaysia and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started