The Sanders Company issued 9.5% bonds, dated January 1, with a face amount of $8,000,000 on January 1, 2024. The bonds mature on December

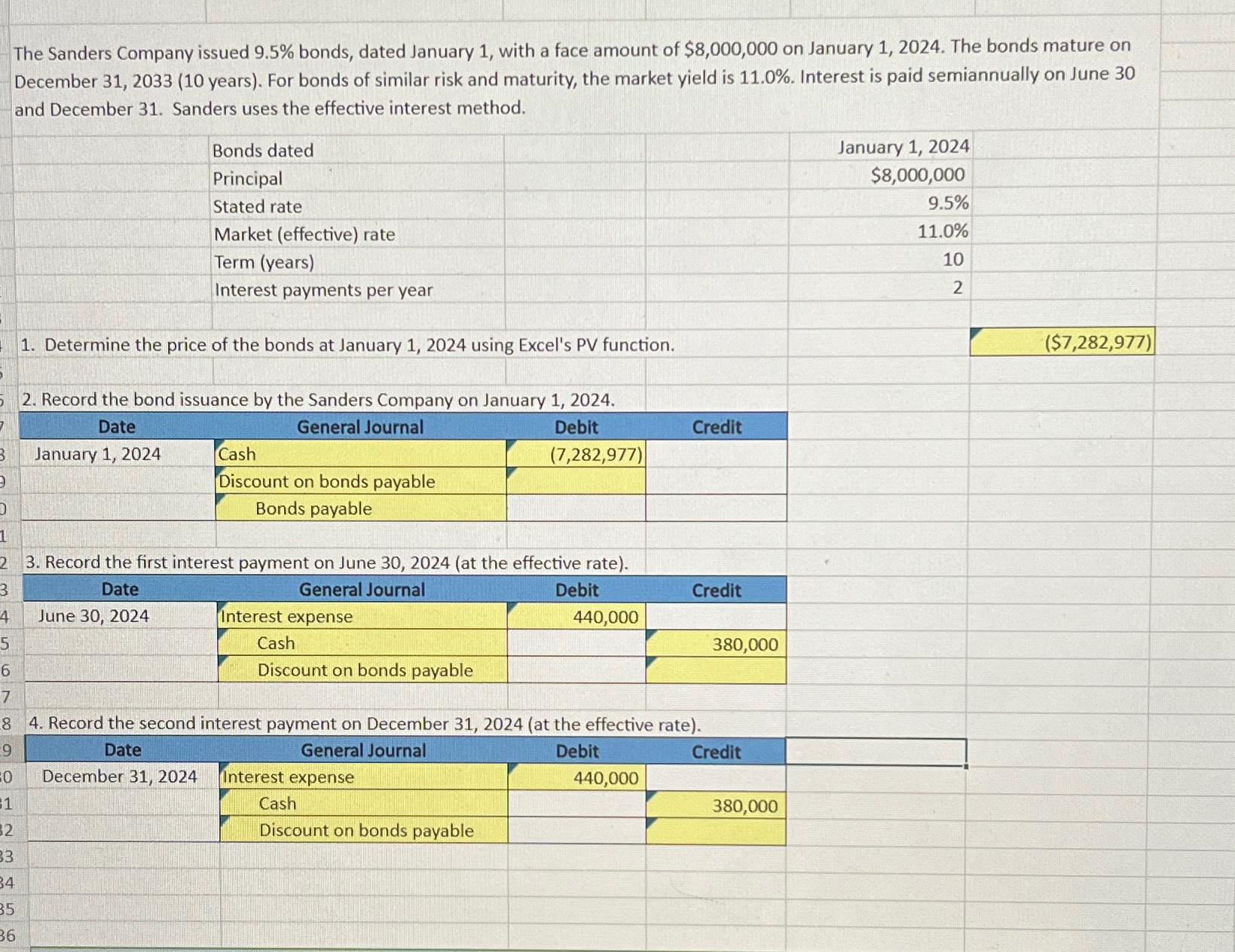

The Sanders Company issued 9.5% bonds, dated January 1, with a face amount of $8,000,000 on January 1, 2024. The bonds mature on December 31, 2033 (10 years). For bonds of similar risk and maturity, the market yield is 11.0%. Interest is paid semiannually on June 30 and December 31. Sanders uses the effective interest method. Bonds dated Principal Stated rate Market (effective) rate Term (years) Interest payments per year 4 1. Determine the price of the bonds at January 1, 2024 using Excel's PV function. January 1, 2024 $8,000,000 9.5% 11.0% 10 2 ($7,282,977) , 2. Record the bond issuance by the Sanders Company on January 1, 2024. 7 Date General Journal 3 January 1, 2024 Cash Debit (7,282,977) Credit Discount on bonds payable 0 1 Bonds payable 2 3. Record the first interest payment on June 30, 2024 (at the effective rate). 3 Date 4 June 30, 2024 5 6 7 General Journal Interest expense Cash Discount on bonds payable Debit Credit 440,000 380,000 8 4. Record the second interest payment on December 31, 2024 (at the effective rate). 9 Date General Journal 0 December 31, 2024 Interest expense 1 Cash 32 Discount on bonds payable 33 34 35 36 Debit 440,000 Credit 380,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you sent is a practice problem about how to account for a bond issuance by the Sanders Company The information in the image is as follows The Sanders Company issued 95 bonds with a face amou...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started