Question

Melodic Musical Sales, Inc. is located at 5500 Fourth Avenue, City, ST 98765. The corporation uses the calendar year and accrual basis for both book

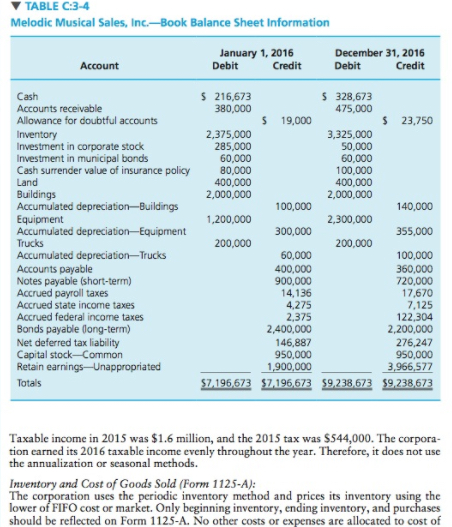

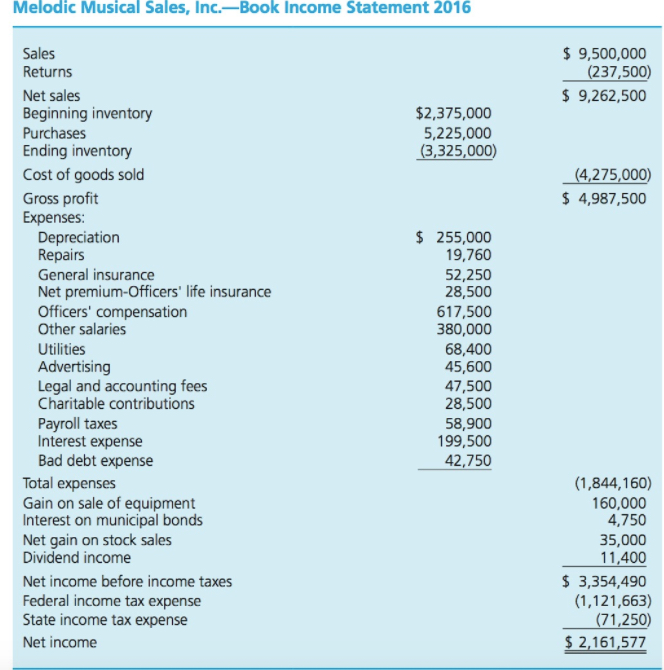

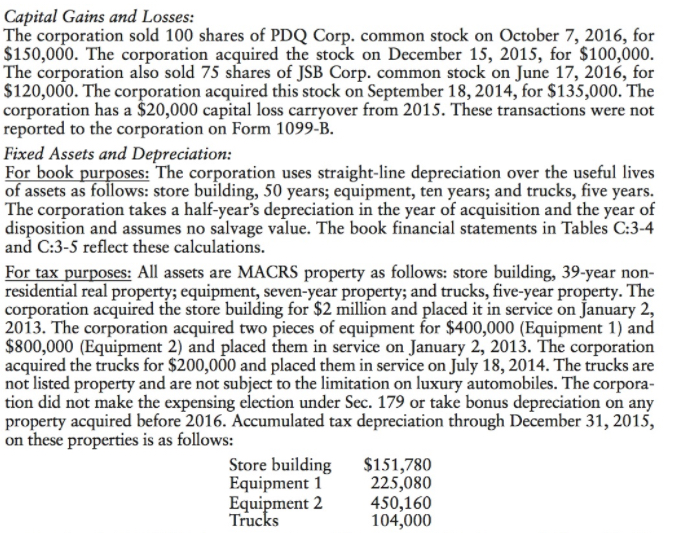

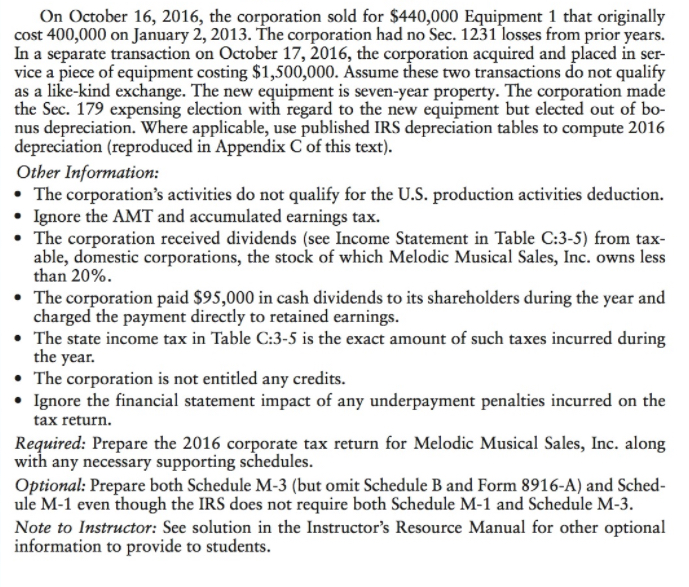

Melodic Musical Sales, Inc. is located at 5500 Fourth Avenue, City, ST 98765. The corporation uses the calendar year and accrual basis for both book and tax purposes. It is engaged in the sale of musical instruments with an employer identification number (EIN) of XX-2018016. The company incorporated on December 31, 2012, and began business on January 2, 2013. Table C:3-4 contains balance sheet information at January 1, 2016, and December 31, 2016. Table C:3-5 presents an unaudited GAAP income statement for 2016. These schedules are presented on a book basis. Other information follows the tables. Estimated Tax Payments (Form 2220): The corporation deposited estimated tax payments as follows: April 15, 2016 June 15, 2016 September 15, 2016 December 15, 2016 Total $110,000 220,000 270,000 270,000 $870,000

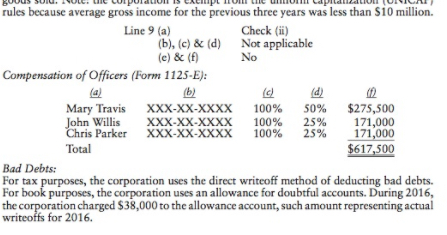

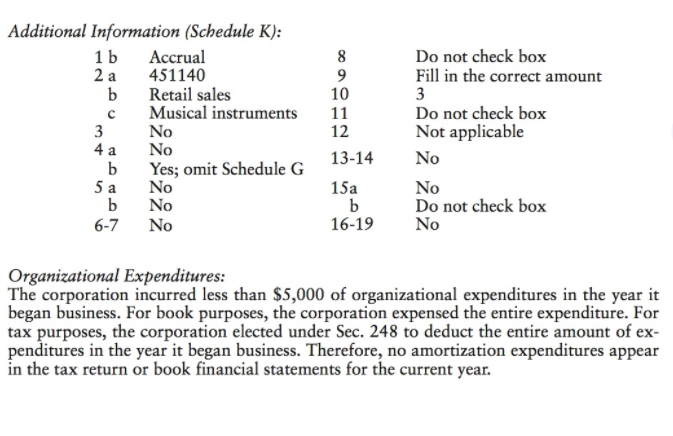

TABLE C:3-4 Melodic Musical Sales, Inc.-Book Balance Sheet Information January 1, 2016 Debit December 31, 2016 Credit Credit Cash Accounts receivable Allowance for doubtful accounts S 216,673 380,000 328,673 475,000 S 19,000 S 23,750 2,375,000 285,000 60,000 80,000 400,000 2,000,000 3,325,000 50,000 60,000 100,000 400,000 2,000,000 Investment in corporate stodk Investment in Cash surrender value of insurance policy 100,000 300,000 60,000 140,000 2,300,000 355,000 200,000 200,000 Accumulated depreciation-Trucks Accounts payable Notes payable (short-term) Accrued payroll taxes Accrued state income taxes Accrued federal income taxes Bonds payable (ong-term) Net deferred tax liability Capital stock-Common Retain earnings-Unappropriated 100,000 360,000 720,000 17,670 122,304 276,247 3,966 577 S7-196573 196,673 SS,238.673 S9,238.673 900,000 14,136 4,275 2,375 2,400,000 146,887 950,000 1.900,000 Taxable income in 2015 was $1.6 million, and the 2015 tax was S544,000. The corpora tion earned its 2016 taxable income evenly throughout the year. Therefore, it does not use the annualization or seasonal methods Inventory and Cost of Goods Sold (Form 1125-A): tion uses the periodic inventory method and prices its inventory lower of FIFO cost or market. Only beginning inventory, ending inventory, and p should be reflected on Form 1125-A. No other costs or expenses are allocated to cost of TABLE C:3-4 Melodic Musical Sales, Inc.-Book Balance Sheet Information January 1, 2016 Debit December 31, 2016 Credit Credit Cash Accounts receivable Allowance for doubtful accounts S 216,673 380,000 328,673 475,000 S 19,000 S 23,750 2,375,000 285,000 60,000 80,000 400,000 2,000,000 3,325,000 50,000 60,000 100,000 400,000 2,000,000 Investment in corporate stodk Investment in Cash surrender value of insurance policy 100,000 300,000 60,000 140,000 2,300,000 355,000 200,000 200,000 Accumulated depreciation-Trucks Accounts payable Notes payable (short-term) Accrued payroll taxes Accrued state income taxes Accrued federal income taxes Bonds payable (ong-term) Net deferred tax liability Capital stock-Common Retain earnings-Unappropriated 100,000 360,000 720,000 17,670 122,304 276,247 3,966 577 S7-196573 196,673 SS,238.673 S9,238.673 900,000 14,136 4,275 2,375 2,400,000 146,887 950,000 1.900,000 Taxable income in 2015 was $1.6 million, and the 2015 tax was S544,000. The corpora tion earned its 2016 taxable income evenly throughout the year. Therefore, it does not use the annualization or seasonal methods Inventory and Cost of Goods Sold (Form 1125-A): tion uses the periodic inventory method and prices its inventory lower of FIFO cost or market. Only beginning inventory, ending inventory, and p should be reflected on Form 1125-A. No other costs or expenses are allocated to cost of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started