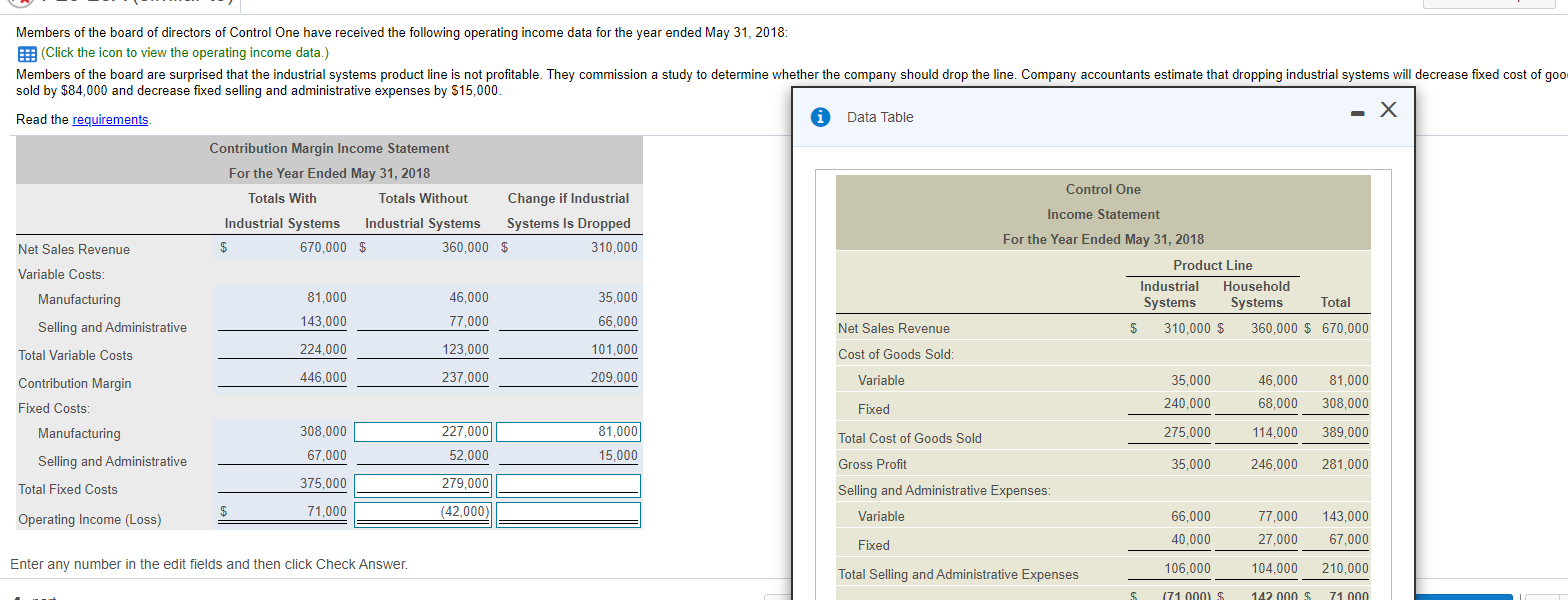

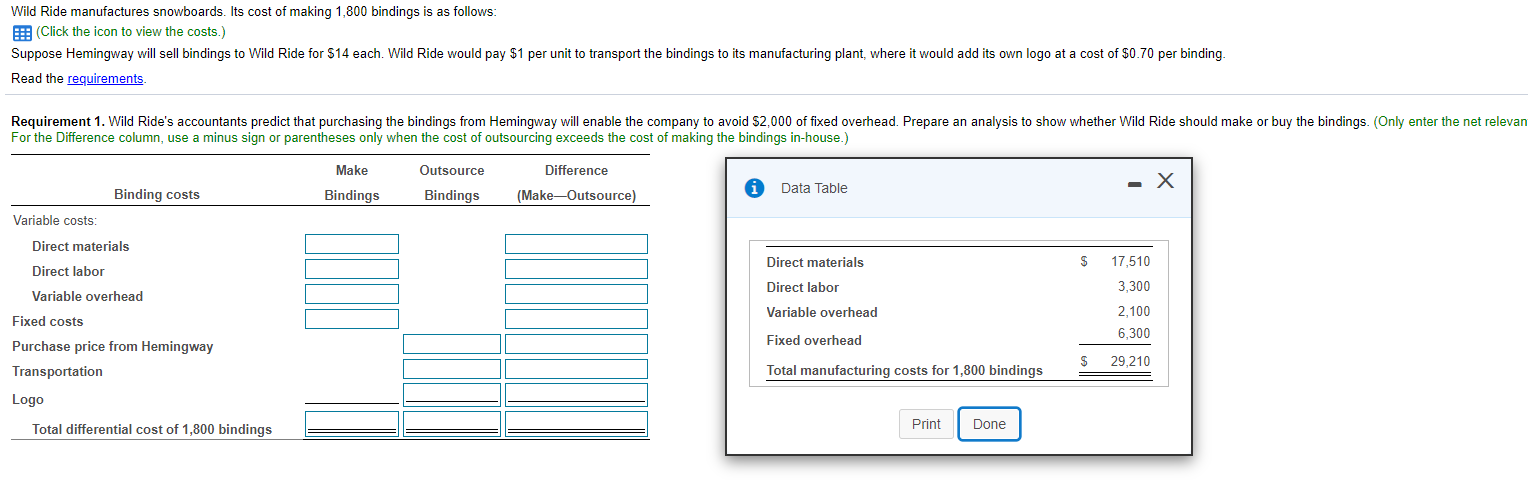

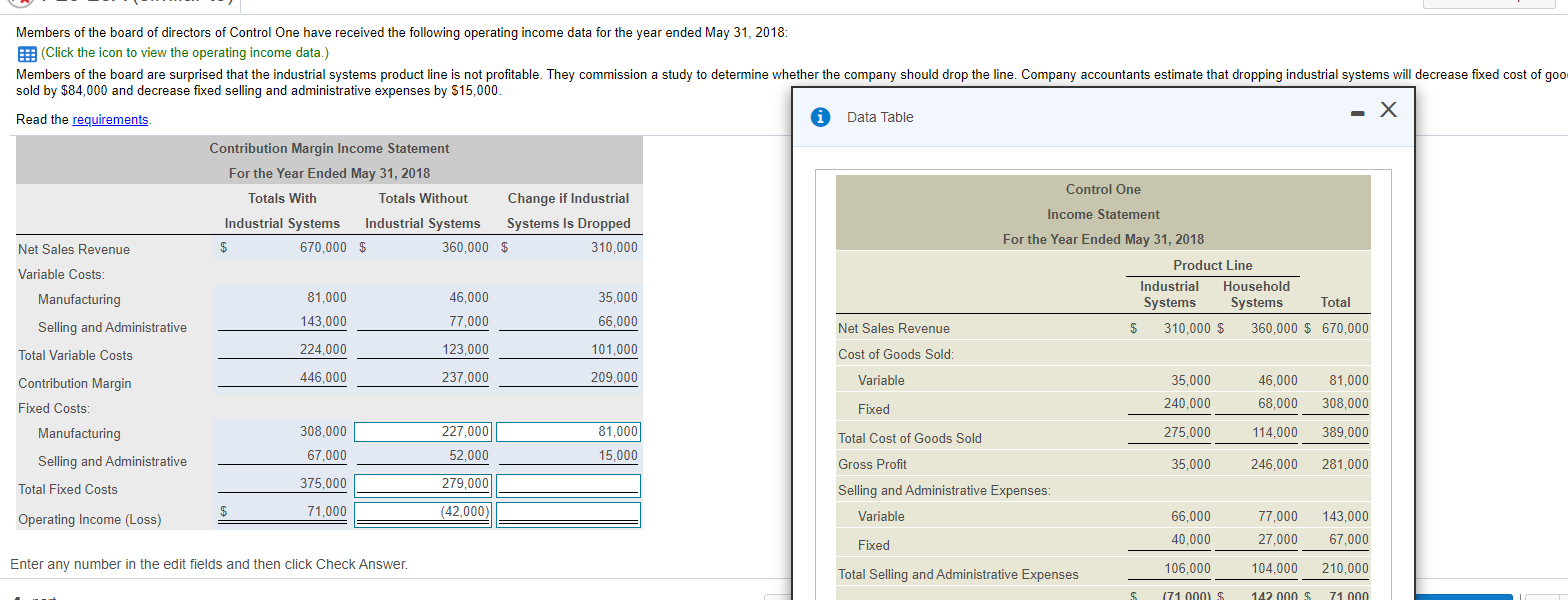

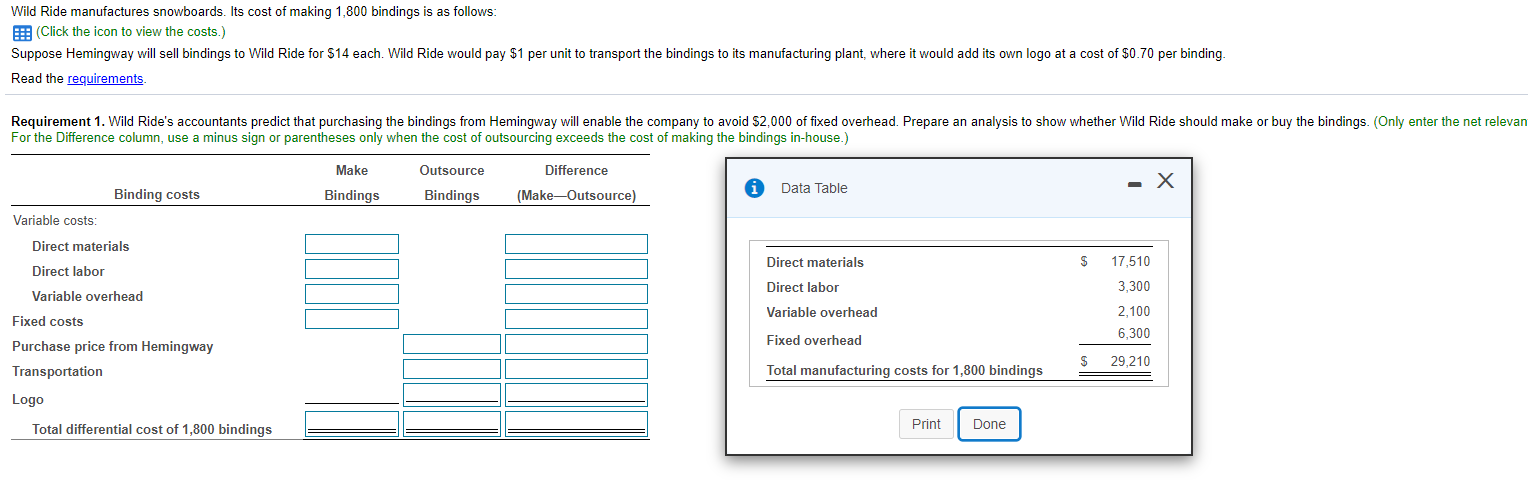

Members of the board of directors of Control One have received the following operating income data for the year ended May 31, 2018 5 Click the icon to view the operating income data.) Members of the board are surprised that the industrial systems product line is not profitable. They commission a study to determine whether the company should drop the line. Company accountants estimate that dropping industrial systems will decrease fixed cost of goo sold by $84,000 and decrease fixed selling and administrative expenses by $15,000 Read the requirements Data Table Contribution Margin Income Statement For the Year Ended May 31, 2018 Control One Totals With Totals Without Change if Industrial Income Statement Industrial Systems Industrial Systems Systems Is Dropped Net Sales Revenue For the Year Ended May 31, 2018 $ 670,000 $ 360,000 $ 310,000 Product Line Variable Costs: Industrial Household Manufacturing 81,000 46.000 35,000 Systems Systems Total 143,000 77,000 66,000 Selling and Administrative Net Sales Revenue $ 310,000 $ 360,000 $ 670,000 Total Variable Costs 224,000 123,000 101,000 Cost of Goods Sold: Contribution Margin 446,000 237,000 209,000 Variable 35,000 46,000 81,000 Fixed Costs: 240,000 68,000 308,000 Manufacturing 308,000 227,000 81,000 275,000 Total Cost of Goods Sold 114,000 389,000 Selling and Administrative 67,000 52,000 15,000 Gross Profit 35,000 246,000 281,000 Total Fixed Costs 375,000 279,000 Selling and Administrative Expenses: $ 71,000 (42,000) Operating Income (Loss) Variable 66,000 77,000 143,000 Fixed 40,000 27,000 67,000 Enter any number in the edit fields and then click Check Answer. 106,000 104.000 210,000 Total Selling and Administrative Expenses 171 000) 142.000 $ 71.000 Fixed Wild Ride manufactures snowboards. Its cost of making 1,800 bindings is as follows: (Click the icon to view the costs.) Suppose Hemingway will sell bindings to Wild Ride for S14 each. Wild Ride would pay $1 per unit to transport the bindings to its manufacturing plant, where it would add its own logo at a cost of $0.70 per binding. Read the requirements Requirement 1. Wild Ride's accountants predict that purchasing the bindings from Hemingway will enable the company to avoid $2,000 of fixed overhead. Prepare an analysis to show whether Wild Ride should make or buy the bindings. (Only enter the net relevan For the Difference column, use a minus sign or parentheses only when the cost of outsourcing exceeds the cost of making the bindings in-house.) Make Outsource Difference - X Binding costs Bindings Data Table Bindings (Make-Outsource) Variable costs: Direct materials Direct materials $ 17,510 Direct labor 3,300 Direct labor Variable overhead 2.100 6,300 Fixed overhead Variable overhead Fixed costs Purchase price from Hemingway Transportation Logo Total differential cost of 1,800 bindings $ 29,210 Total manufacturing costs for 1,800 bindings Print Done