Question: MENG 0429 - Engineering Economics Problem Set #3 1. You bought a bond for $930 at the time of issue. The bond has a face

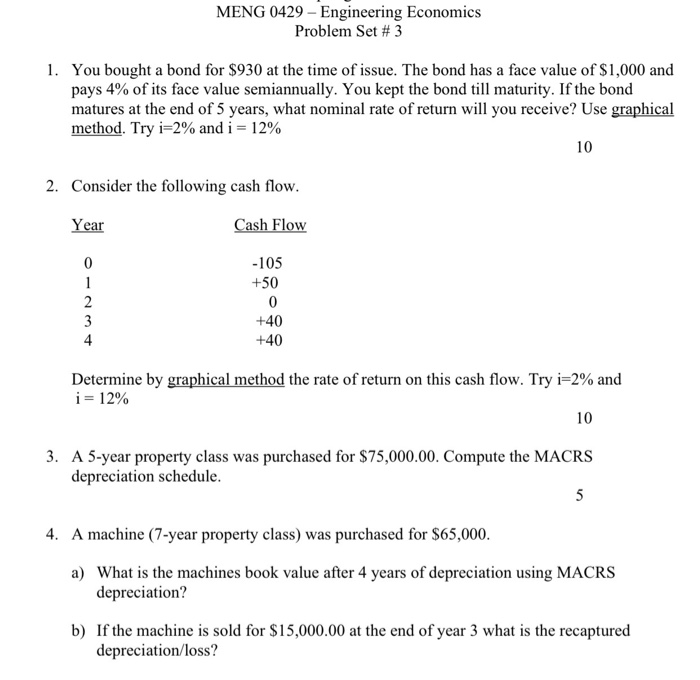

MENG 0429 - Engineering Economics Problem Set #3 1. You bought a bond for $930 at the time of issue. The bond has a face value of $1,000 and pays 4% of its face value semiannually. You kept the bond till maturity. If the bond matures at the end of 5 years, what nominal rate of return will you receive? Use graphical method. Try i=2% and i = 12% 10 2. Consider the following cash flow. Year Cash Flow -105 +50 +40 +40 Determine by graphical method the rate of return on this cash flow. Try i=2% and i= 12% 10 3. A 5-year property class was purchased for $75,000.00. Compute the MACRS depreciation schedule. 5 4. A machine (7-year property class) was purchased for $65,000. a) What is the machines book value after 4 years of depreciation using MACRS depreciation? b) If the machine is sold for $15,000.00 at the end of year 3 what is the recaptured depreciation/loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts