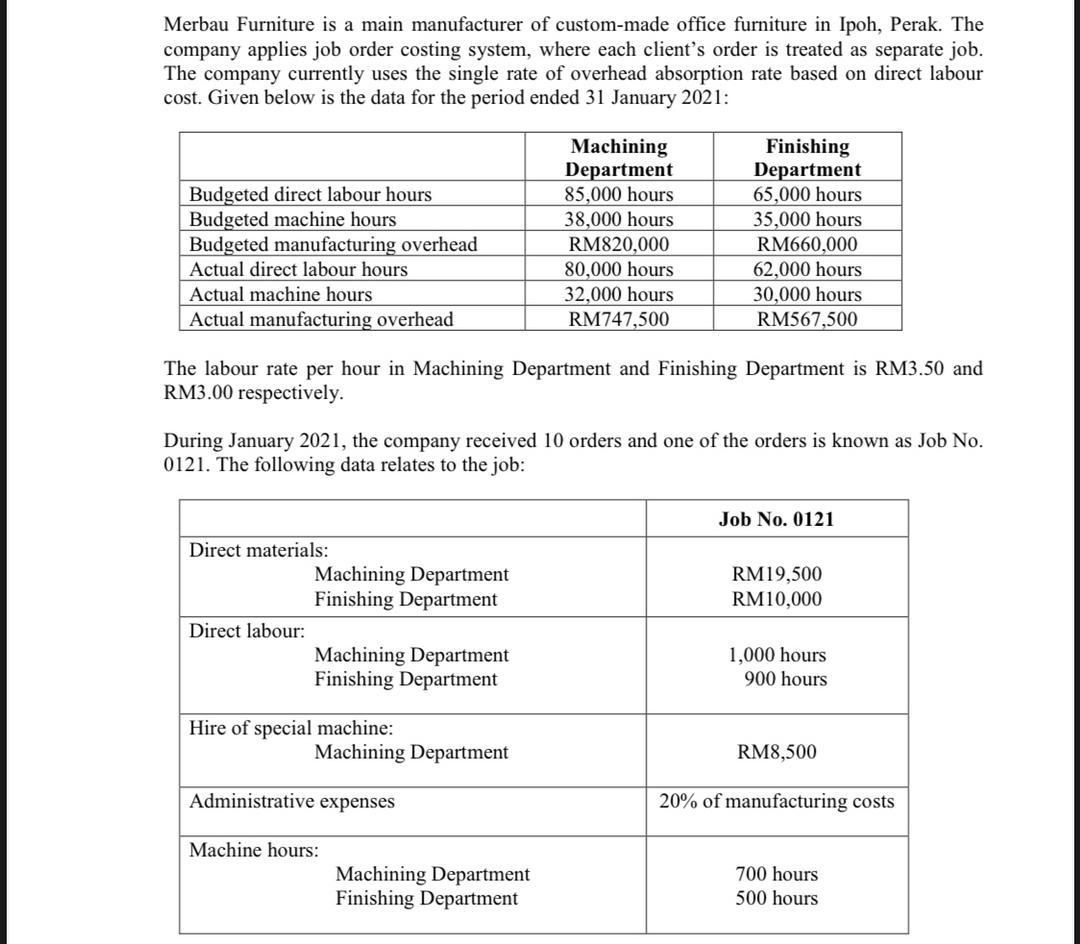

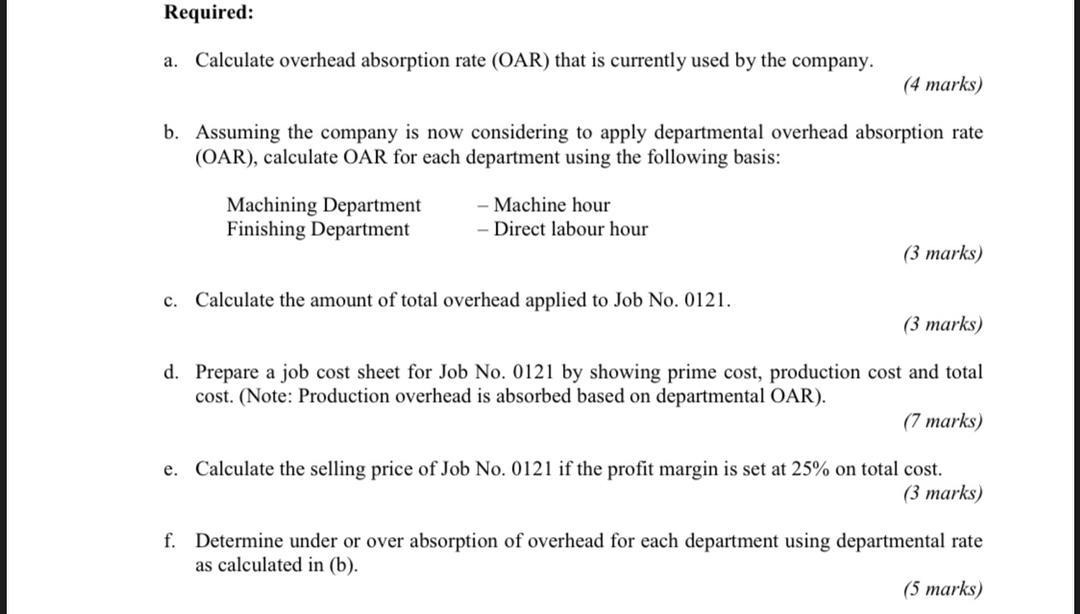

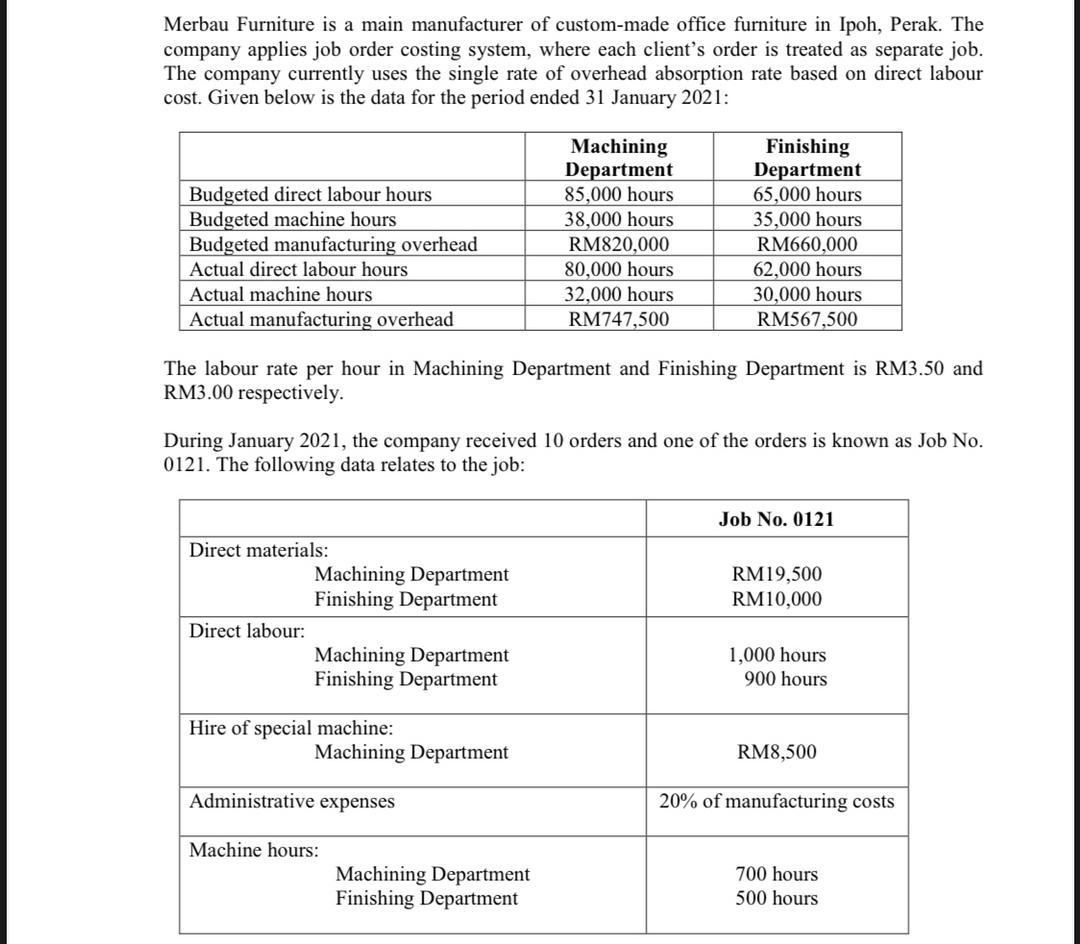

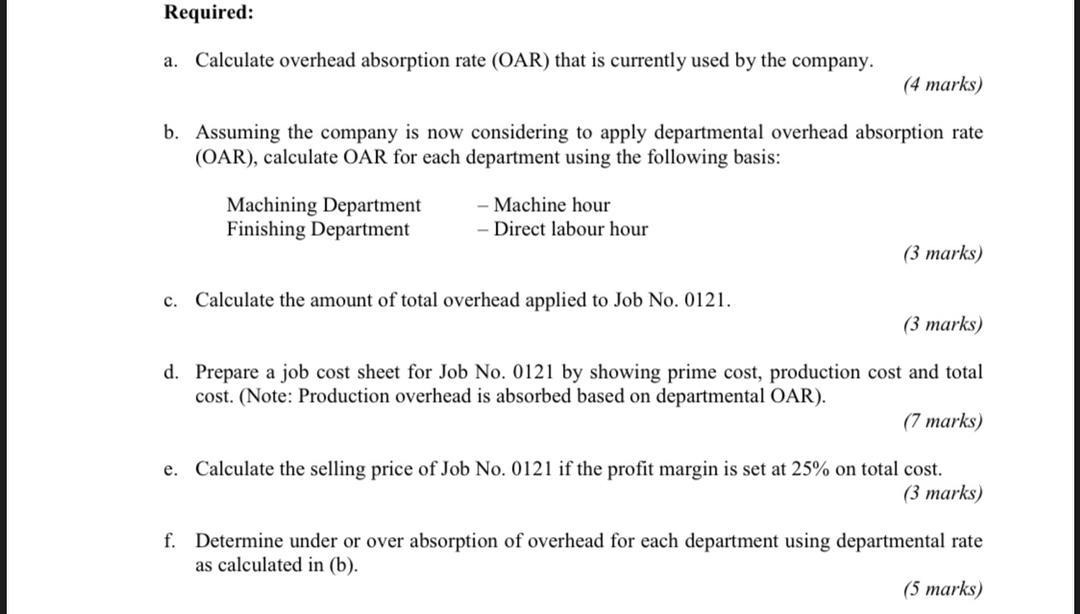

Merbau Furniture is a main manufacturer of custom-made office furniture in Ipoh, Perak. The company applies job order costing system, where each client's order is treated as separate job. The company currently uses the single rate of overhead absorption rate based on direct labour cost. Given below is the data for the period ended 31 January 2021: Budgeted direct labour hours Budgeted machine hours Budgeted manufacturing overhead Actual direct labour hours Actual machine hours Actual manufacturing overhead Machining Department 85,000 hours 38,000 hours RM820,000 80,000 hours 32,000 hours RM747,500 Finishing Department 65,000 hours 35,000 hours RM660,000 62,000 hours 30,000 hours RM567,500 The labour rate per hour in Machining Department and Finishing Department is RM3.50 and RM3.00 respectively. During January 2021, the company received 10 orders and one of the orders is known as Job No. 0121. The following data relates to the job: Job No. 0121 RM19,500 RM10,000 Direct materials: Machining Department Finishing Department Direct labour: Machining Department Finishing Department 1,000 hours 900 hours Hire of special machine: Machining Department RM8,500 Administrative expenses 20% of manufacturing costs Machine hours: Machining Department Finishing Department 700 hours 500 hours Required: a. Calculate overhead absorption rate (OAR) that is currently used by the company. (4 marks) b. Assuming the company is now considering to apply departmental overhead absorption rate (QAR), calculate OAR for each department using the following basis: Machining Department Finishing Department - Machine hour - Direct labour hour (3 marks) c. Calculate the amount of total overhead applied to Job No. 0121. (3 marks) d. Prepare a job cost sheet for Job No. 0121 by showing prime cost, production cost and total cost. (Note: Production overhead is absorbed based on departmental OAR). (7 marks) e. Calculate the selling price of Job No. 0121 if the profit margin is set at 25% on total cost. (3 marks) f. Determine under or over absorption of overhead for each department using departmental rate as calculated in (b)