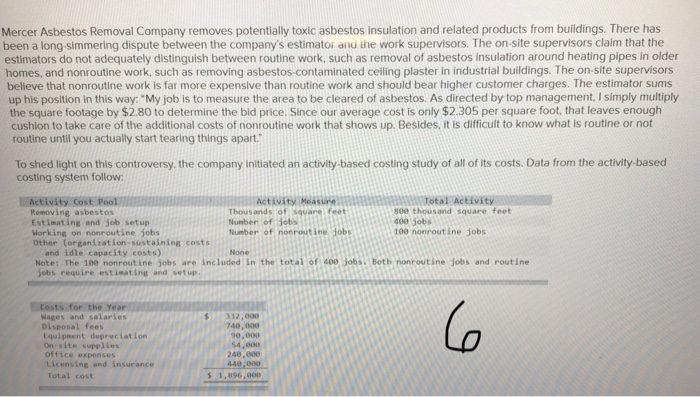

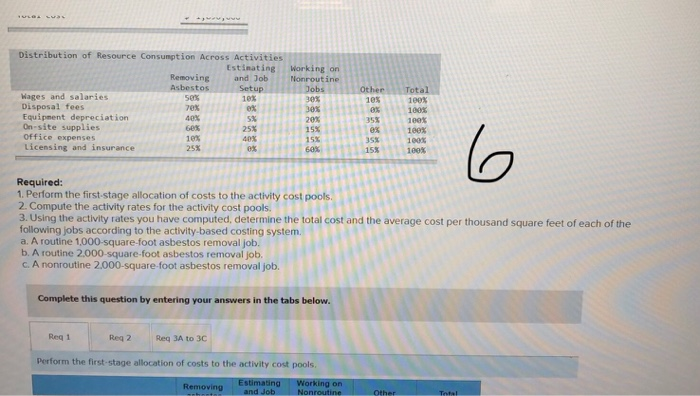

Mercer Asbestos Removal Company removes potentially toxic asbestos insulation and related products from buildings. There has been a long-simmering dispute between the company's estimator and the work supervisors. The on-site supervisors claim that the estimators do not adequately distinguish between routine work, such as removal of asbestos insulation around heating pipes in older homes, and nonroutine work, such as removing asbestos-contaminated ceiling plaster in industrial buildings. The on-site supervisors believe that nonroutine work is far more expensive than routine work and should bear higher customer charges. The estimator sums up his position in this way: "My job is to measure the area to be cleared of asbestos. As directed by top management, I simply multiply the square footage by $2.80 to determine the bid price. Since our average cost is only $2.305 per square foot, that leaves enough cushion to take care of the additional costs of nonroutine work that shows up. Besides, it is difficult to know what is routine or not routine until you actually start tearing things apart. To shed light on this controversy, the company initiated an activity-based costing study of all of its costs. Data from the activity-based costing system follow Activity Cost Pool Removing asbestos Estimating and job setup Working on nonroutine jobs Other (organization-sustaining costs and idle capacity costs) Note: The 100 nonroutine jobs are included in the total of 400 jobs. Both nonroutine jobs and routine jobs require estinating and setup. Activity Measune Thousands of square feet Total Activity 800 thousand square feet 400 jobs 100 nonrout Number of jobs Number of nonroutine jobs jobs None Costs for the Year Wages and salaries Disposal fees Equipment depreciation On-site supplies office expenses Licensing and insurance 332,000 740,000 90,000 54,000 240.000 440,000 Total cost $ 1.896,000 Distribution of Resource Consumption Across Activities Estimating Working on Removing and Job Nonroutine Asbestos Setup 10% Jobs 30% Other 10% Total Wages and salaries Disposal fees Equipment depreciation On-site supplies Office expenses 50% 7e% 1ee% 30% 100% 40% S% 25% 40% ex 20% 35% 100% 6e% 15% es 100% 100% 100% 10 % 15% 35% Licensing and insurance 25% 60% 15% Required: 1. Perform the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools 3. Using the activity rates you have computed, determine the total cost and the average cost per thousand square feet of each of the following jobs according to the activity-based a. A routine 1,000-square-foot asbestos removal job. b. A routine 2.000-square-foot asbestos removal job. C. A nonroutine 2,000-square-foot asbestos removal job. ing system. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 Req 3A to 3C Perform the first-stage allocation of costs to the activity cost pools. Estimating and Job Working on Nonroutine Removing -- et Total Other